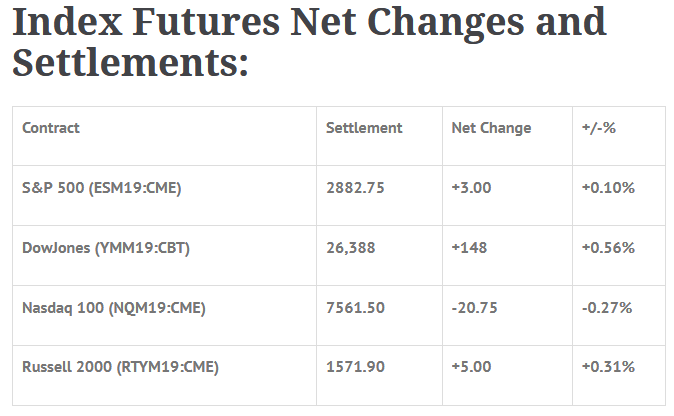

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.94%, Hang Seng -0.17%, Nikkei +0.38%

- In Europe 10 out of 13 markets are trading higher: CAC +0.22%, DAX -0.02%, FTSE +0.12%

- Fair Value: S&P +3.88, NASDAQ +25.53, Dow +6.90

- Total Volume: 1.04m ESM & 166 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Employment Situation 8:30 AM ET, the Baker-Hughes Rig Count 1:00 PM ET, Consumer Credit 3:00 PM ET, and Raphael Bostic Speaks at 3:30 PM ET.

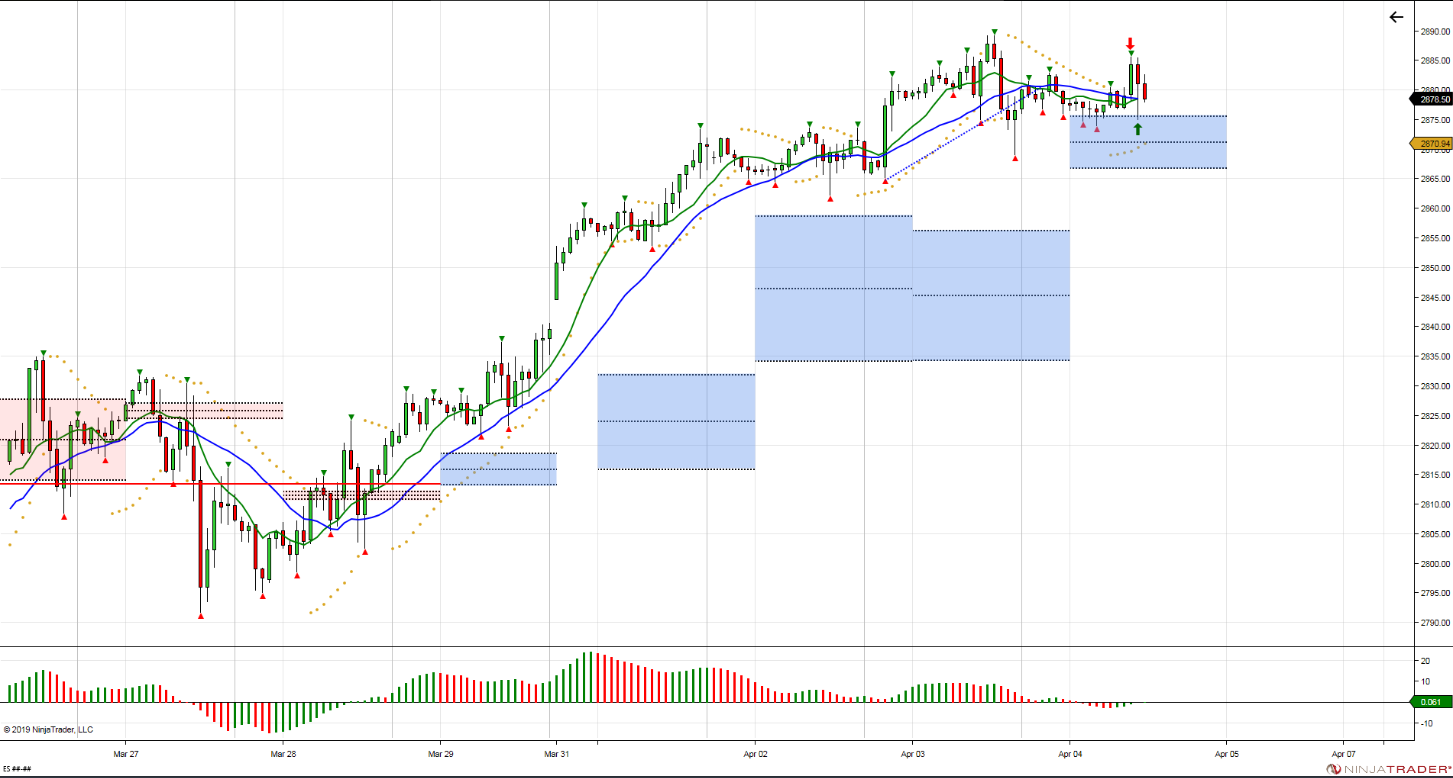

S&P 500 Futures: Nasdaq Leads S&P

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F After forcing buyers to chase for 4 days w/o allowing test of 3D pivot to defend, today they are getting that chance. Question is, will there be any demand left after forcing buyers to chase? Close > pivot needed to keep bull in control, close below = bearish.

During Wednesday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2883.00, a low of 2874.00, and opened Thursday’s regular trading hours at 2878.75.

The first move after the 8:30 CT bell was a rally up to a new high at 2885.75, followed a reversal down to 2875.00, completing a MrTopStep 10 Handle Rule. From there, the ES pulled back to 2883.00, then reversed again to take another shot at the Globex low. Just before 10:30, the futures printed a new low by a single tick at 2873.75, and immediately ripped higher.

After trading back up to 2881.00, the ES turned lower for the third time, this time bottoming out at 2871.00. That would remain the low for the day. By 2:00 the futures had traded back up to 2882.75, and when the 2:45 cash imbalance reveal showed $157M to buy, the ES was trading 2881.75. It then went on to trade 2883.00 on the 3:00 cash close, and settled the day at 2833.00 on the 3:15 futures close, up +3.25 handles, or +0.11%.

In the end, the overall tone of the ES was weak early in the day, and strong late in the day. In terms of the days overall trade, total volume was lower, with 1.04 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.