The stock bears finally showed they aren‘t an extinct species – merely a seriously endangered one. Yesterday‘s close gives them a chance to try again today, but they should be tame in expectations. While there is some chart deterioration, it‘s not nearly enough to help fuel a full-on bearish onslaught in the S&P 500. There is no serious correction starting now, nothing to really take down stocks seriously for the time being.

The Fed remains active, and monetary policy hasn‘t lost its charm effect just yet. Commodities and asset price inflation has been in high gear for quite some time, yet it‘s not a raging problem for the Main Street as evidenced by the CPI. Food price inflation, substitution and hedonistic adjustments in its calculation, are a different cup of tea, but CPI isn‘t biting yet.

Meanwhile, the real economy recovery goes on. Jjust check yesterday‘s Empire State Manufacturing figures for proof. Once we see signs of strain in the job market (higher participation rate, hourly earnings and hours worked), then the real, palpable inflation story can unfold. But we‘re talking 2022, or even 2023 to get there – and the Fed will just let it overshoot to compensate for the current and prior era.

Meanwhile, the wave of new money creation keeps hitting the markets, going into the real economy, predictably lifting many boats. (We‘re almost at double the early 2020 Fed‘s balance sheet value – $4T, give or take, then versus almost $7.5T now – and that‘s before the multiplier in commercial banks loan creation kicks in.) It‘s my view that we have to experience a stock market bubble accompanied by a precious metals and commodities bubble simultaneously for the stock market to get under pressure first. Again, I am talking the big picture here – not the coming weeks.

Meanwhile, the intense talk of S&P 500 correction any-day-week-now is on, just as outrageous gold, silver and miners' drop projections.

Let‘s examine the bear market is gold. Some say that late 2015 marked the bottom. I'm of the view that the 2016 steep rally was a first proof of the tide turning. But the Fed got serious about tightening (raising rates, shrinking its balance sheet), and gold reached the final bottom in August 2018. Seeing through the hawks versus dove fights at the Fed in the latter half of 2018.

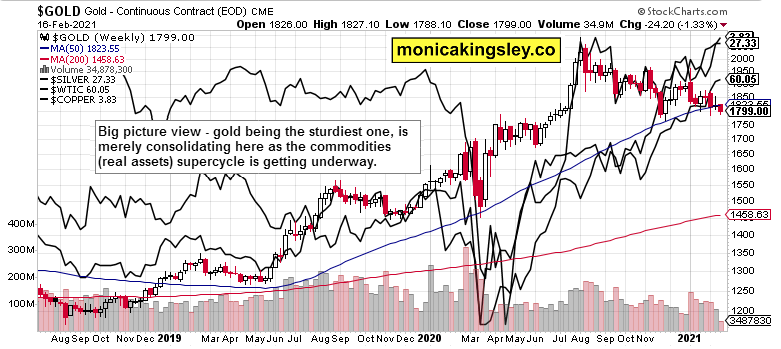

Since then, gold was slowly but surely gathering steam, and speculation in stocks was on. The repo crisis of autumn 2019 didn‘t have a dampening effect either. The Fed was solidly back to accomodative back then. These have all happened well before corona hit – and it wasn‘t able to push gold down really much. The recovery from the forced selling, this deflationary episode was swift. Commodities have clearly joined, and the picture of various asset classes taking the baton as inflation is cascading through the system, is very clear.

Let‘s get right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

Finally, there is a whiff of bearish activity. Will it last or turn out a one-day event? The chances for a sideways correction to last at least a little longer, are still on, however the short- and medium-term outlook remains bullish.

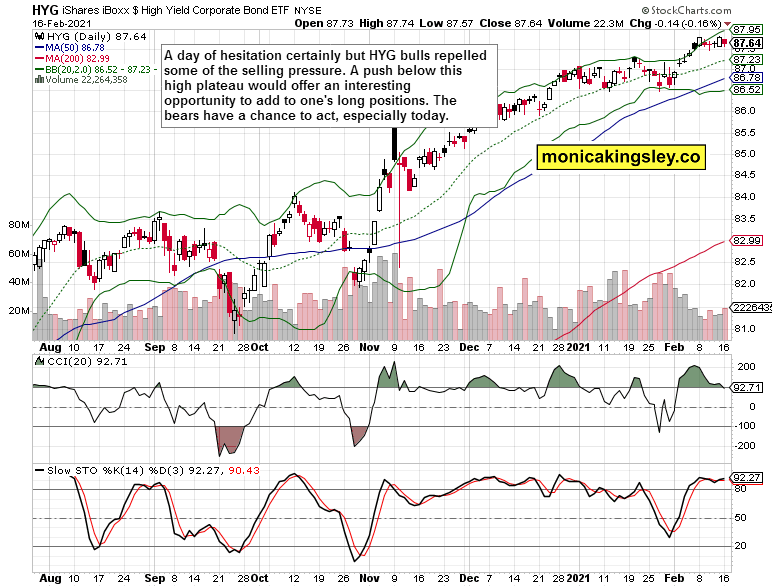

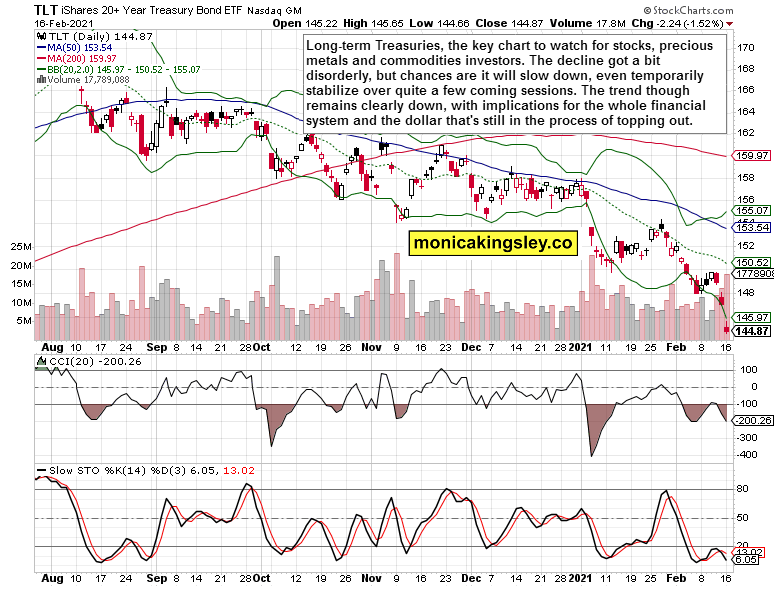

Credit Markets and Treasuries

High-yield corporate bonds (iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) ETF) wavered yesterday, trading in a sideways pattern during recent days. Encouragingly, yesterday‘s session attracted increasing volume, which I read as willingness to buy the dip. One dip and done?

Long-term Treasuries (iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) ETF) is the key chart on my radar screen right now. The rise in yields is accelerating, and if progressing unmitigated, would throw a spanner into many an asset‘s works. Even though it‘s not apparent right now, there is a chance that we‘ll see a slowdown, even a temporary stabilization, over the coming sessions. The larger trend in rates is higher though,.

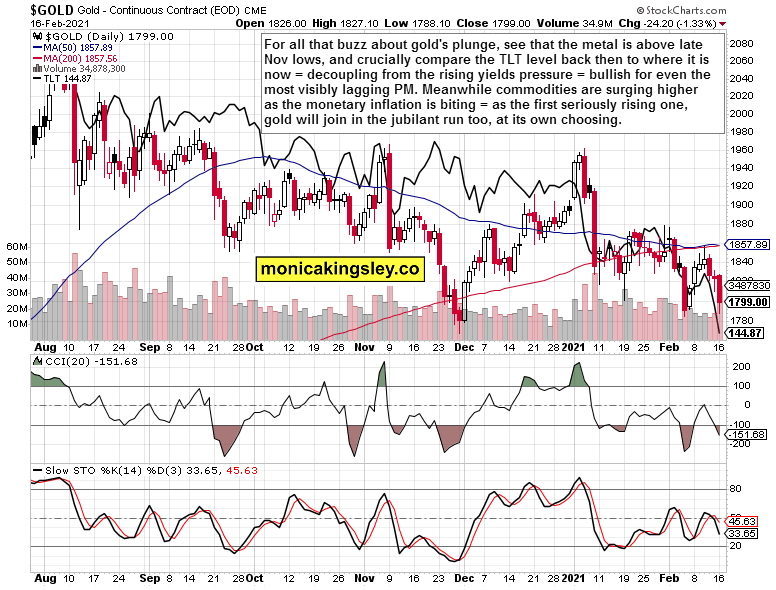

Gold, Silver And Commodities

The heat gold is taking from rising Treasury yields, has gotten weaker recently, with the decoupling from rising nominal (real) yields being a good omen for precious metals universally. The dynamics of commodity price inflation, the dollar hardly balancing under the weight of unprecedented economic policy and twin deficits, attests to the gold upleg arriving sooner rather than later.

Let‘s step back, and compare the performance of gold, silver, copper and oil. The weekly chart captures the key turns in monetary policy, the plunge into the corona deflationary bottom, and crucially the timing and pace of each asset‘s recovery. Gold and silver were the first to sensitively respond to activist policies, followed by copper, and finally oil. Is their current breather really such a surprise and reversal of fortunes? Absolutely not.

Summary

The bearish push in stocks has a good chance of finally materializing today. How strong will its internals be? Will it entice the bulls to step in? The stock bull run is firmly on, and there are no signals thus far pointing to an onset of a deeper correction with today‘s price action.

The gold bulls continue lagging behind their silver counterparts, predictably, with both under continued pressure. The yields are rising a bit too fast, taking the metals along – temporarily, until they decouple to a greater degree. Combined with the miners‘ signals, and unprecendented monetary and fiscal stimulus, unfolding real economy recovery, inflation making its way through the system, and the dollar struggling to keep its head above water, the new precious metals upleg is a question of time