For the second consecutive month, retail sales were positive, increasing .5% M/M and 2.5% Y/Y. At the Adviser Perspective’s website, Doug Short provides additional detail by breaking the data down into two additional subsets. The first is “core,” which excludes auto sales and the second is “control,” which excludes autos, gasoline, food service and building material purchases. The former increased 2.7% Y/Y while the latter rose 3.6%. Both numbers are encouraging, indicating that the consumer, who is responsible for 70% of U.S. economic activity, is still capable of driving economic growth.

Unlike the retail sales numbers, industrial production declined .4% M/M, which is the fourth drop in the last six months. Auto production’s 4.2% DROP contributed to a .4% decline in manufacturing while utilities' activity slipped 1%. Surprisingly, mining activity rose for the first time in six months, increasing .2%. But the slight gain in oil and gas activity is more an afterthought. The headline number’s consistent decline indicates this statistic is still in a worrying downtrend, as shown in the following chart which has the month to month decline in blue (left scale) and year over year in red (right scale):

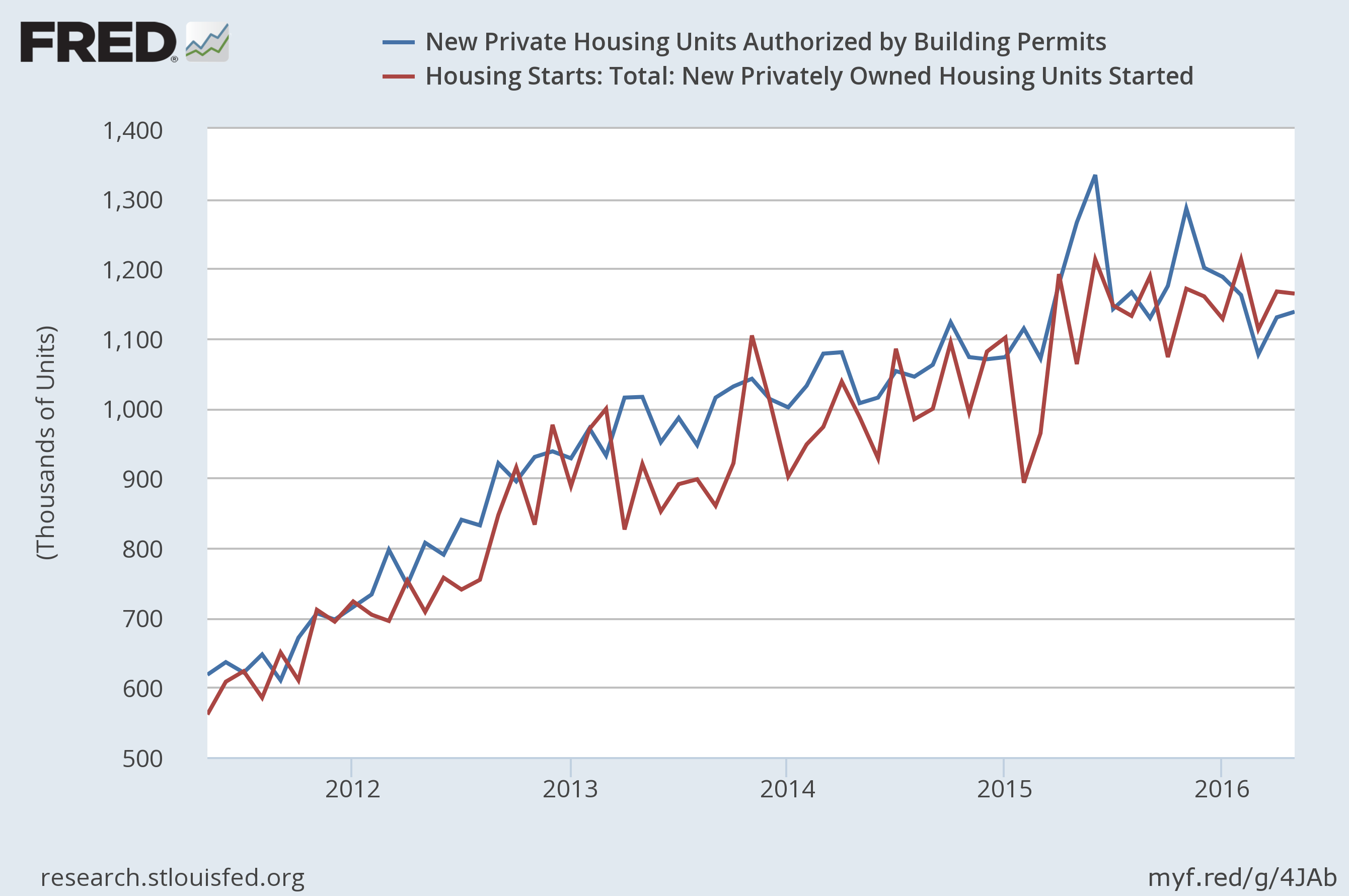

Finally, building permits increased .7% M/M but were down 10.1% Y/Y; housing starts declined .3% M/M but were up 9.5% Y/Y. The following chart shows that both numbers continue to move sideways since 1Q15:

Economic Summary: this week’s news was mixed. Retail sales provided the best news, indicating that the U.S. consumer’s 1Q spending slump was probably temporary. Housing news was neutral as both starts and permits continue to move sideways. Finally, the weak industrial production numbers show the oil and gas slowdown continues.

Market Analysis: I’ve been slightly bearish for the last 12-18, largely due to the weak earnings environment. But this week, the iShares Russell 2000 (NYSE:IWM) and iShares S&P Midcap 400 (NYSE:IJH) continued their 4-month rally, potentially indicating an increase in overall risk appetite among traders. This led me to wonder if we could be seeing a longer-term rally developing. To that end, let’s take a look at the respective charts:

The IWMs’ rally (top chart) started in February when prices were ~93. In late May, prices broke through upside resistance provided by the downward sloping trend line connecting June 2015 and July 2015 highs. Prices continued to rally and are now positioned right on the trend line. The IJH’s (bottom chart) rally also started in February. Prices have moved higher since, recently closing around the trend line.

Both of these averages could be considered measures of risk appetite, so their rally potentially indicates an increase in risk-taking behavior. The cumulative advance/decline lines add to the bullish argument: the NYSE AD line is rising while the NASDAQ numbers are moving sideways. And finally, the number of NYSE and NASDAQ stocks above their respective 50 day EMA is 56% and 45%, indicating a large amount of upside potential.

But if traders are truly increasing their risk appetite, it has yet to show up in the major averages:

While the SPDR S&P 500 (NYSE:SPY) (top chart) started to rally in February with the other averages, they fell through their technical support trendline on Monday and are currently resting on their 50-day EMA. The PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) (bottom chart) have been consolidating between 104 and 110 since mid-April.

This is not to say that both averages couldn’t move higher from current levels. But it would help if they had a fundamental reason to rally such as a strong 2Q earnings season. Unfortunately, that isn’t in the cards.

Both Zacks and Factset are predicting declining revenue and earnings growth for the upcoming quarter. And while the NY and Atlanta Fed’s respective GDP models are predicting an average 2Q growth rate of 2.4%, the yield curve’s spread is near its lowest level in 5 years, indicating bond traders aren’t as optimistic as the Fed. This lack of fundamental impetus continues to be the primary reason I remain sanguine about current growth prospects and am, therefore, still moderately bearish.