A key issue to note if you want to time market turns is that stocks are always the last asset class to “get it.”

Consider that high yield credit or Junk Bonds (NYSE:HYG) have lead stocks from the January ’16 lows.

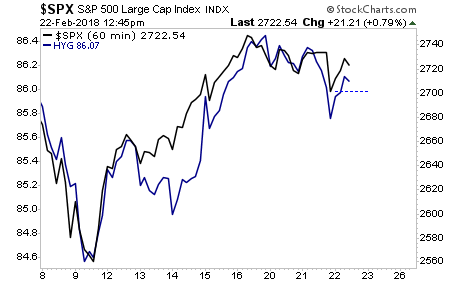

HYG also peaked and rolled over before the S&P 500 during this recent meltdown (blue vs. black circles).

With that in mind, I note that HYG is NOT leading the S&P 500 during this recent bounce. If anything HYG is lagging and preparing to roll over again (blue line vs. black line).

This is a major warning to the bulls. Credit isn’t buying this rally for a minute. And remember, stocks are always last to “get it.” And the next leg down will be far worse than the first.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.