No one can reliably predict the start date of the next recession, but the last half century suggests that the stock market will suffer when the economy contracts.

Business-cycle risk looks tame at the moment, but it’s not too early for investors to decide how — or if — they’ll react when the next round of macro trouble arises. There are two basic options. One is to ride out the storm. That’s a reasonable strategy. As Ben Carlson at Ritholtz Wealth Management points out in a recent Bloomberg column, “the stock market was actually up during half of the past 14 recessions.”

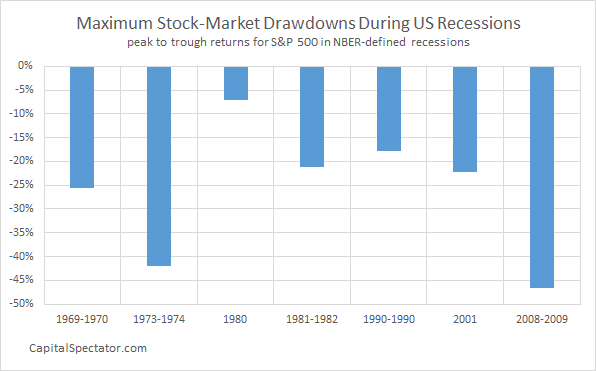

True, but equities generally suffer during recessions, even if prices tend to rebound once growth resumes. In every NBER-defined economic decline since the 1969-1970 slide, the S&P 500 took a hit within the confines of the contraction, measured by the maximum drawdown relative to the start of the recession. The haircuts ranged from a relatively light 7.1% decline in the brief 1980 downturn to the hefty 46.7% loss in the Great Recession of 2008-2009.

As part of sound risk management process it’s essential to decide – at a time of low recession risk – the strategy you’ll practice when the next recession arrives. It’s reasonable to assume that the stock market will decline, perhaps dramatically, during the downturn. The key question: Are you prepared for the white-knuckle ride?

The worst-case scenario is assuming that you’re a buy-and-hold investor only to find out in the depths of a recession that you can’t take it anymore. Selling at or near the bottom is a hazard that too often derails an otherwise informed investment strategy. One of the reasons, perhaps the key reason, why expected return tends to rise dramatically during recessions is that many (most?) investors bail when the going gets rough. The best laid plans, it can be assumed, run amuck when the economy’s contracting, perhaps for a year or two.

That leads some investors to plan on adjusting asset allocation in the early stages of an economic contraction with an eye on minimizing the portfolio damage. Is this possible? There are no guarantees, but a careful review of vintage economic data (before revisions) is encouraging.

Take the last recession as an example. The three-month average of the Chicago Fed National Activity Index, a monthly US business-cycle benchmark, posted a recession warning on Mar. 24, 2008. As the chart below shows, that was a relatively early signal. The S&P closed at just below 1350 that day; when the market hit bottom, a year later, equities had been cut nearly in half.

Deciding when the worst of a recession has passed is a key part of a dynamic asset allocation strategy too. Close monitoring of the economy can be productive on this front too.

While no one can reliably call tops or bottoms in the market – or the economy – there’s a strong case for including business-cycle signals as part of your risk-management process. Even if you’re intent on riding out a recessionary storm, developing context about business-cycle risk in real time is valuable, if only because it prepares you for what’s coming. And let’s be honest – managing behavioral risk is at a premium in money management during recessions.

Keeping a close eye on the Chicago Fed index is a solid foundation for monitoring recession risk. But the data is released monthly, and so there’s room for improvement. For example, consider The US Business Cycle Risk Report (US-BCRR), which combines nowcasts from multiple sources (including the Chicago Fed benchmark) to deliver relatively reliable and timely estimates of start dates for recessions. The goal isn’t to predict recessions. Instead, by quantitatively analyzing a broad set of existing data, the newsletter’s weekly updates seek to anticipate the upcoming Chicago Fed index signals.

The good news: US-BCRR’s track record is encouraging, largely because it relies on a diversified set of business-cycle indicators that reflect different design methodologies. During the US economy’s swoon in the first quarter of 2016, for example, US-BCRR never issued a recession signal, echoing the Chicago Fed data. NBER data tells us that the US remained recession free in 2016, although many pundits at the time warned that a new downturn was destiny. It was easy to think so, if you relied on media headlines or cherry-picked a couple of data points.

Regardless of how you manage your portfolio, developing a robust, objective system for monitoring recession risk is useful, arguably essential, in part to neutralize the noise that generally passes as economic analysis in the wider world.

The business cycle, of course, is only one facet for risk analysis. But there’s a strong case for including it in your overall risk-management process for one simple reason: sooner or later it’s probably going to be a factor in your investment analytics.