When there is bull market in tech stocks, there is likely to be leadership from the semiconductor sector.

In fact, one might argue that the Philadelphia Semiconductor Index has been on fire since the 2020 low.

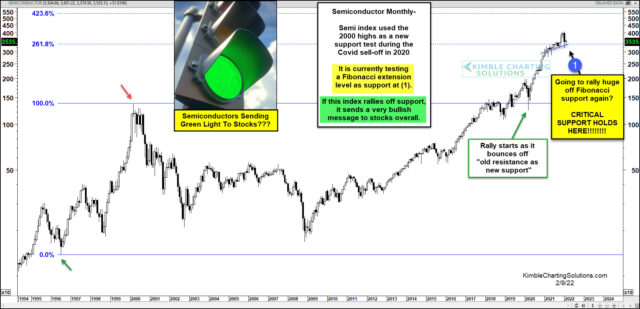

Today’s long-term monthly chart highlights this and more. Note that the 2020 COVID crash brought the Semiconductors down to an old key resistance, new support line (red/green arrows).

When that support held firm, it ignited a sharp multi-month rally higher into and breaking out above the 261.8% Fibonacci extension level. It is currently testing this key Fibonacci level as support at (1) – i.e. trying to hold onto the breakout over it.

This is a big test for tech stock at (1). If the Semiconductor Index rallies from here, it would send a solid bullish message to tech and the broader market.

If Semiconductors break support at (1), this would signal the tech and broader market are in trouble.