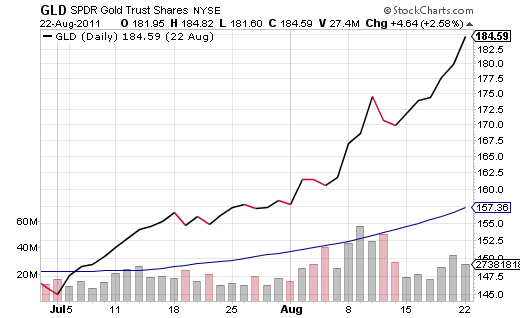

Flash back to the summer of 2011. The U.S. Congress struggled with a decision to raise the debt ceiling. The “PIGS” (i.e., Portugal, Italy, Greece, Spain) had dramatically overspent, endangering the existence of the euro-zone. Stocks cratered. The CBOE S&P 500 Volatility Index (VIX) soared. Meanwhile, the SPDR Gold Trust (ARCA:GLD) catapulted 26% in a matter of six weeks.

Flash forward to the summer of 2014. Tensions have flared up between Russia and Ukraine, but the conflict has had little direct impact on stock assets. Even fewer seem concerned about the sustainability of country debt in Europe. What’s more, gold bears have hammered the idea that the yellow metal might serve as a safe haven against political turmoil, inflation or electronic money printing.

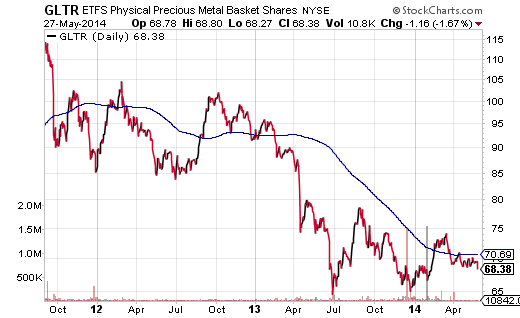

Do precious metals bears have a point? They might. Investors have not rushed into iShares Silver Trust (ARCA:SLV) or SPDR Gold Trust (GLD) in response to recent events in Crimea or Syria. In addition, increases in quantitative easing (QE) by the U.S. Federal Reserve, the Bank of Japan as well as the Bank of England did not result in rapid price appreciation for precious metals proxies. On the contrary. The long-term downtrend for funds like ETFS Physical Precious Metals Basket (NYSE:GLTR) remains intact.

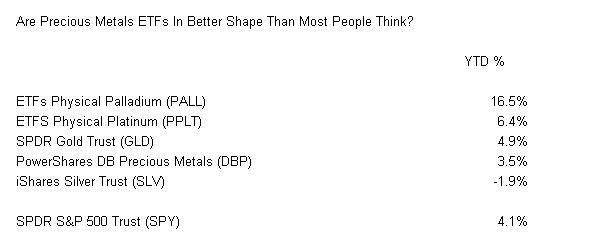

The poor three-year performance percentages on precious metals notwithstanding, is it proper to dismiss gold and silver altogether? Probably not. For one thing, calendar year-to-date returns for a variety of precious commodity assets have demonstrate signs of perking up. In fact, the returns are still competitive with broader stock market indices.

What about the recent slide in prices? A number of analysts note that gold is historically weak in the May-June period. It follows that if the SPDR Gold Trust (GLD) can stay on the positive side going into July, it might very well be an exceptionally bullish sign for the rest of 2014.

Perhaps most importantly, precious metals bears have forgotten the link between emerging market growth and gold. Rolling 5-year correlation coefficients for the S&P 500 and the yellow metal are close to 0.0. (Note: Fans of diversification might prefer non-correlated assets such as GLD and the SPDR S&P 500 (ARCA:SPY) in their portfolios.) Yet the same coefficient between iShares MSCI Emerging Markets (ARCA:EEM) and GLD is closer to .35. Granted, the relationship is not particularly strong, but it is relevant. Strength in emerging market assets in the previous decade, where the global growth theme relied heavily on China and India, played a role in precious metal price appreciation. Weakness in the emergers over the last three years has played a role in precious metal price depreciation in the current decade.

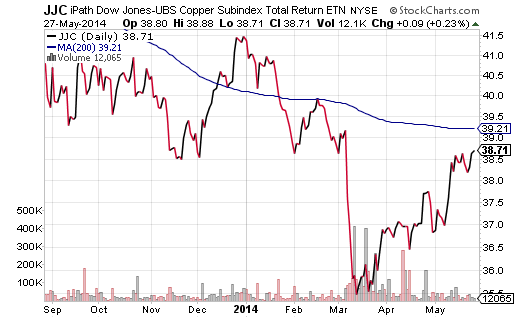

In sum, weak Asian demand coupled with seasonality factors may be taking some of the shine off of precious metals, gold in particular. In the 2nd half of 2014, however, precious metals could see a pick-up in Asian demand. Indian citizens recently elected pro-growth, pro-business leaders into power. Meanwhile, vopper prices have been steadily recovering on the notion that China, the world’s largest consumer of copper, is likely to see stimulus measures soon.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationship.