Oil prices are a big factor this earnings season... even for companies not involved in the energy sector.

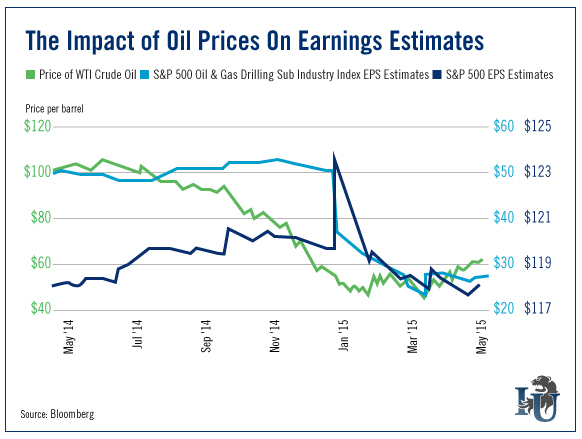

This week’s chart looks at how earning-per-share (EPS) estimates for the S&P 500 and Bloomberg’s S&P 500 Oil & Gas Drilling Sub Industry Index have fared against the price of oil.

The Bloomberg index contains a basket of large cap drillers, including ENSCO plc (NYSE:ESV) and Transocean Ltd (NYSE:RIG). As the chart above shows, when EPS estimates for these giants tumble, the rest of the S&P feels the vibrations.

After a spike at the end of 2014, EPS estimates across all sectors of the S&P 500 plunged, not surprisingly, along with crude prices.

As Oxford Club Emerging Trends Strategist Matthew Carr wrote in April: “We’ve known for months that energy earnings were going to be bad. Any time a sector sees its underlying commodity collapse, it’s not good.”

Last quarter, total earnings for the energy sector were down 17.3% on 13.5% lower revenues. And with oil prices still low, estimates for the sector have fallen 47.3% so far in the first quarter of 2015.

From the chart, it’s clear that oil prices have a huge impact - not only on energy companies, but on the broader market. The good news is: if oil prices rally as Energy & Infrastructure Strategist David Fessler has been predicting, current estimates could be gross underestimations for the entire economy.

P.S. Recently, Dave and Resource Strategist Sean Brodrick uncovered the story of the 94-year-old man who is almost single-handedly responsible for America’s entire energy resurgence.