Starting with Fed Chairman Powell:

- Most Recent Labor Data Sends Signal of Cooling

- Labor Market Appears to Be Fully Back In Balance

- No Longer A Heated Economy

- ‘We Are Well Aware’ We Face Two-Sided Risks

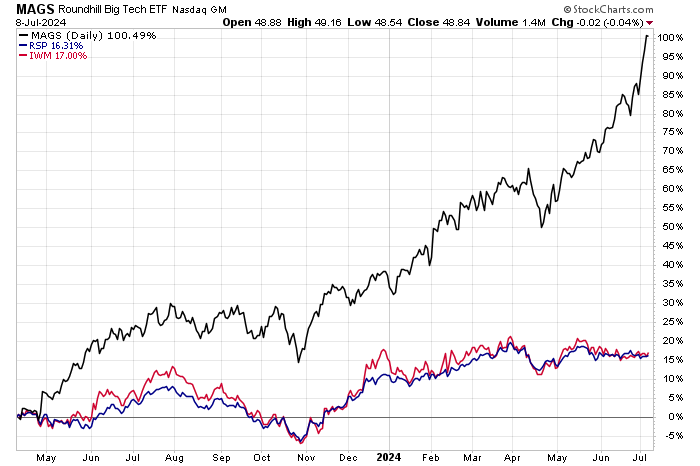

Last night I wrote on the US Small Cap 2000:

“We have heard many discussions on whether small caps matter for the market.”

The chart above is clear.

Do we care about the small caps?

Is there a correction coming in large caps (NASDAQ:MAGS)?

Did Powell say anything, really?

As we all try to read between the lines, please have a look at where you might consider parking money right now.

ETF Summary

- S&P 500 (SPY) 5400 support 5600 resistance

- Russell 2000 (IWM) 197-205 tightest range to watch

- Dow (DIA) 40k resistance

- Nasdaq (QQQ) Meager consolidation at the all-time high

- Regional banks (KRE) Watching the range 45-50 CAREFULLY

- Semiconductors (SMH) 260 -280 range

- Transportation (IYT) Not pretty under 64

- Biotechnology (IBB) 140 pivotal resistance

- Retail (XRT) 200 week moving average support at 72.75. Needs to recapture 74.50

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) Pointing more risk on for now