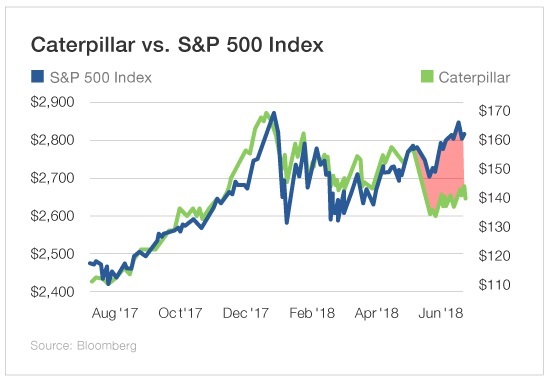

The correlation between the S&P 500 and industry is traditionally a tight one. Historically, as industrials perform well, the market follows suit.

However, over the past year or so, the S&P has outperformed industrials, due in no small part to the overperformance of tech stocks. This is worrying analysts who fear a market correction will be necessary to return the correlation to traditional levels.

Before we jump to any conclusions, let’s consider Caterpillar (NYSE:CAT), which is one of the major holdings of the Industrial Select Sector SPDR (NYSE:XLI), an $11 billion industrial-themed ETF. In the past, Caterpillar has been a bellwether for future performance of the sector and the market overall.

Based in Deerfield, Illinois, Caterpillar is the world’s largest maker of heavy equipment for mining, construction and energy companies. Last month it beat analysts’ expectations, reporting a second quarter profit that was more than double that of the same quarter last year. And equipment sales were up 25% due to rising demand natural gas, oil and mining companies, as well as Chinese construction companies.

Since 2011, Caterpillar and the global economy as a whole have enjoyed a long run of escalating activity. This most recent earnings announcement brings renewed hope that robust global economic activity will continue through 2019.

It’s also good news for Caterpillar's business model. Selling to more than 190 countries, the overseas markets account for half of its sales. Despite the looming tariffs that threaten to destabilize material costs, Caterpillar continues to book more orders and deliver higher profits.

The short-term future is bright for Caterpillar. Although the stock is still roughly 30 points below its 52-week high, it’s sitting on a backlog of $17.7 billion in orders, up $200 million from the first quarter. And company executives expect product prices to more than offset looming cost increases.

Hopefully, Caterpillar’s performance is an indicator that industrials are catching back up to meet the market and return it to its traditional correlation with the sector. It’s a better scenario than the market dramatically dropping to do the same.