There seems to be a lot of confusion out there as to whether the stock markets are bullish or bearish. Is the Dow Jones in a topping pattern as so many analysis are suggesting? I’ve seen some charts that are calling the big trading range on the Dow Jones going all the way back to the 2000 bull market top, THE JAWS OF DEATH. It doesn’t get anymore dire than that, does it? As usual I have a different take on things, which I would like to share.

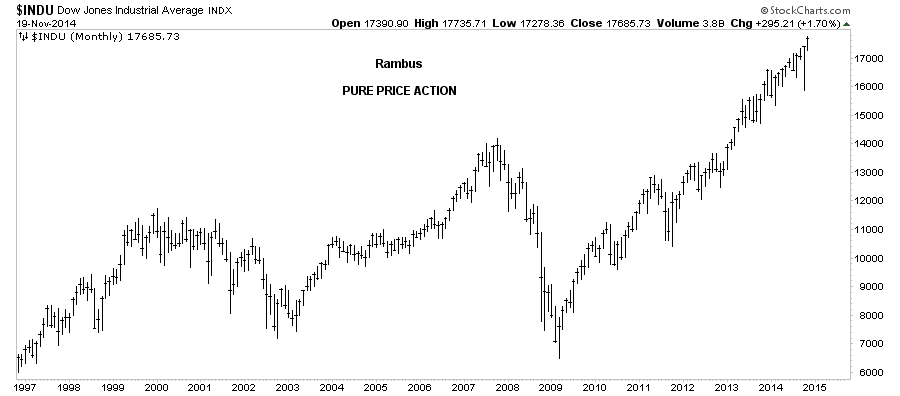

Before we look at the first chart for the Dow Jones, clear your mind of everything related to the stock markets. That means no Elliot Wave counts, Time Cycles, Gann Lines , volume studies, no indicators of any kind. Clear your mind of every article you’ve ever read on the stock markets, bullish or bearish. And last of all, no Chartology. I want you to look at just the pure price action without any bias whatsoever.

From this point we can then start to see what is really happening to the Dow and related markets.

This first chart is a long-term, monthly look at the Dow going back to 1997 with no annotations or indicators of any kind. Just pure price action. When you look at this chart, look at the very last bar on the top right hand side of the chart.

As you can see, the Dow Jones is making new all time highs for the month of November. This is not what a top or a bear market looks like. This is as bullish a chart as you will find anywhere. Claiming anything else just doesn't add up. Again, look at the last bar on the top right hand side of the chart:

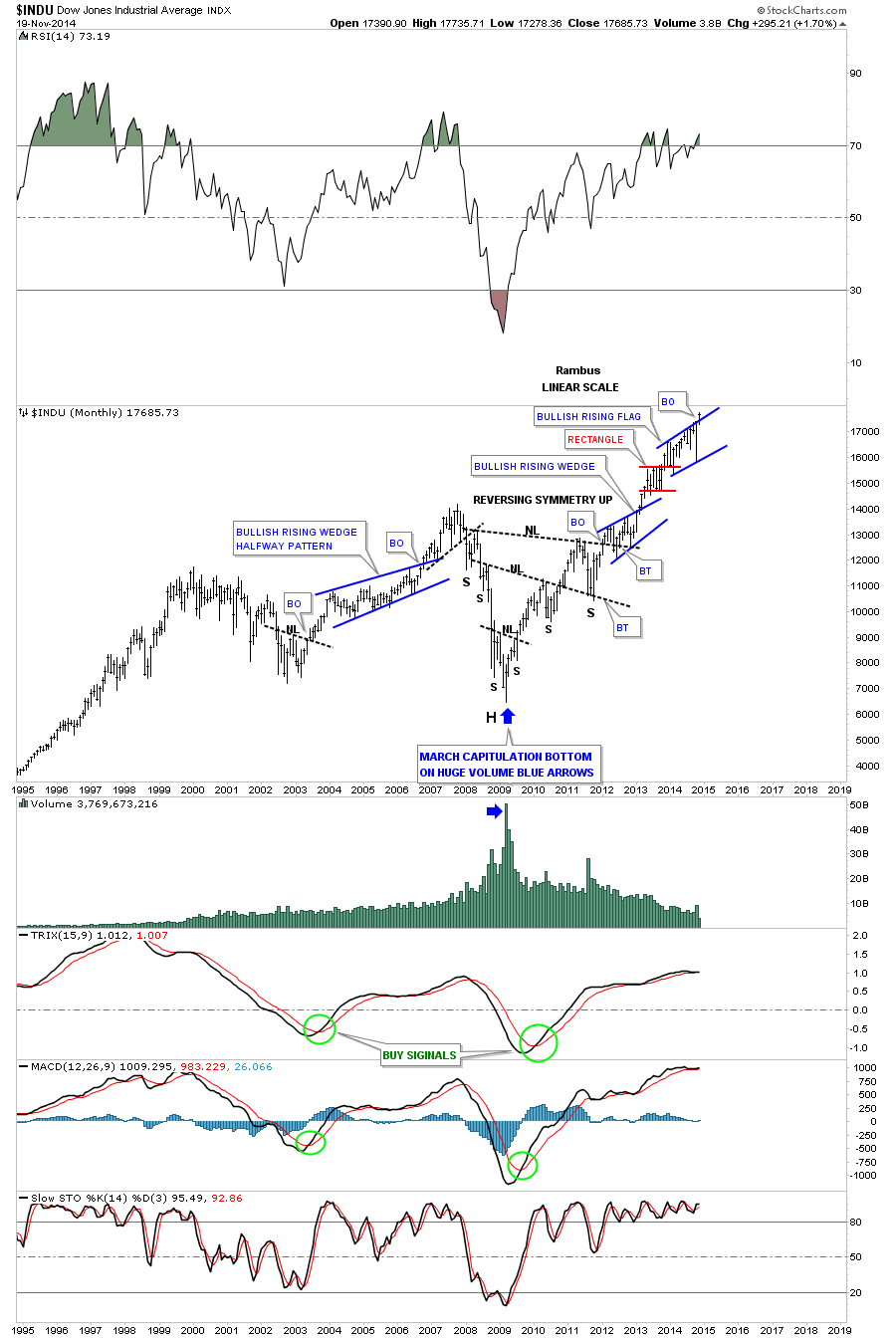

Now that you're able to see what I’m seeing, let's bring in some Chartology and see what it looks like. If you prefer, you can put on your own trading discipline and see what you come up with.

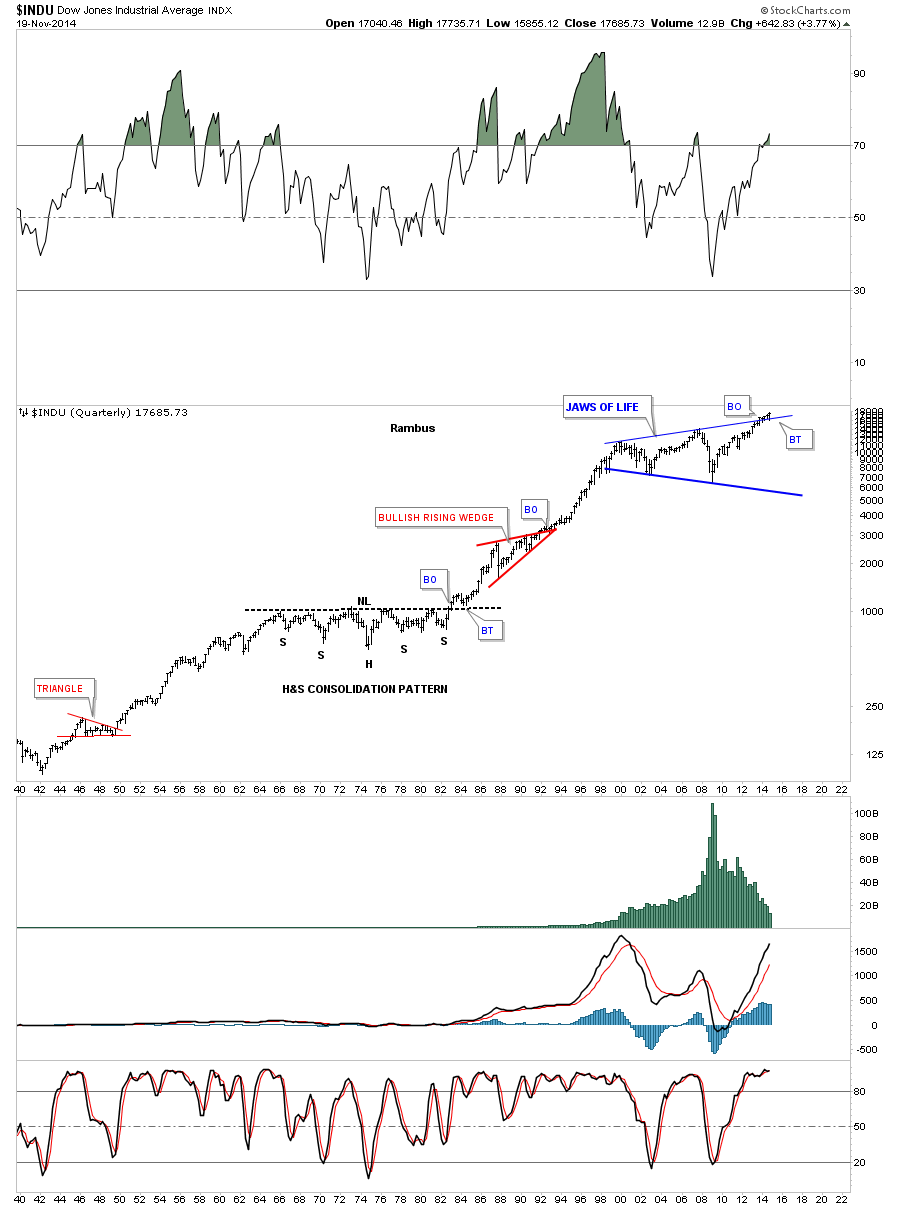

One of the basic principals of charting is defining and determining what's an uptrend or a down trend. An uptrend consists of higher lows and higher highs while a downtrend makes lower lows and lower highs. This is a simple concept to understand. On the monthly chart below I’ve added all the chart patterns, as I’ve seen them form through the years.

Let's start at the 2009 crash low that ended on a massive capitulation spike in volume. Who could have ever guessed that five years later the Dow would be making record highs in 2014? I remember the 2009 low very well, the world as we knew it was coming to an end. That has stuck with investors all these years and makes them fearful every time the Dow has a decent rally. In the real world, nothing could be further from the truth over the last five years. The old saying, 'the stock markets like to climb a wall of worry,' pertains perfectly in this case.

Getting back to what a basic uptrend is, you can see the Dow has fulfilled this requirement to a T. Higher highs and higher lows all the way up. Start at the 2009 crash low and follow the price action all the way up to our most recent high. I have said many times that gold’s bull market produced some of the best chart patterns I’ve ever seen in a bull market but the Dow is quickly catching up. Once again, notice the last bar on the top righthand side of the chart.

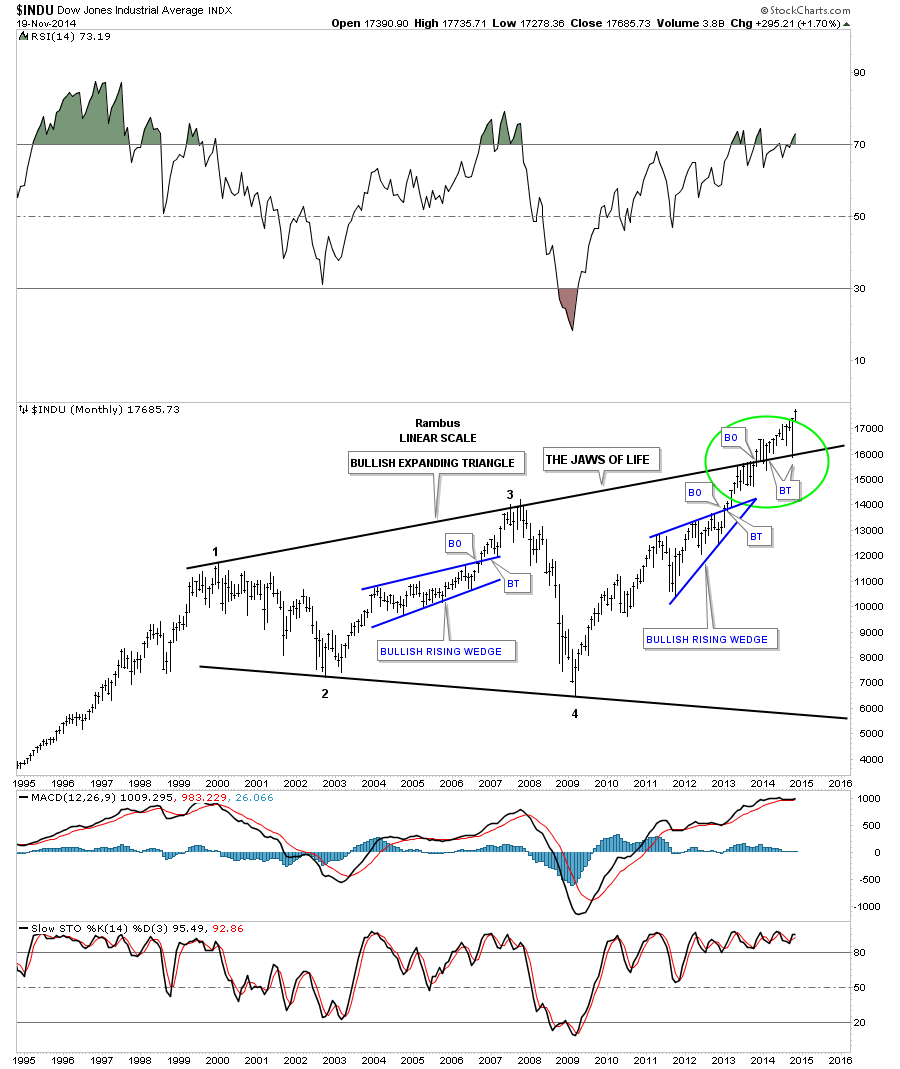

The next chart shows you what most chartists are calling the 'Jaws of Death.' From a Chartology perspective this is classic price action. Any trendline you put on a chart is either a support or resistance line. When the price is trading above a trendline it will act as support when touched from the top side and when the price action is trading below a trendline it will act as resistance. Eventually one of the trendlines will fail and that’s when you get your breakout.

If you look at a triangle consolidation pattern, the top rail is resistance and the bottom rail is support. The price action trades between the two rails until either the bulls or the bears win out. In a bull market the bulls usually win the battle and in bear markets the bears usually win out.

Looking at the chart below you can see it took six months of chopping action below the top rail of the Jaws of Life consolidation pattern before the Dow was able to overcome that strong resistance rail, as shown by the BO (Break Out) annotation. The Dow then spent about a year trading above what had been a resistance rail but is now a support rail. This is a perfect example of what happens when the bulls win the battle: resistance turns into support. Note the two backtests, BT, that touched the top rail of the Jaws of Life from the topside.

You may recall last month when the markets were having a tough time of it and everyone was talking bear market. Note where the October low hit. Dead on the top rail of the Jaws of Life. …Let that sink in for a moment….it was dead on ! A rapid waterfall 10% move to precisely the breakout point. Mr. Market was just checking back from above. Here at Rambus Chartology we were hoping and waiting for a chance to get on board. But we had to be nimble. Mr. Market did not hang around for a millisecond. A small head and shoulders pattern on the minute charts was the only signal he gave. Fortunately we pounced on it in our General Market Leveraged ETF Trading Portfolio .

This tells us that this is one hot rail and must be respected. It’s very simple. Above that top rail is bullish, below is bearish. Until that top rail of the Jaws of Life pattern is broken to the downside, one has to be bullish on the longer term time frame, as this massive 14 year consolidation pattern is just breaking out.

In truth, it's been breaking out for a year now but it looks like all the work is done and the next big impulse move up is ahead of us. Again, notice the last bar on the top righthand side of the chart.

A 75 Year Bull Market? Are You Serious? Yes Virginia I am.

Next let's get some perspective on our Jaws of Life by looking at a 75 year chart for the Dow Jones. I know some of you will remember the period during the 1970s when it looked like the world was coming to an end with inflation and rising interest rates going through the roof. That period on the chart carved out a massive H&S consolation pattern complete with a breakout and backtest before the bull market of a lifetime began.

You can see our Jaws of Life consolidation pattern just breaking out at the top of the chart. Are we now at the equivalent to the 1982 period for the Dow Jones? Few believed back in 1982 that a bull market was just getting started. It really wasn’t until the mid 90s that everyone finally figured it out, which led to the parabolic blow off. And that was followed by our just completed 14 year Jaws of Life consolidation.

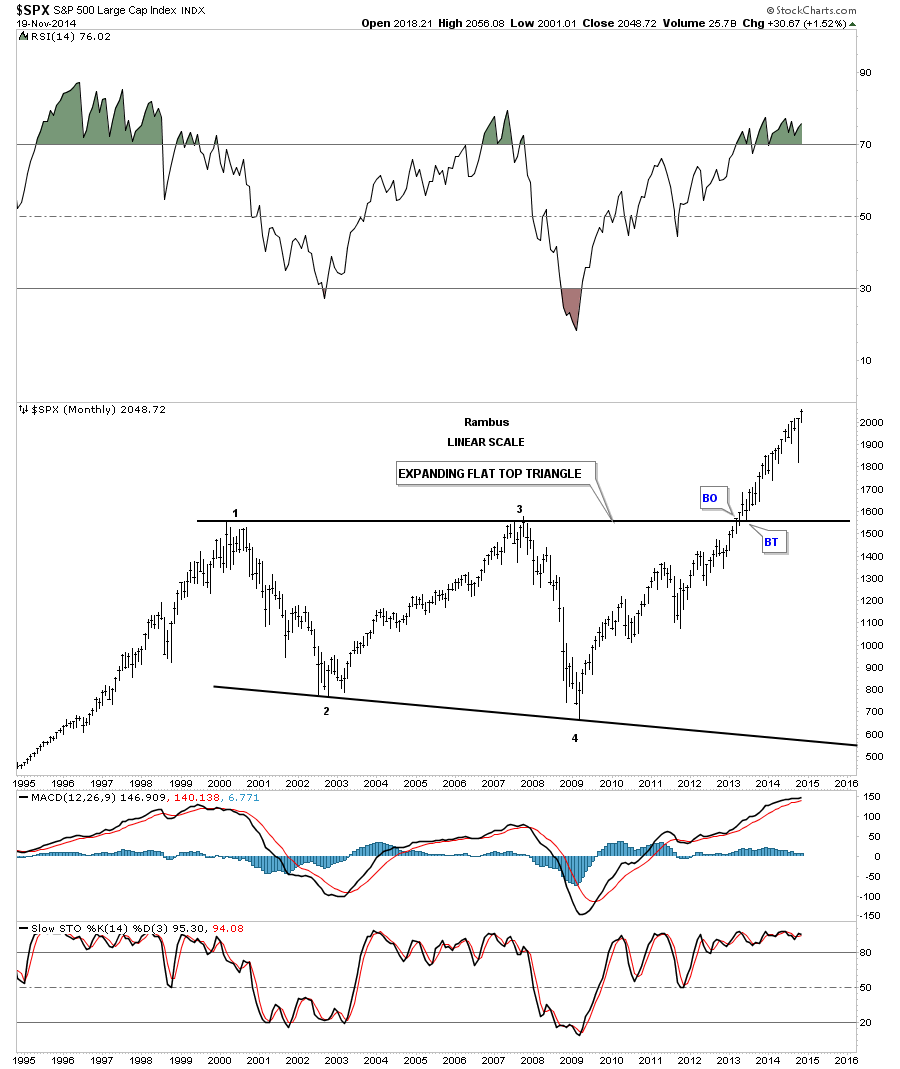

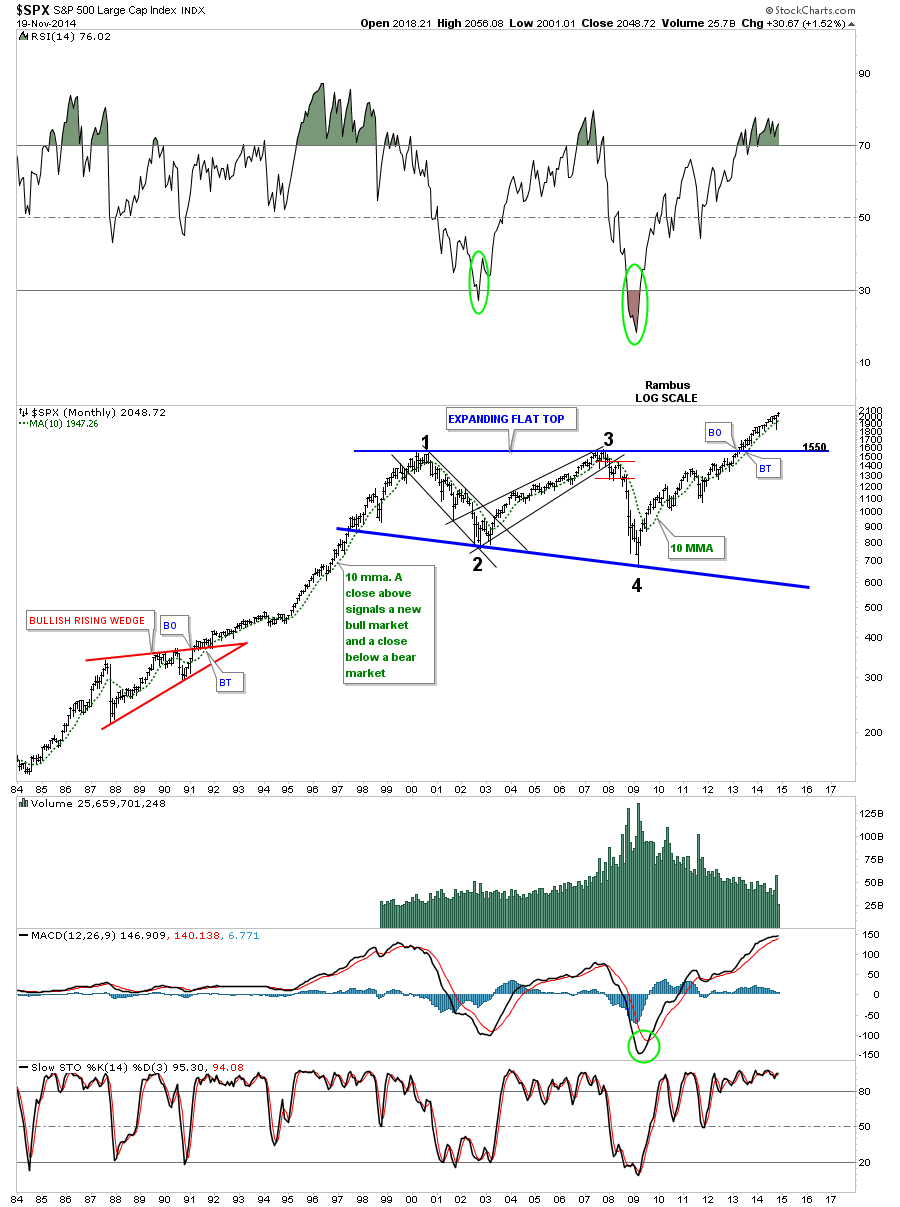

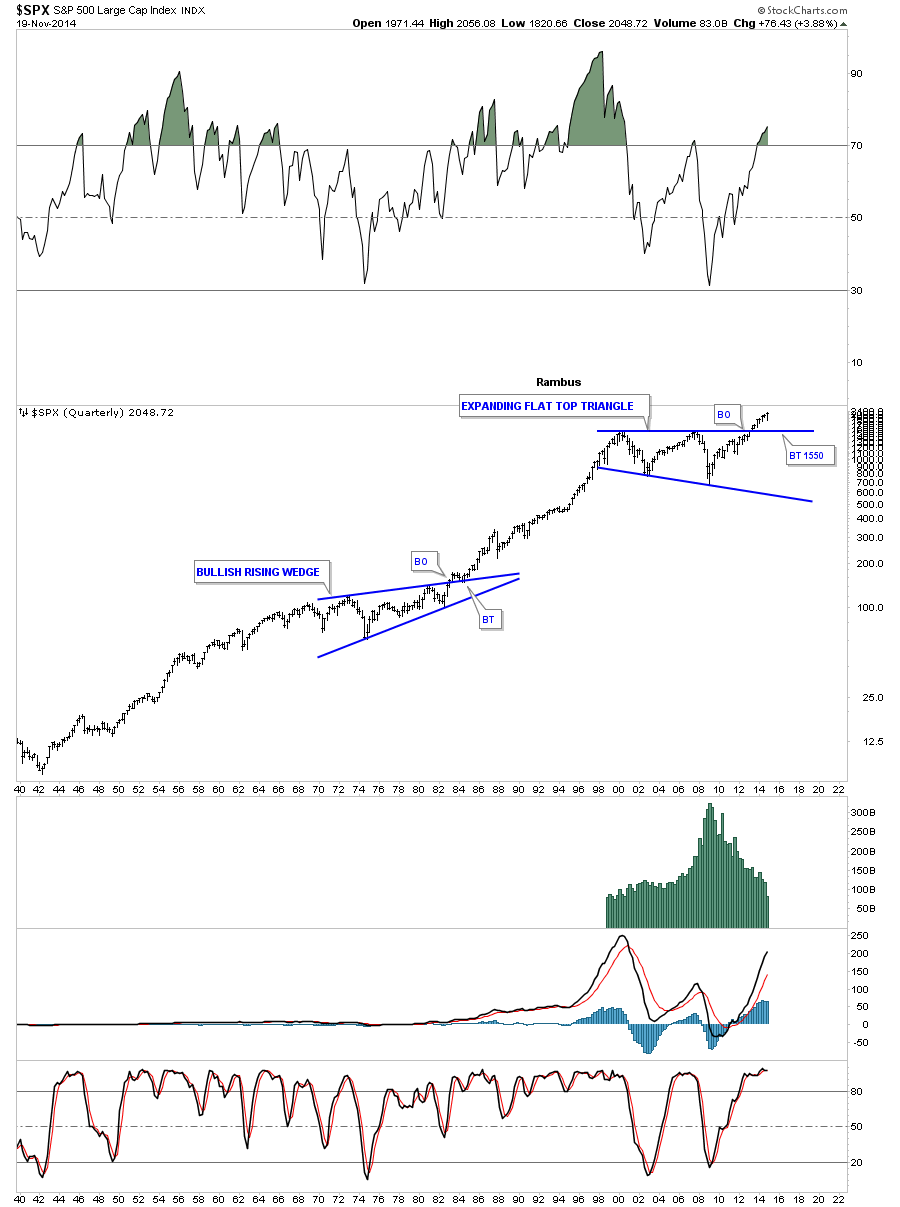

Let's now look at the Dow’s little brother, the S&P 500. As you can see, it's been almost two years since the SPX has broken out of its massive, flat top triangle. If you focus in on the breakout area you will see there was one quick backtest shortly after the breakout. Since then, the SPX hasn’t looked back.

Let's now look at the 30 year chart for the SPX which shows the beautiful flat top triangle consolidation pattern with four complete reversal points. If you compare the current price action since the 2009 crash low to the bull market rally back in the 80s and 90s, separated by the red bullish rising wedge, you can see the price action just seems to keep rising relentlessly with only small corrections along the way. This h as left many retail investors staring from the sidelines in sheer awe.

Looking at the 75 year chart for the SPX you can see how our current flat top triangle fits into the bigger picture. As in any time frame, an uptrend is a series of higher highs and higher lows. For the most part we can call this a massive 75 year uptrend.

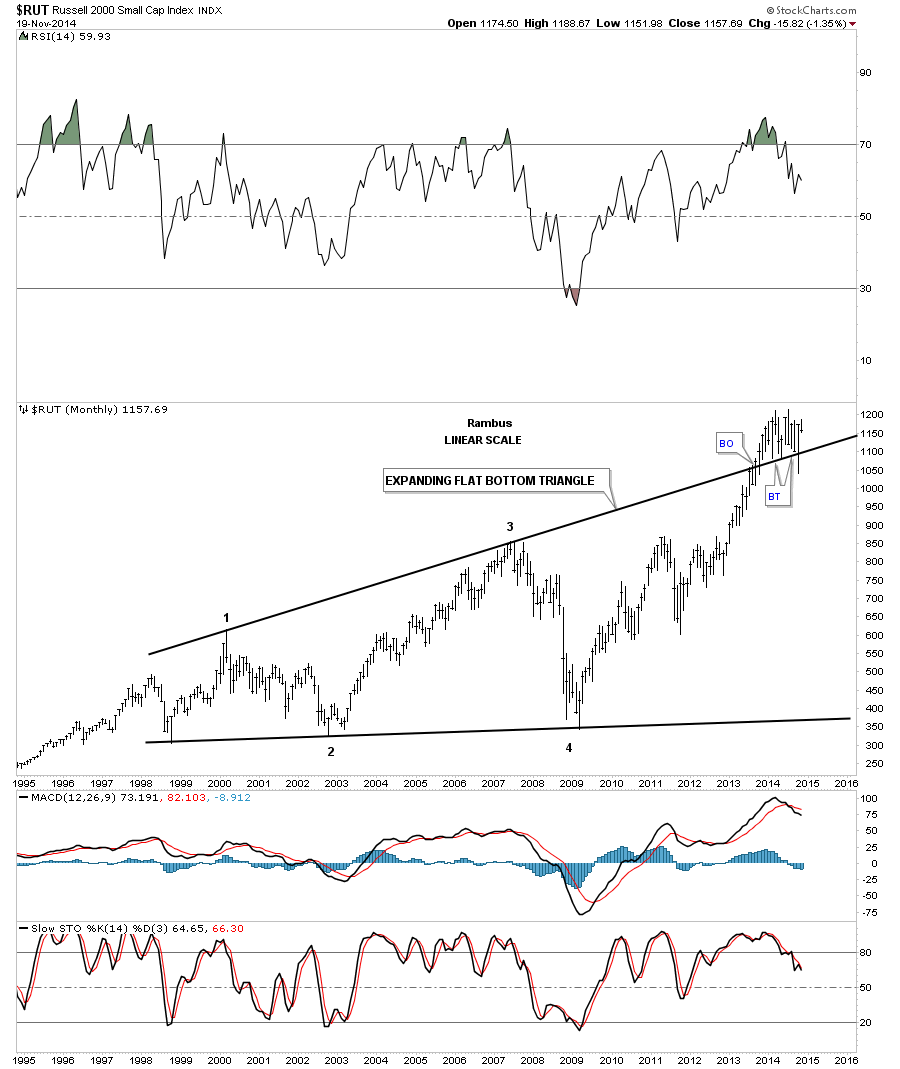

Finally, let's look at one last chart, for the Russell 2000 small cap stock index. It too has broken out above the top rail of its 14 year expanding flat bottom triangle and is still in the process of backtesting the top rail from above:

As these charts show, we’re at an interesting juncture right now in the stock markets. If one has the discipline and courage to buy the strongest stocks or ETFs and hold them for several years or longer, one will be well rewarded in the future for their efforts. I can tell you it’s never easy to hold on during a bull market as every little correction will seem like the next bear market is starting.

There were some outrageous profits made during that last secular bull market in the 80s and 90s for those that bought the right stocks—particularly in the tech sector. If investors were able to hold on, for some it became the ride of a lifetime. Obviously, no one knows how long our current five year bull market will run for, but by the looks of those really big consolidation pattens shown above, it’s not going to be a flash-in-the-pan type of move. The bigger the consolidation pattern, the bigger the move that follows.

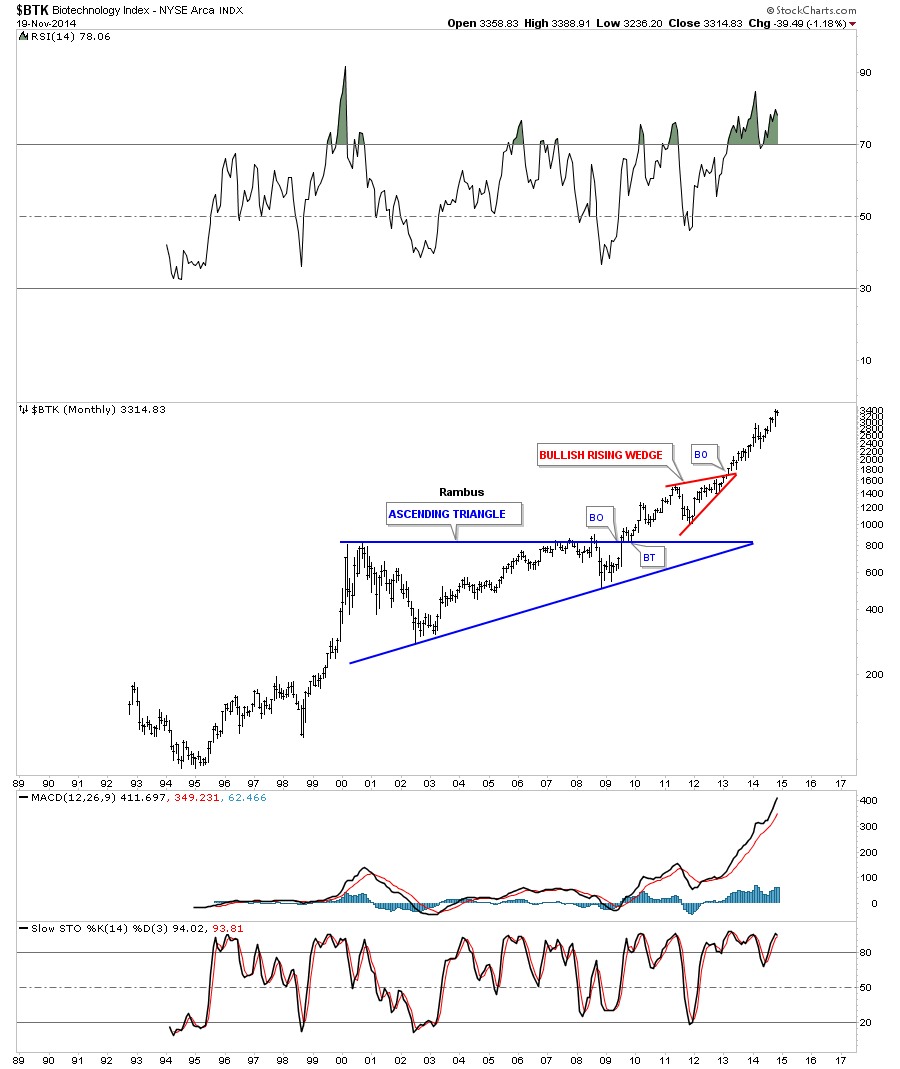

I want to leave you with one last long term chart for the ARCA Biotechnology, the biotec index. It has been the leader in this bull market and has a similar big blue consolidation pattern to the ones in the charts above. I expect the Dow Jones and the other US stock market charts will have a similar look when they really get going. Will you be watching or participating?