Last week we wondered if a change in sector leadership was brewing for US equities, based on a set of exchange traded funds. Among the leading candidates, we mused: Consumer Staples Select Sector SPDR® Fund (NYSE:XLP). The future’s still unclear (as always), but after XLP’s strong gain yesterday, building on last week’s solid rally, the possibility that staples are moving to the fore after posting lagging results remains an intriguing possibility.

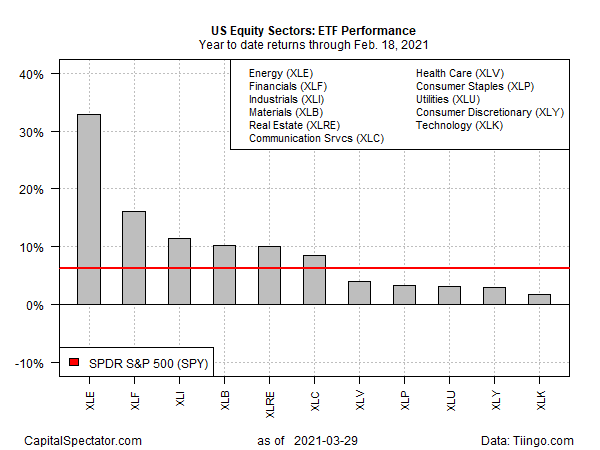

Let’s start with a quick recap. Recall that just days ago, XLP was the worst-performing sector on a year-to-date basis (through Mar. 23). At the time, The Capital Spector noted that “the sector laggards are stirring, hinting at the possibility of a shift in leadership.”

Fast forward a week and a staples-led shift in leadership looks a bit more plausible after a sharp rally in these stocks in recent trading sessions through yesterday’s close (Mar. 29).

XLP’s rally is all the more impressive when you consider that that broad market has been mostly churning in a range lately. Meanwhile, the current year-to-date sector leaders – energy (XLE) and financials (XLF) – are modestly below their recent highs. XLP, by comparison, closed at yet another record high yesterday.

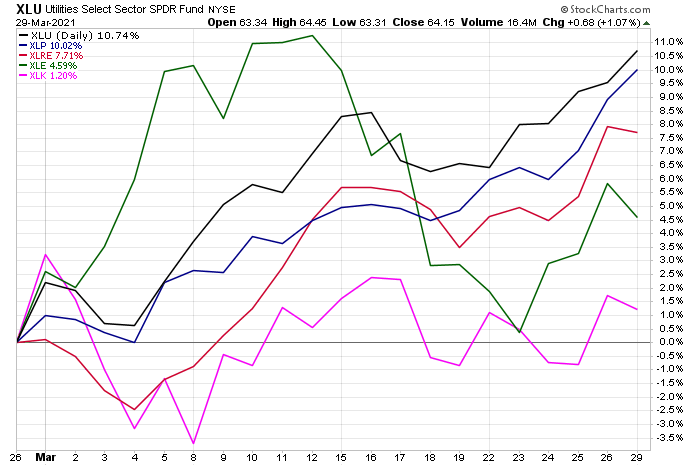

To be fair, the potential for a change in sector leadership also highlights utilities (XLU) and real estate investment trusts (XLRE), which have also been relatively strong lately. For some perspective, here’s how a select group of sector performances stack up over the past month. Note that utilities (XLU), consumer staples (XLP) and real estate (XLRE) are in the lead while the formerly sizzling energy (XLE) and tech (XLK) sectors have cooled.

Yes, it could be noise. A few days or weeks hardly makes a trend. Indeed, on a year-to-date basis, energy and financials are still firmly in the lead while XLP is lagging the broad market (SPY).

But as Barron’s notes, expectations for higher inflation are starting to change minds about which slices of the stock market may fare better.

Defensive sectors, themes and stocks generally hold up better as markets get worried about rising rates and other threats to corporate profits. Traditional defensive sectors like consumer staples and utilities may not cut it, though. Both sectors are underperforming the broader market this year. Healthcare is also lagging.

It’s premature to assume that the rebound in energy and financials has run out of road, or that tech’s leadership has faded for the foreseeable future. But if we’re at a turning point, we may see the signs in the days ahead. Watch this space.