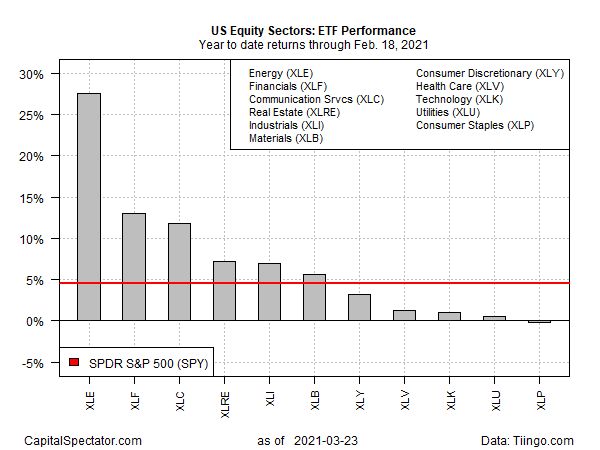

Shares in the energy patch continued to post the strongest year-to-date performance for US equity sectors, based on a set of exchange traded funds through yesterday’s close (Mar. 23). The dramatic bounce from last year’s low has left the rest of the sector field in the dust in 2021. But some of the laggards are showing relative strength in recent weeks, suggesting that a leadership rotation may be brewing.

At the moment, however, the rear-view mirror for the year so far favors energy companies by a wide margin. Energy Select Sector (NYSE:XLE) was s up 27.5% in 2021 through Tuesday’s close. That’s nearly double the gain for the next-best sector rally—financials via Financial Select Sector SPDR® Fund (NYSE:XLF)—or the market overall, based on SPDR® S&P 500 (NYSE:SPY), which was up a relatively modest 4.5% year-to-date.

A key driver of the rebound in energy shares: expectations that US economic growth is picking up. But after pricing in a forecast for accelerating economic activity, the question is will the macro data will deliver upbeat numbers?

As Michael Arone, chief investment strategist for State Street Global Advisors noted:

“Shares are being bid up because there are expectations for greater demand. We need to see the follow-through.”

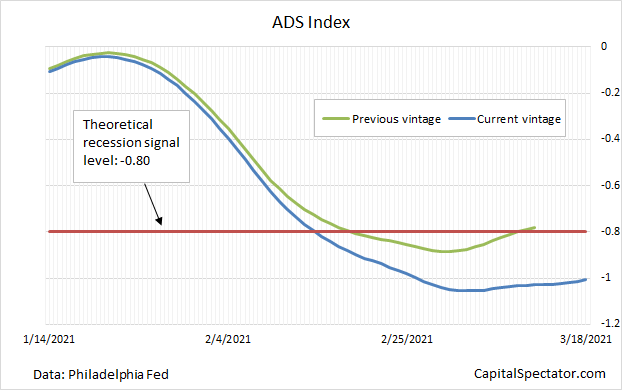

Recent economic data hasn’t been cooperative. Two broad measures of the US macro trend have been surprisingly weak. Start with the Philly Fed’s ADS business cycle index, which is currently reflecting a contraction in US output, based on data through Mar. 18. This index can be volatile in the short term and so the weakness may be noise, but the latest results offer reason for managing expectations down.

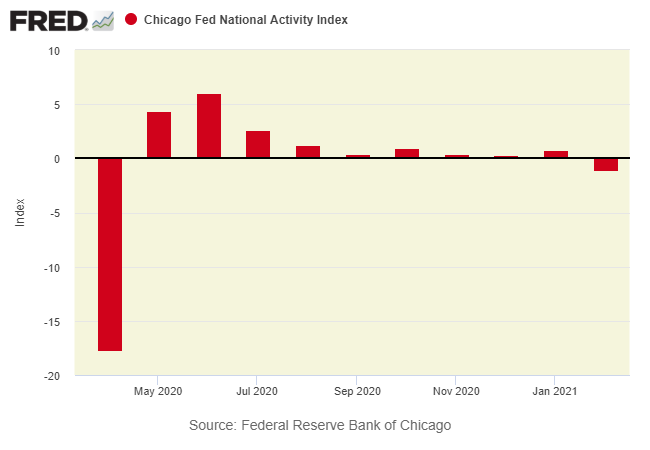

The monthly data for the Chicago Fed National Activity Index (CFNAI), by contrast, is more reliable. Unfortunately, this week’s update for February shows a decline in US output last month—the first monthly negative print since April 2020, when the pandemic-induced recession was raging.

The CFNAI data may be noisy, too, suffering a temporary slide as the pandemic blowback continues to take a toll. The counterpoint is that as the vaccine rollout continues, the prospects are improving for firmer economic activity in the months ahead and so looking backward is unusually misleading.

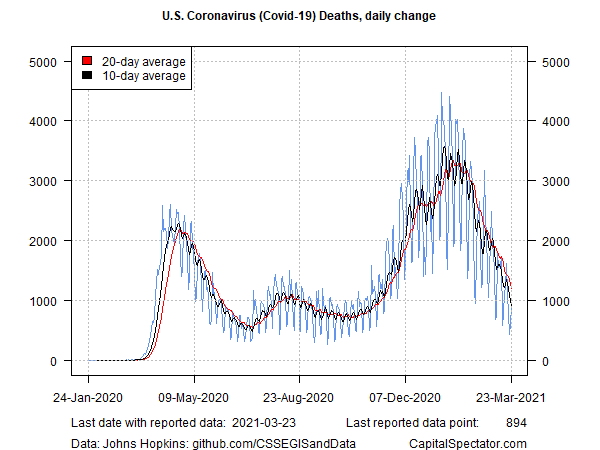

Consider the trend in new US COVID-19 fatalities through yesterday (Mar. 23), which looks encouraging relative to recent history. Notably, the 10-day average was below the 1,000-per-day mark for a second day on Tuesday—the lowest two-day run in more than four months.

Despite the weakness in business-cycle indexes lately, nowcasts for next month’s first-quarter GDP report remain upbeat, albeit moderately less so compared with previous weeks. The Atlanta Fed’s GDPNow model, for instance, is currently projecting a strong 5.7% increase in output (real annualized rate) for Q1, up from Q4’s 4.1% rise.

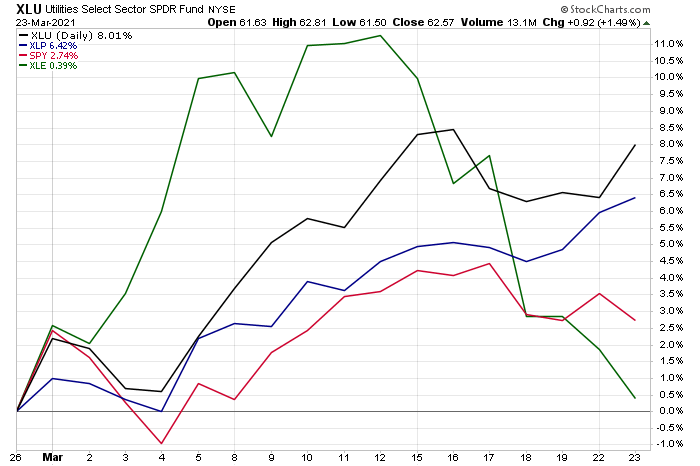

Meantime, the sector laggards are stirring, hinting at the possibility of a shift in leadership. Consider, for instance, that the two equity sectors with the weakest year-to-date results – utilities—Utilities Select Sector SPDR® Fund (NYSE:XLU)—and consumer staples—Consumer Staples Select Sector SPDR® Fund (NYSE:XLP)—were posting the strongest sector returns so far in March, returns that are well ahead of energy (XLE) and the broad US market (SPY).

Is this a sign that energy’s leadership is fading and more defensive sectors are picking up the slack? Unclear for now, but if economic data in the weeks ahead is softer than expected, the appetite for utilities and consumer staples could benefit further at the expense of energy stocks.