The S&P 500 added to recent gains Tuesday and is within a few points of all-time highs. This is a long way from the anxiety and uncertainty traders felt last week. In my post last week, “Don’t Let the Bears Scare You”, I wrote that weakness was “a better place to be buying stocks than selling them”. Given this week’s strong performance, that was definitely the prudent trade. While it feels good to pat ourselves on the back, the most important trade is always the next trade. Now that we returned to the highs, everyone wants to know what comes next?

The first thing we need to analyze is what brought things out of last week’s doldrums. This rebound kicked into overdrive Monday when the French election went according to the market’s plan. While it was nice to eliminate this risk factor, “not-bad” news is a lot different than good news. The market would have been upset if two anti-EU candidates made the final round, but for what seems like the first time this year, a moderate is the clear front-runner.

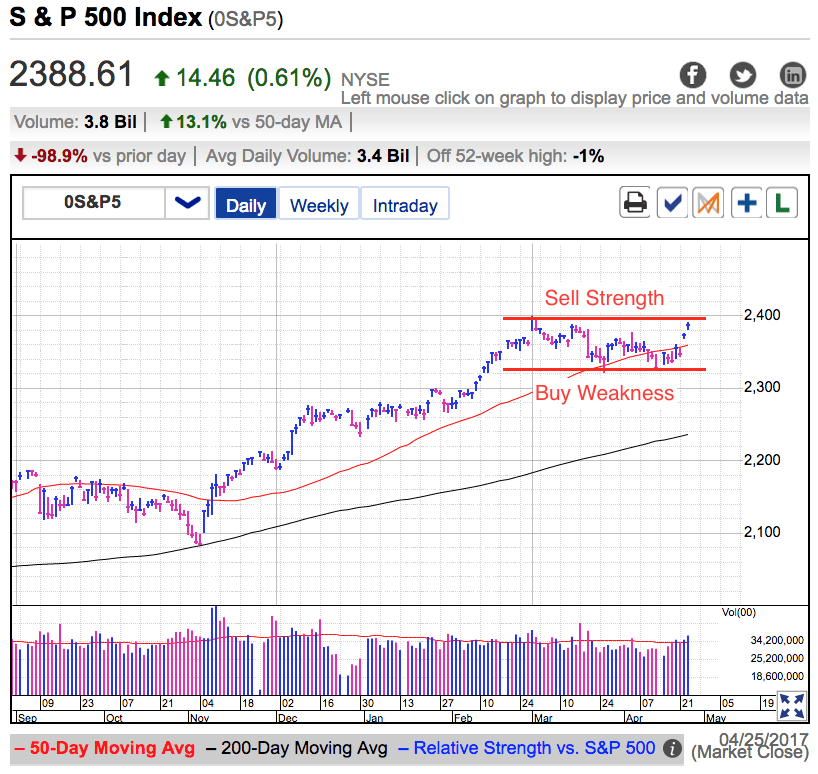

But the thing about “not-bad” news is it doesn’t do anything to improve corporate earnings in the U.S. We experienced a brief period of relief this week when we avoided a worst-case scenario, but now that we traversed those waters, we are largely left where we were a couple of weeks ago. We remain near the highs as hope for tax and regulatory reform remains high, but we are still waiting for Trump and the GOP to deliver on those promises. We couldn’t break through 2,400 in March and not much has changed since then.

The next bogie on the horizon is Congress passing a federal budget. Even though the GOP controls the government, they have been unable to use their strength effectively. Last month they failed to repeal Obamacare and right now it looks like they are on the verge of screwing up even simple procedures. If the GOP cannot agree on the budget, then that endangers even more important things like tax reform.

Most traders know markets trade sideways more often than they rally or pull back. But we often forget that in the heat of battle. When prices are falling, we assume they will keep falling. When we rebound, we assume prices will keep rallying. But most of the time these periods of strength fizzle and bouts of weakness rebound.

While most investors feel a lot better than they did last week, we should assume we will stay inside this trading range until something more meaningful happens. Just like how last week was a buying opportunity, this week we should be selling this strength. Expect us to remain rangebound until tax reform either passes or dies. Until then keep buying weakness and selling strength.