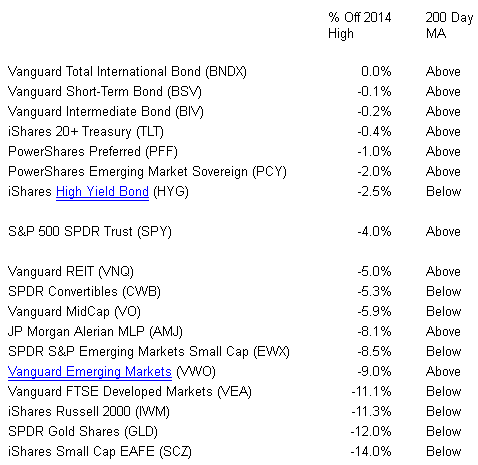

Since the S&P 500 hit 2011 on September 18, it has forfeited 4.1%. That may not represent a significant decline. Yet, the year-to-date damage across an array of 18 popular asset classes is a bit more vexing.

Depreciation Across 18 Unique Asset Classes

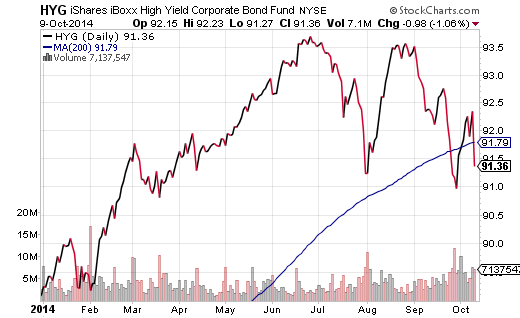

The two major areas that have entered official corrections – foreign developed stock ETFs and small-cap U.S. stock ETFs – started their precarious journey in July. Funds like iShares Russell 2000 (ARCA:IWM), iShares Small Cap EAFE (NYSE:SCZ) and Vanguard Developed Markets (NYSE:VEA) have not only depreciated significantly in price, each is below its long-term trendline (200-day moving average). Higher yielding bond assets via iShares High Yield Bond (ARCA:HYG) and SPDR Convertible Securities (NYSE:CWB) have entered long-term downtrends as well. The depreciation may not be as destructive in the higher yielding bond arena. That said, the widening of yield spreads between high yield and investment grade is another closemouthed canary in the investment mines.

The initial troublemakers – high yield bonds, foreign stock ETFs, small-cap U.S. stock ETFs – caused a collective stir in July. It was not until the start of September, however, that we began to see other asset classes flounder. Energy MLPs, convertible bonds, emerging markets and mid-cap U.S. stocks suddenly became victims of selling pressure. ETFs like SPDR Convertible Bond (NYSE:CWB), Vanguard MidCap (NYSE:VO), SPDR S&P Emerging Market Small Cap (NYSE:EWX) and JP Morgan Alerian MLP (NYSE:AMJ) began to diverge from the more widely followed large-cap U.S. stocks in the Dow and the S&P 500; many were losing ground in mid-September even as the S&P 500 surged to an all-time record.

With the asset class canaries from July reeling – with a host of additional asset classes teetering in September – will the rest of the “risky assets” follow suit? It is beginning to seem that way. Granted, European leaders might say or do something to alleviate the fears of a global recession. Earnings season might prove far better than many are anticipating. What’s more, the U.S. Federal Reserve might serve up a statement to indicate that zero percent interest rate policy will continue well into the foreseeable future. (Note: I personally believe in the likelihood that overnight lending rates stay at 0% throughout 2015.)

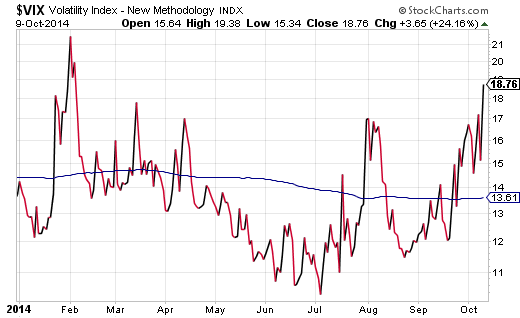

On the flip side, the mid-term elections in November introduce uncertainty over which party may ultimately control the legislative agenda in Washington D.C. Corporate guidance on revenue and earnings might disappoint. And the CBOE S&P 500 Volatility Index (VIX) has been logging “higher lows” since early July. Additionally, the S&P 500 has traded more consecutive days above its 200-day moving average than at any other time in its history as a benchmark, and probability alone suggests a deeper sell-off is in the works.

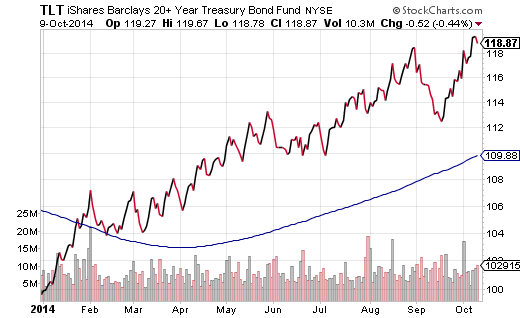

With the Dow diving 335 points on October 9 – with so many asset classes experiencing heavy-volume selling – are all correlations heading for 1.0? That may be the case for riskier asset classes, but it is not the case for rate-sensitive, investment grade bonds. Most investment-grade bond ETFs enjoy strong uptrends; most reside near year-to-date highs. In fact, the more one has allocated to long-term bonds like iShares 20+Treasury (ARCA:TLT), the better he/she has protected his portfolio.

I have maintained an allocation to longer-term investment grade debt throughout the year with my clients. I have discussed it in the context of a barbell approach to ETF investing. Not only has it served to protect and to diversify, it has also offered better risk-adjusted returns throughout the year.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.