Arconic Inc. (NYSE:ARNC) logged profit, as reported, of $212 million or 43 cents per share for the second quarter of 2017. The results in the reported quarter include $47 million of special items that includes a gain on debt-for-equity exchange of shares of Alcoa Corp. (NYSE:AA) .

Barring one-time items, earnings came in at 32 cents per share for the reported quarter, marginally down from 33 cents per share a year ago. The results topped the Zacks Consensus Estimate of 27 cents. Arconic gained from its cost-saving actions in the quarter and all units delivered higher volumes.

Arconic reported revenues of $3,261 million, up around 1% year over year. The figure surpassed the Zacks Consensus Estimate of $3,234 million. Revenues were driven by improved volumes across all segments and higher aluminum prices.

Segment Highlights

Engineered Products and Solutions (EPS) – Revenues from the division came in at $1.5 billion in the second quarter, up about 1% year over year. Adjusted EBITDA declined 5.8% year over year to $310 million in the quarter, as volume gains and net cost savings (which exclude costs related to engine ramp-up) were more than offset by unfavorable mix and pricing.

Global Rolled Products (GRP) – The division recorded sales of $1.3 billion in the quarter, down 4% year over year. Adjusted EBITDA inched up 0.6% year over year to $164 million, driven by strong automotive volumes and benefits of cost saving actions which partly offset reduced airframe destocking, aerospace wide-body build rates and pricing pressure in regional specialties.

Transportation and Construction Solutions (TCS) – The segment logged sales of $501 million, up 7% year over year. Adjusted EBITDA increased around 7.9% to $82 million in the quarter on the back of higher volumes and net cost savings, more than offsetting the pricing pressure in the heavy-duty truck market.

Financial Position

Arconic ended the quarter with cash and cash equivalents of roughly $1.8 billion. Long-term debt was reduced by around $1.25 billion since the beginning of the year.

Outlook

Arconic delivered a strong performance in the second quarter as it continues to cut cost and boost margins. The company has also revised the full year guidance on the back of higher volumes, higher aluminium prices and stronger net cost savings.

The company now expects revenues in the range of $12.3–$12.7 billion (up from $11.8–$12.4 billion) and adjusted earnings of $1.15–$1.20 per share (up from $1.10–$1.20 per share) for 2017.

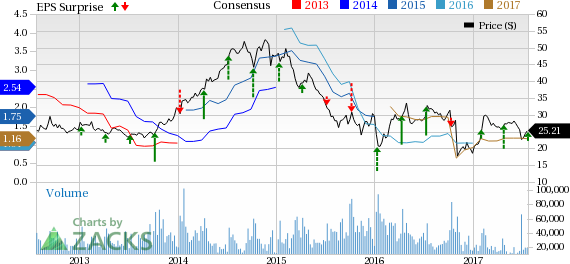

Price Performance

Arconic has lost 6.1% of its value in the last three months versus the 2.9% growth of its industry.

Arconic currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the basic materials space include Ternium S.A. (NYSE:TX) and Westlake Chemical Corp. (NYSE:WLK) . Both stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Ternium has expected long-term earnings growth rate of 18.4%.

Westlake Chemical has expected long-term earnings growth rate of 7.15%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Westlake Chemical Corporation (WLK): Free Stock Analysis Report

Alcoa Corp. (AA): Free Stock Analysis Report

Arconic Inc. (ARNC): Free Stock Analysis Report

Ternium S.A. (TX): Free Stock Analysis Report

Original post

Zacks Investment Research