ArcelorMittal (NYSE:MT) recently announced plans to invest €96 million at its Florange and Dunkerque sites in France.

ArcelorMittal will invest €67 million in Florange, eastern France, for a new production line for automotive steels and €29 million at Dunkerque, in the plant’s steel shop, for technical improvements that will yield greater flexibility for high value-added products. The investment is a part of the company’s strategy to develop a centre of excellence for automotive steels production.

The project at Florange involves the construction of a new 600,000 ton Usibor line, which the company expects to be operational by mid-2019. The new line will replace the current electro-galvanizing line and will be dedicated for producing advanced high strength steels (AHSS) and will also strengthens ArcelorMittal’s position in the automotive industry.

The company noted that demand for electro-galvanized products is witnessing a decreasing trend as consumers are more inclined toward more advanced high-strength steels. Demand for electro-galvanized products will be met by its three other electro-galvanizing lines namely, Genk and Marchin in Belgium and Dudelange in Luxembourg.

At Dunkerque, ArcelorMittal plans to modify the vacuum degassing unit by adding steel desulphurization and an enhanced slag retention system, which will be installed on the converters. The project is expected to be operational in the fourth quarter of 2018.

The investment will increase the plant steel shop's capability to manufacture grades with low phosphorus, sulphur and nitrogen contents. This will help the company to meet the requirements of automotive customers. ArcelorMittal expects the much awaited industrial production of Usibor 2000 at Dunkerque to start in 2019.

According to ArcelorMittal, the Florange project will increase the company’s ability to produce advanced high-strength steels, add flexibility to additional capacity and deliver better services. The company aims to produce AHSS products on commercial scale the earliest, courtesy of this investment.

Similarly, the investment at Dunkerque is also in line with ArcelorMittal Atlantique & Lorraine’s strategy to attain its long-term performance objectives of enhanced efficiency, quality and customer service.

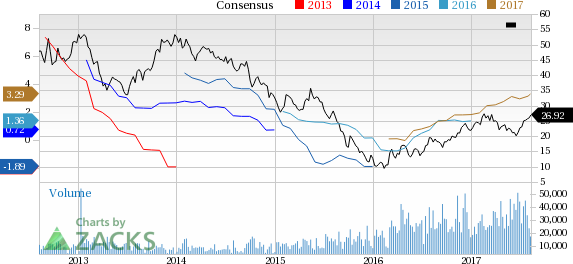

Shares of ArcelorMittal have moved up 15.5% in the last three months, outperforming the industry’s 13.2% rally.

ArcelorMittal logged a net income of $1,322 million or $1.29 per share in second-quarter 2017, as against net earnings of $1,112 million or $1.13 per share recorded a year ago. Adjusted earnings came in at $1.33 per share, topping the Zacks Consensus Estimate of 78 cents.

Revenues went up 17% year over year to $17,244 million in the quarter on the back of higher seaborne iron ore prices and steel prices, partly offset by lower steel and iron ore shipments. Sales surpassed the Zacks Consensus Estimate of $16,851 million.

ArcelorMittal now expects global apparent steel consumption to rise 2.5–3%, year over year in 2017, up from earlier growth expectation of 0.5-1.5%. In the U.S., the company sees apparent steel consumption growth of 2–3% in 2017, down from the previous forecast of 3-4% due to lower automotive production impacting flat products. The company also anticipates modest growth (0.5–1.5%) in apparent steel consumption in Europe.

Moreover, apparent steel consumption is forecasted to rise 2–3% in Brazil, down from the previous forecast of 3-4% as sustained weakness in construction is partly offset by modest improvement in consumer confidence and automotive demand. Apparent steel consumption in China is expected to grow 2.5–3.5%, up from previous forecast of -1.0– 0% owing to strength in real estate and machinery.

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the basic materials space are POSCO (NYSE:PKX) , The Chemours Company (NYSE:CC) and Kronos Worldwide Inc (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

POSCO has expected long-term earnings growth rate of 5%.

Chemours has expected long-term earnings growth rate of 15.5%.

Kronos Worldwide has expected long-term earnings growth rate of 5%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

ArcelorMittal (MT): Free Stock Analysis Report

Original post

Zacks Investment Research