On Sep 4, we issued an updated research report on the Luxembourg-based steel behemoth ArcelorMittal (NYSE:MT) .

ArcelorMittal logged a net income of $1,322 million or $1.29 per share in second-quarter 2017, against net earnings of $1,112 million or $1.13 recorded a year ago. Adjusted earnings came in at $1.33 per share, topping the Zacks Consensus Estimate of 78 cents.

Revenues went up 17% year over year to $17,244 million in the quarter on the back of higher seaborne iron ore and steel prices, partly offset by lower steel and iron ore shipments. Sales surpassed the Zacks Consensus Estimate of $16,851 million.

ArcelorMittal, in second-quarter earnings call, announced that it expects global apparent steel consumption (ASC) to rise 2.5-3% year over year in 2017 (up from the earlier expectation of 0.5-1.5%). In the United States, the company expects apparent steel consumption grow 2-3% in 2017, down from the previous forecast of 3-4% due to lower automotive production impacting flat products. The company also anticipates modest growth in apparent steel consumption in Europe.

Moreover, apparent steel consumption is forecasted to rise 2-3% in Brazil, down from the previous forecast of 3-4% as sustained weakness in construction is partly offset by modest improvement in consumer confidence and automotive demand. Apparent steel consumption in China is expected to grow 2.5-3.5%, up from previous forecast of -1.0-0% owing to strength in real estate and machinery.

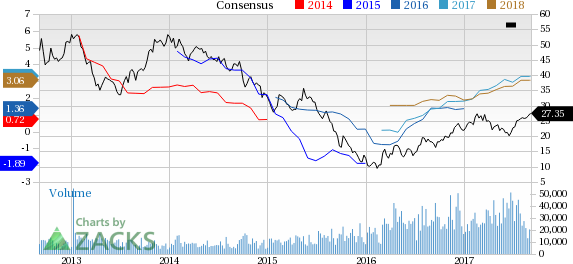

Price Performance

Shares of ArcelorMittal have moved up 29.1% in the last three months, outperforming the industry’s 17.2% rally.

Strategic Actions to Boost Growth

ArcelorMittal remains focused on reducing debt and lowering costs. The company’s net debt declined to $11.9 billion at the end of second-quarter 2017 from $12.1 billion recorded at the end of first quarter. The company also remains on track with its cost-reduction actions under its Action 2020 program, which includes plans to optimize costs and increase steel shipment volumes, along with improving the portfolio of high added value products.

ArcelorMittal continues to focus on shifting to high added value products and expanding its automotive steel line of products. The company is expanding its global portfolio of automotive steels by launching a new generation of advanced high strength steel. It is also planning to expand its family of third-generation advanced high strength steel. These products will enable the company to meet customer requirements via a strong technical and product portfolio.

Further, the recently announced acquisition of Ilva S.p.A. in Italy will provide growth opportunity for the company in Europe. Ilva is expected to be a good investment without compromising on the strength of the company’s balance sheet. The deal is expected to create synergies of €310 million by 2020, excluding impact from volume improvements and fixed cost reductions.

A Few Concerns

Depressed demand in Europe remains a concern. Despite some recovery, steel demand in Europe is still below the pre-crisis level. The company sees modest growth in steel consumption in Europe in 2017.

Moreover, the steel industry remains affected by significant production overcapacity. The company has also reduced its demand growth expectations for 2017 for the United States and Brazil. Soft construction activity in Brazil remains a concern.

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the basic materials space are The Chemours Company (NYSE:CC) , Kronos Worldwide Inc (NYSE:KRO) and Air Liquide (OTC:AIQUY) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Chemourshas an expected long-term earnings growth rate of 15.5%.

Kronos Worldwide has an expected long-term earnings growth rate of 5%.

Air Liquidehas an expected long-term earnings growth rate of 8.1%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Air Liquide (AIQUY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

ArcelorMittal (MT): Free Stock Analysis Report

Original post

Zacks Investment Research