Aqua America Inc. (NYSE:WTR) reported third-quarter 2017 earnings per share of 43 cents, in line with the Zacks Consensus Estimate and ahead of the year-ago quarter’s earnings of 41 cents by 4.9%.

Total Revenues

Third-quarter revenues of $215 million lagged the Zacks Consensus Estimate of $236 million by 8.9% and missed the year-ago quarter’s figure of $226.6 million by 5.1%.

Highlights of the Release

The company signed an agreement to acquire 3,800-connection municipal wastewater system to drive growth.

Year to date, Aqua America's state subsidiaries in Indiana, Illinois, New Jersey, North Carolina and Ohio have received rate awards or infrastructure surcharges amounting $21.4 million. In addition, the company currently has rate proceedings pending in Illinois, North Carolina and Virginia worth $14.1 million.

Consolidated operations and maintenance expenses were $68 million for third-quarter 2017, compared with $79.8 million in the year-ago quarter. The year-over-year decline was due to divestitures in market-based activities, lower production expenses and employee-related expenses.

Interest expenses increased 11.1% to $22.41 million from $20.17 million in the year-ago quarter.

Financial Highlights

Current assets were $138.3 million as of Sep 30, up from $128.7 million as of Dec 31, 2016.

Long-term debt was $1,952.5 million as of Sep 30, higher than $1,737.6 million as of Dec 31, 2016.

Guidance

Aqua America reiterated 2017 earnings guidance in the range of $1.34-$1.39 per share. It expects customer base to expand 1.5-2% in 2017.

Aqua America’s same-system operations and maintenance expenses are expected to increase by less than 2%.

The company also reaffirmed 2017 capital investment budget of $450 million. This is part of the 2017-2019 investment plan of nearly $1.2-billion.

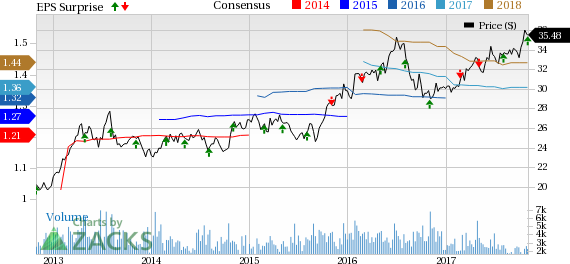

Aqua America, Inc. Price, Consensus and EPS Surprise

Upcoming Peer Releases

American States Water Company (NYSE:AWR) is expected to report third-quarter 2017 results on Nov 6. The Zacks Consensus Estimate for earnings is pegged at 58 cents.

American Water Works Company (NYSE:AWK) is expected to report third-quarter 2017 results on Nov 2. The Zacks Consensus Estimate for earnings is pegged at $1.08.

Consolidated Water Company Ltd. (NASDAQ:CWCO) is expected to report third-quarter 2017 results on Nov 9. The Zacks Consensus Estimate for earnings is pegged at 14 cents.

Zacks Rank

Aqua America carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

American Water Works (AWK): Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO): Free Stock Analysis Report

Aqua America, Inc. (WTR): Free Stock Analysis Report

American States Water Company (AWR): Free Stock Analysis Report

Original post

Zacks Investment Research