Semiconductor materials maker Applied Materials (NASDAQ:AMAT) late Thursday posted mixed fourth quarter earnings and offered an upbeat outlook, but its backlog decline sent investors heading for the exits in after-hours trading.

The Santa Clara-based company reported Q4 EPS $0.66, which narrowly beat out Wall Street expectations of $0.65. Revenues surged 39.2% from last year to $3.3 billion, just missing estimates for $3.31 billion.

On a sour note, AMAT’s backlog fell 7% from the previous quarter to $4.58 billion.

Looking ahead, AMAT forecast Q1 EPS of $0.62 to $0.70, which would easily beat Wall Street’s view of $0.58, on revenues ranging from $3.20 to $3.34 billion, also ahead of estimates for $3.12 billion.

The company commented via press release:

“In fiscal 2016, we grew orders, revenue, and earnings to the highest levels in the company’s history, and made significant progress towards our longer-term strategic and financial goals,” said Gary Dickerson, President and CEO. “We’ve focused our organization and investments to deliver highly differentiated solutions that enable customers to build new devices and structures that were never possible before.”

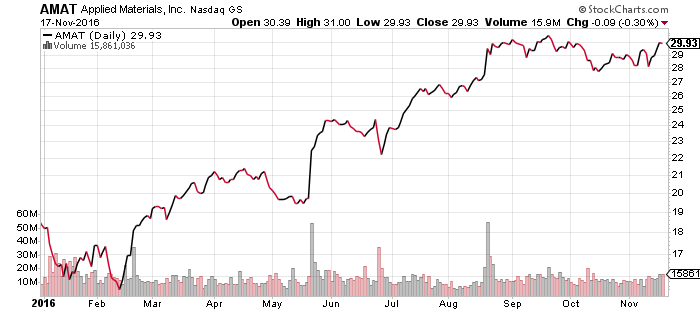

Applied Materials shares fell $1.35 (-4.39%) to $29.38 in after-hours trading Thursday. Prior to today’s report, AMAT had gained 64.6% year-to-date, versus a 7.41% rise in the benchmark S&P 500 index during the same period. AMAT had been one of the very best performers in the S&P 500 this year, amid a huge semiconductor sector rally.