Applied Materials, Inc. (NASDAQ:AMAT) just released its third-quarter 2017 financial results, posting earnings of $0.86 per share and revenues of $3.74 billion. Currently, Applied Materials is a Zacks Rank #2 (Buy), and is up 3.15% to $44.48 per share in after-hours trading shortly after its earnings report was released.

Applied Materials, Inc. (AMAT):

Beat earnings estimates. The company posted earnings of $0.86 per share (which excludes $0.01 from non-recurring items), beating the Zacks Consensus Estimate of $0.83 per share.

Beat revenue estimates. The company saw revenue figures of $3.74 billion, topping our consensus estimate of $3.66 billion.

Applied Materials reported record revenues in its third-quarter, which were up 33% year-over-year. The company’s earnings skyrocketed 85% from the year-ago period, while non-GAAP earnings soared 72%

The semiconductor maker reported $1.37 billion in operating cash flow. The company returned $482 million to shareholders through stock repurchases and cash dividends.

Applied Materials expects fiscal fourth-quarter revenues in the range of $3.85 billion to $4 billion. The company projects earnings to range from $0.86 a share to $0.94 a share.

“With revenue and profits at all-time highs, Applied has tremendous momentum and a very positive outlook for the future,” CEO Gary Dickerson said in a statement. “Our markets are growing with a broader set of demand drivers, and the breadth of Applied’s technology enables us to play a larger and more valuable role advancing the innovation roadmap in semiconductor and display.”

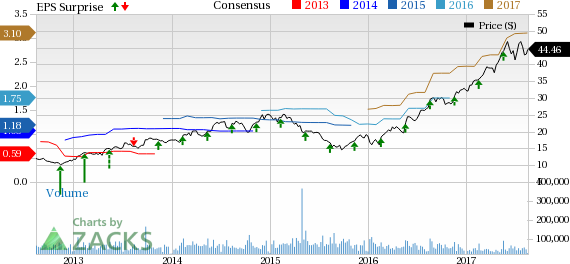

Here’s a graph that looks at AMAT’s Price, Consensus and EPS Surprise history:

Applied Materials develops, manufactures, markets and services semiconductor wafer fabrication equipment and related spare parts for the worldwide semiconductor industry. Customers for these products include semiconductor wafer manufacturers and semiconductor integrated circuit manufacturers, who either use the Ics they manufacture in their own products or sell them to other companies. These ICs are the key components in most advanced electronic products such as computers, telecommunications devices, automotive engine management systems and electronic games.

Check back later for our full analysis on AMAT’s earnings report!

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research