Today was a strange one. After last week’s experience (awesome Wednesday, awesome Thursday, terrible Friday), I was already worried that I was going to repeat the same thing (awesome Monday, awesome Tuesday……….and then we opened sharply higher Wednesday). I whined to my buddy Northy that we bears were limited to just two good days by federal law.

I had come into the day with 90 shorts, but as the market was pushing higher, I went through all of them and trimmed my risk by covering 15 of them. However, the market completely lost its mojo (once oil reversed its rally), and things went into a free-fall again. By the end of the day, I had a nice profit, but the profit would have been twice as big if I’d just stayed in bed all day and looked at reddit. Twice as big. It really sucks to know I gave up half my day’s profits simply by trying to reduce risk. Yuck.

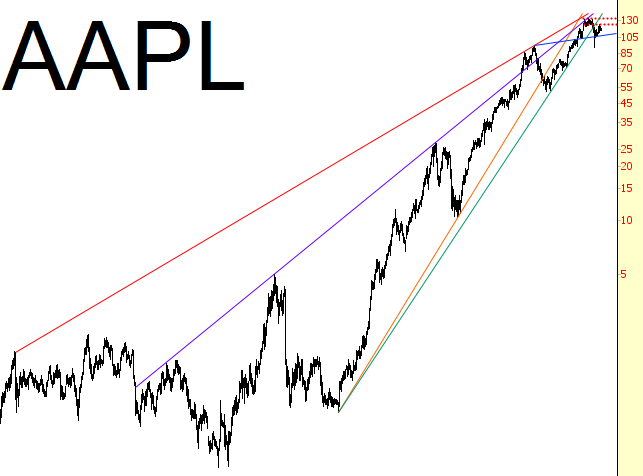

One stock I didn’t cover was Apple (O:AAPL), and I wanted to finish up the day by offering a couple of thoughts about it. As you can see from this very long-term chart, Apple has spent decades within a couple of wedges, and it has broken both of them now. I will repeat what I’ve said many times before: I believe the high price we saw earlier this year on Apple will be the highest price for years and years to come (if not forever).

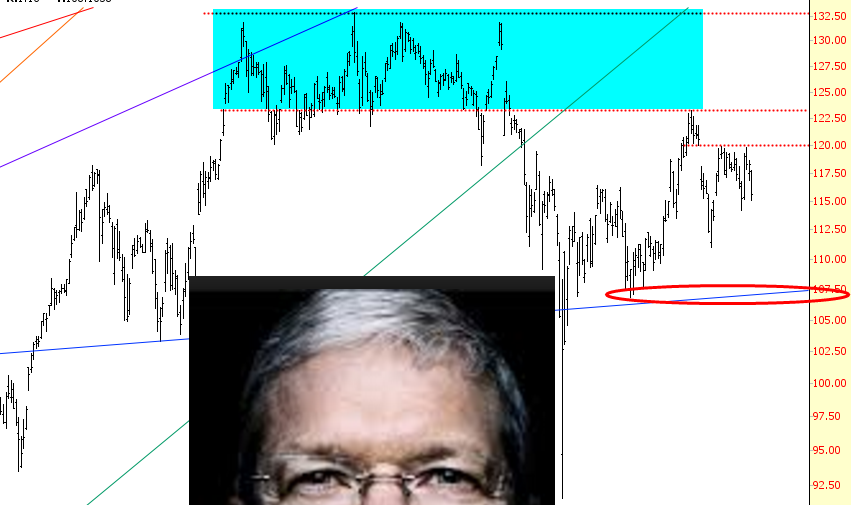

Looking more closely, you can see tinted in cyan the distribution top, which was followed by a break of the long-term wedge pattern. The mini-crash of August 24 pushed the price down to nearly $90, but it rebounded strongly by about 33% (which, let’s face it, is an amazing lift for the largest company in the whole world).

The red oval below is what I think really matters. If we break beneath it (about $107), that will start a new down-phase in the company. I would not be at all surprised to see Apple in the lower 80s next year.