- Apple's new "Apple Intelligence" integration announced at WWDC 2024 marks its significant entry into the AI space.

- The company's partnership with Microsoft and OpenAI aims to bring ChatGPT to iOS, iPadOS, and macOS, sparking both excitement and security concerns.

- Despite the buzz, Apple's stock closed down 1.91%, reflecting cautious market reactions.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Apple (NASDAQ:AAPL) finally made a splash in the AI space at WWDC 2024 with its new "Apple Intelligence" integration. This ambitious move comes after criticism that the tech giant lagged in AI advancements over the past two years.

The strategy involves a large-scale partnership with Microsoft (NASDAQ:MSFT) and its OpenAI platform, known for the popular ChatGPT tool. This partnership will see ChatGPT integrated into upcoming iterations of iOS, iPadOS, and macOS.

While some anticipate Apple's AI features to unlock unprecedented growth, security concerns cast a shadow over the announcement. Elon Musk emerged as the most vocal critic, harshly criticizing the move as a potential security breach and threatening to ban Apple devices from his companies.

Musk's primary concern centers on user data potentially being transferred to a third-party AI system operated by OpenAI. Apple, however, has pledged to prioritize user privacy and insists that no user data will be stored by OpenAI.

Despite the excitement surrounding this integration of advanced AI technology, Wall Street reacted with disappointment to the news. Analysts say that the market expected a more dazzling AI update. AAPL closed the day down 1.91% at $193.

However, it's worth noting that AAPL stock has a history of dipping slightly after WWDC events. This trend continued even with a development that generated widespread market buzz.

AI Can Help Maximize Your Portfolio Gains

June could present a golden opportunity to snag undervalued stocks poised for explosive growth. But how do you identify these hidden gems before everyone else?

Introducing ProPicks: Our cutting-edge AI analyzes mountains of data to pinpoint high-potential stocks before the market reacts.

Stop missing out! Subscribe to ProPicks today, and:

- Unearth hidden opportunities: Leverage AI to identify undervalued stocks with explosive growth potential.

- Stay ahead of the curve: Get a monthly list of AI-picked buys and sells before the market reacts.

- Gain an edge: Make informed investment decisions with powerful data and insights.

Subscribe to ProPicks and start building your wealth today!

Can Apple Reignite Growth With AI?

Apple's dominance in the smartphone industry, established with the revolutionary iPhone in 2007, faces a new challenge: replicating that success with artificial intelligence (AI).

While Apple boasts a loyal user base, concerns linger. Unlike Google (NASDAQ:GOOGL), Samsung (KS:005930), and Microsoft, Apple isn't an AI frontrunner. The upcoming AI integration in iOS 18 and other platforms raises questions about true innovation. Siri's future performance with its new partner is another uncertainty that could impact user upgrade decisions.

Further complicating the picture is the limited device compatibility for these AI features. Only iPhone 15 Pro and above models, along with recent M1-equipped Macs and iPads, will be able to utilize them. This strategy presents a challenge: convincing a large portion of existing device owners to upgrade for the AI experience.

However, Apple's plan to leverage OpenAI's GPT-4o technology for a personalized user experience, offered at no additional cost, could be a game-changer. This feature has the potential to significantly alter how users interact with their devices.

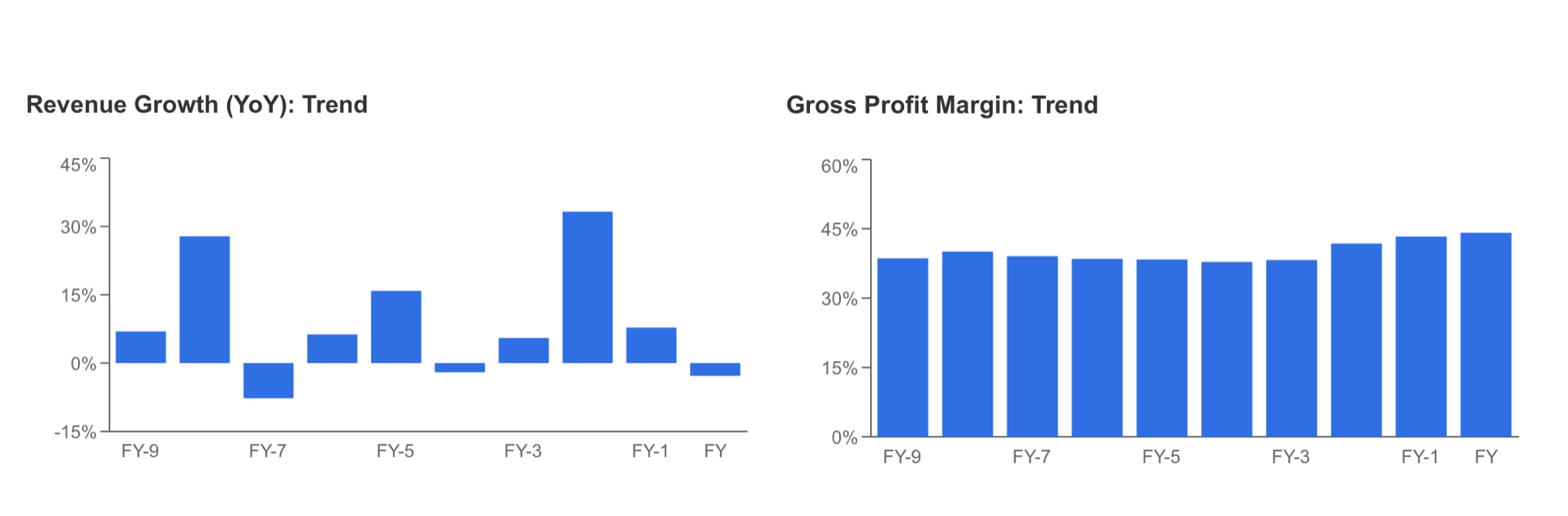

Apple faces an uphill battle. The company's revenue growth has been declining for two years, culminating in negative growth in 2023. This slump can be partly attributed to a lack of groundbreaking products and an underwhelming reception for recent releases.

Apple's AI push holds promise, but its success hinges on several factors. Can Siri's partnership revitalize its appeal? Will users choose expensive upgrades for AI functionality? Only time will tell if Apple's AI strategy can reignite its sales growth.

Source: InvestingPro

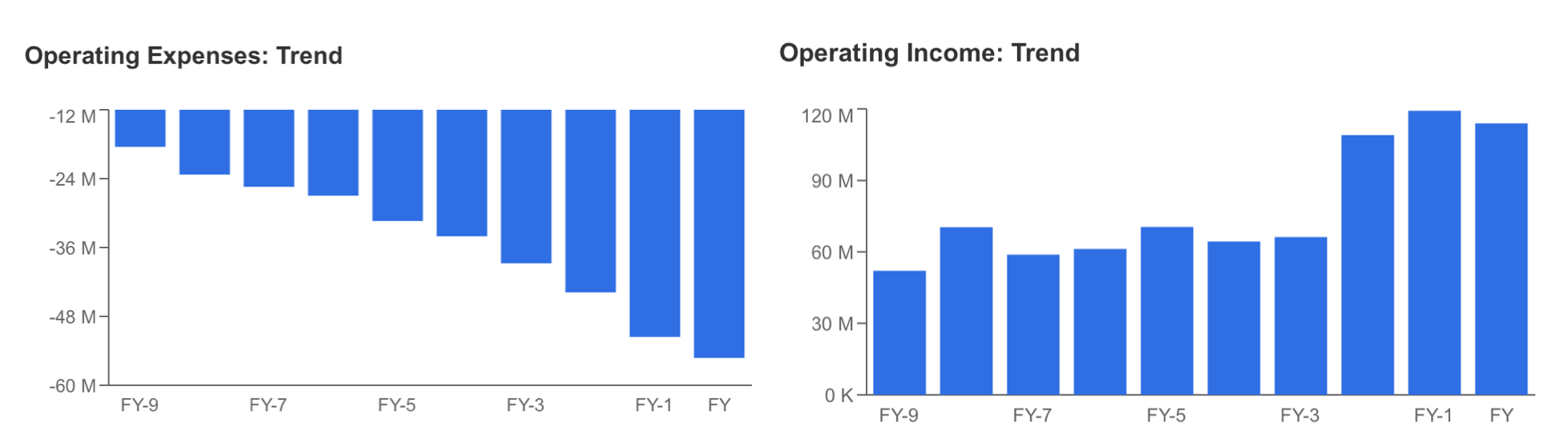

However, while operating expenses continue to increase annually, operating revenues remain in the range of 110-120 billion dollars. While the flat gross profit margin in the last 3 years was also noteworthy, it was clear that the company needed a new catalyst like this latest development.

Source: InvestingPro

Now, the sales performance of new AI-enabled devices in the last quarter of the year will play a key role. Last quarter's sales could also provide a perspective for the year ahead.

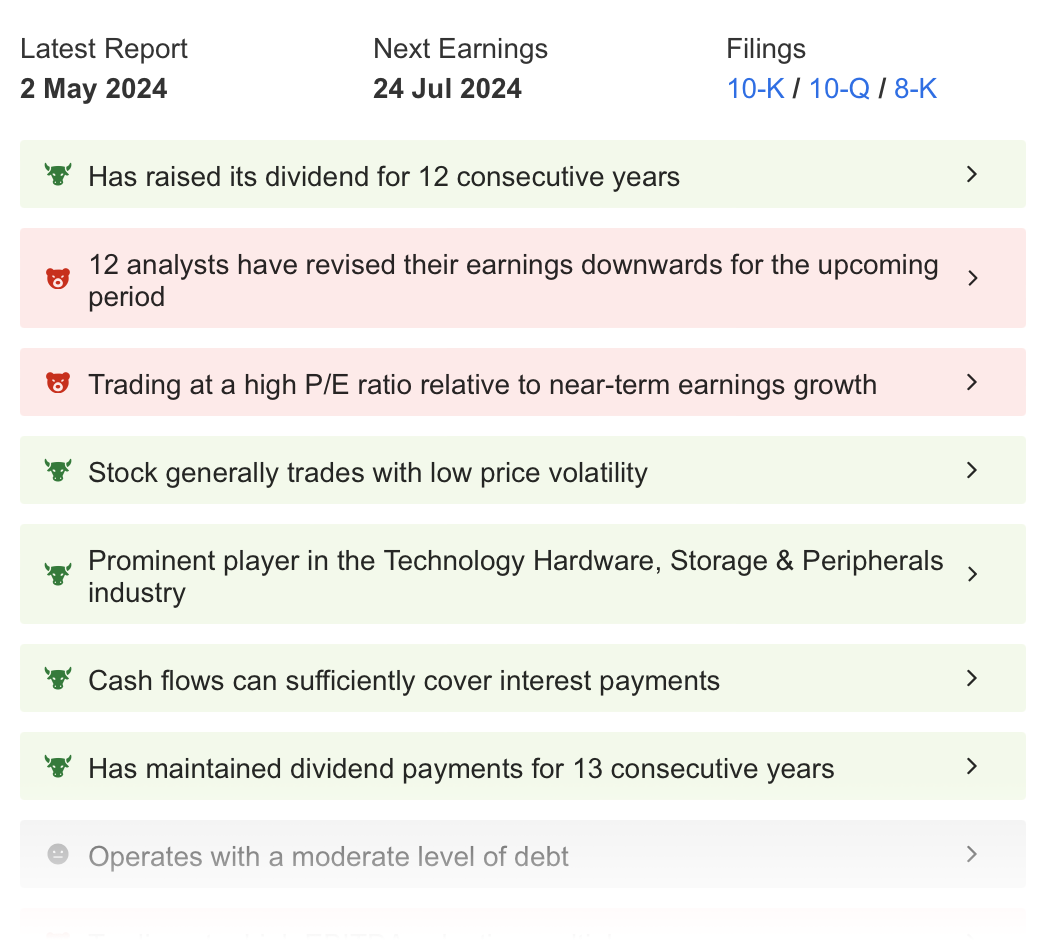

The overall outlook for Apple, via InvestingPro, is that the company will remain profitable this year, and its strong long-term financial structure and 13 years of continuous dividend payments are among the most attractive features for investors.

Source: InvestingPro

While AAPL's low volatility also reassures investors, the data, combined with criteria such as the fact that the stock is in the overbought zone and the valuation ratios remain high, warns of a possible correction. In addition, the fact that 12 analysts revised their earnings expectations downward in the quarterly report to be announced in July can also be considered a handicap.

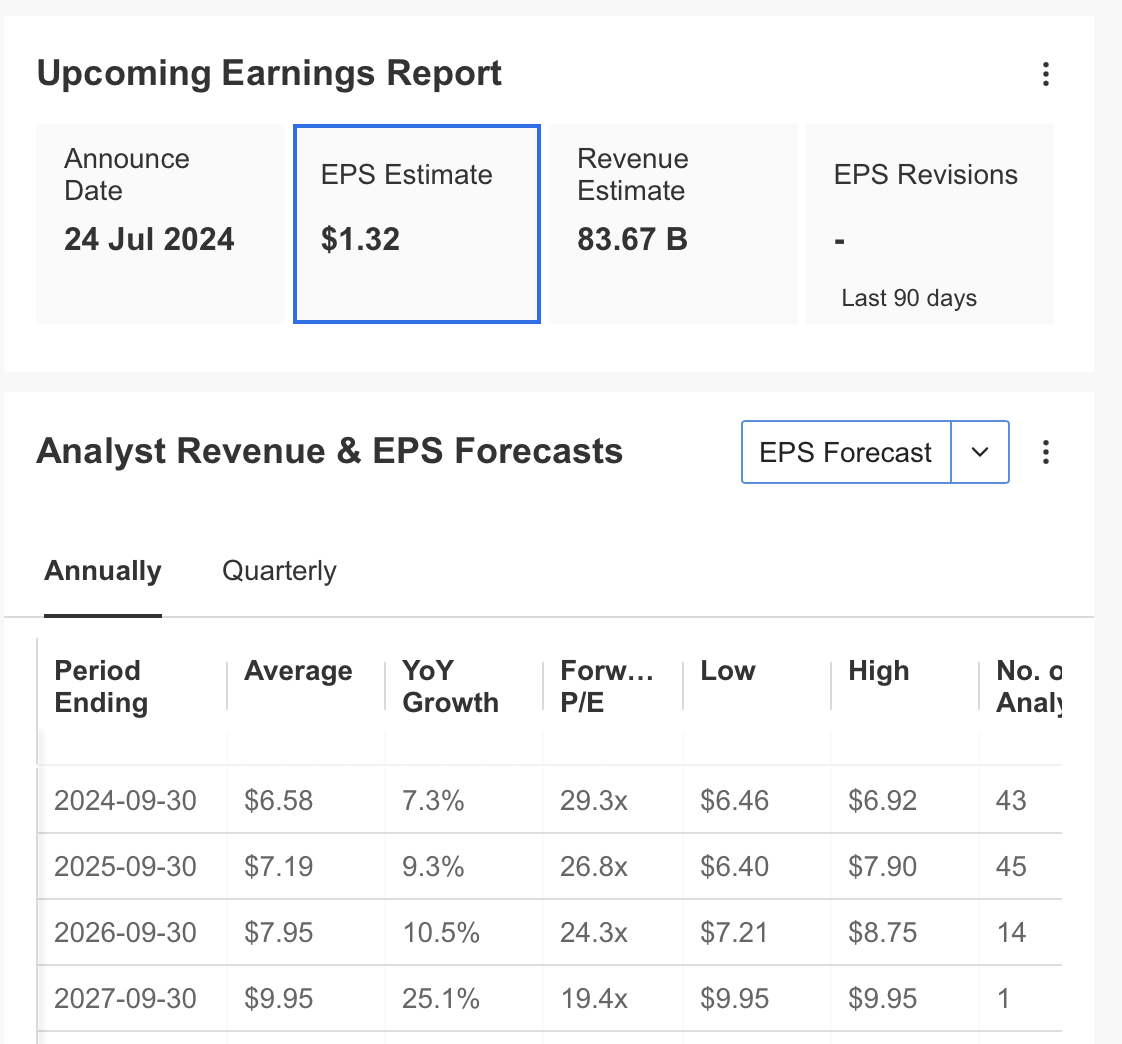

Source: InvestingPro

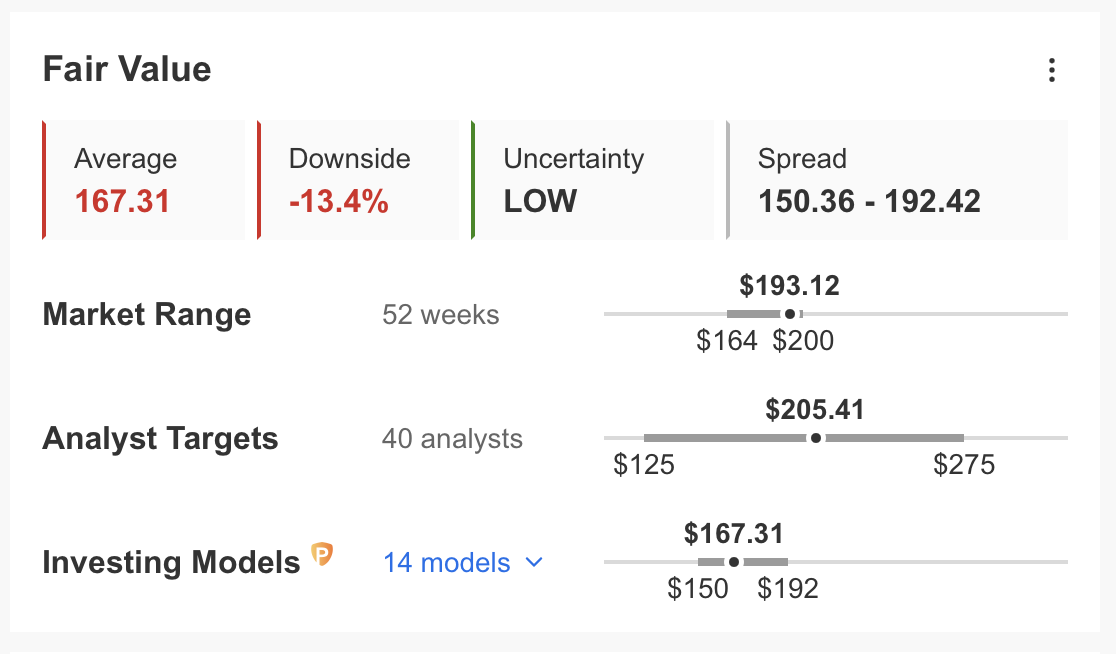

So much so that the latest estimates are that revenue could be $ 83.67 billion, down 5%, and earnings per share will be announced at $ 1.32, down close to 1.5%. Accordingly, InvestingPro calculates the fair value for AAPL as $167.31 based on 14 financial models and low uncertainty. This means that the stock is currently moving at a partial premium and could correct by more than 10%. However, the consensus view of 40 analysts points to $ 205 for AAPL's target price.

Source: InvestingPro

Apple: Technical View

Apple's stock price (AAPL) faces a critical test at a resistance level of around $200. This level held firm in July and December of last year, causing the price to retreat. A rejection from this point again could trigger a new correction, pushing the share price below $170.

On the other hand, if Apple's announcement of its new artificial feature causes an increase in positive reactions in the coming days, this time we may see a ground above the critical resistance of $200.

This could mean a breakout of the current setup and trigger the share price to rise towards the $ 205-218 range. At this point, the $190 level can be followed as an important support point in the lower region for the new direction.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.