During Apple’s (NASDAQ:AAPL) highly anticipated unveiling event last week, CEO Tim Cook predicted that the iPhone 6 would usher in the mother of all upgrade cycles. So far, so good…

On Monday, Apple announced it had received over four million pre-orders for the iPhone 6 and iPhone 6 Plus in the first 24 hours. By comparison, the iPhone 5 only managed slightly more than two million pre-orders in the first day. Indeed, it seems as though the hype may have been warranted.

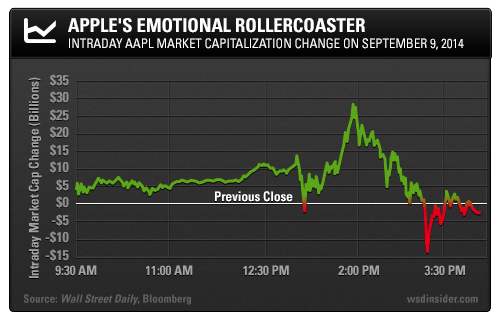

That’s a welcome sign for investors, who are still recovering from an emotional rollercoaster during the phone’s debut. But where is the stock headed from here? The chart below shows Apple’s intraday market capitalization change on September 9, 2014.

The emotional journey began when the stock gapped up 0.7% at the open. By the time the Apple event began at 1:00 PM EST, the stock was up nearly 2%. But as the iPhone 6 was unveiled, AAPL’s stock sold off sharply, giving up all of the day’s gains.

Perhaps the market was questioning the company’s ability to innovate. After all, the new phone seemed to offer little more than a bigger screen. Nonetheless, the stock price stabilized and began to grind higher. Then, Apple Pay was unveiled.

This new mobile payment system, which utilizes a near-field communication (NFC) antenna and Apple’s Touch ID, will allow users to purchase items in an easy, secure manner. Apple’s stock surged higher. You can almost imagine the masses of traders all thinking… This could be the biggest thing EVER!

At its highest point of the day, AAPL was up 4.8%, having gained around $28 billion in market cap. Given its total market capitalization of around $600 billion, Apple’s intraday market value changes can reach eye-popping levels. And then came the big reveal…

The Apple Watch was introduced, representing Apple’s first all-new product category in four-and-a-half years. Unfortunately, its design left many feeling underwhelmed. Worse yet, its retail price will start at $349. Uh oh, this could get ugly…

Ridicule of the overpriced gadget began to flood Twitter. Instagram became inundated with images of actual Red Delicious apples taped to wrists. The Apple Watch had bombed… and the market responded decisively. Between approximately 1:55 PM and 3:15 PM, Apple’s market cap lost $41.6 billion.

Perspective Matters

That sum is roughly the size of the market cap of Prudential Financial (NYSE:PRU), an insurance company that has been in business for 138 years, has 47,000 employees, and operates in 41 countries and territories.

Now, some say that the financial markets are efficient and that stock prices reflect all available information. But it’s hard to believe that the present value of Apple’s future cash flows declined by over $40 billion in just over an hour, especially since the stock regained much of what it lost by the end of the week. Thus, investors shouldn’t lose sight of the big picture amid these erratic swings in market cap.

In April, Apple increased its dividend by 8%. At the time, I noted that Apple was one of the most attractive mega caps for income investors. Since April 28, AAPL has risen 21%, compared with a total return of 7% for the S&P 500.

This goes to show that investors should view dividend hikes – not new product unveilings – as monumental actions.