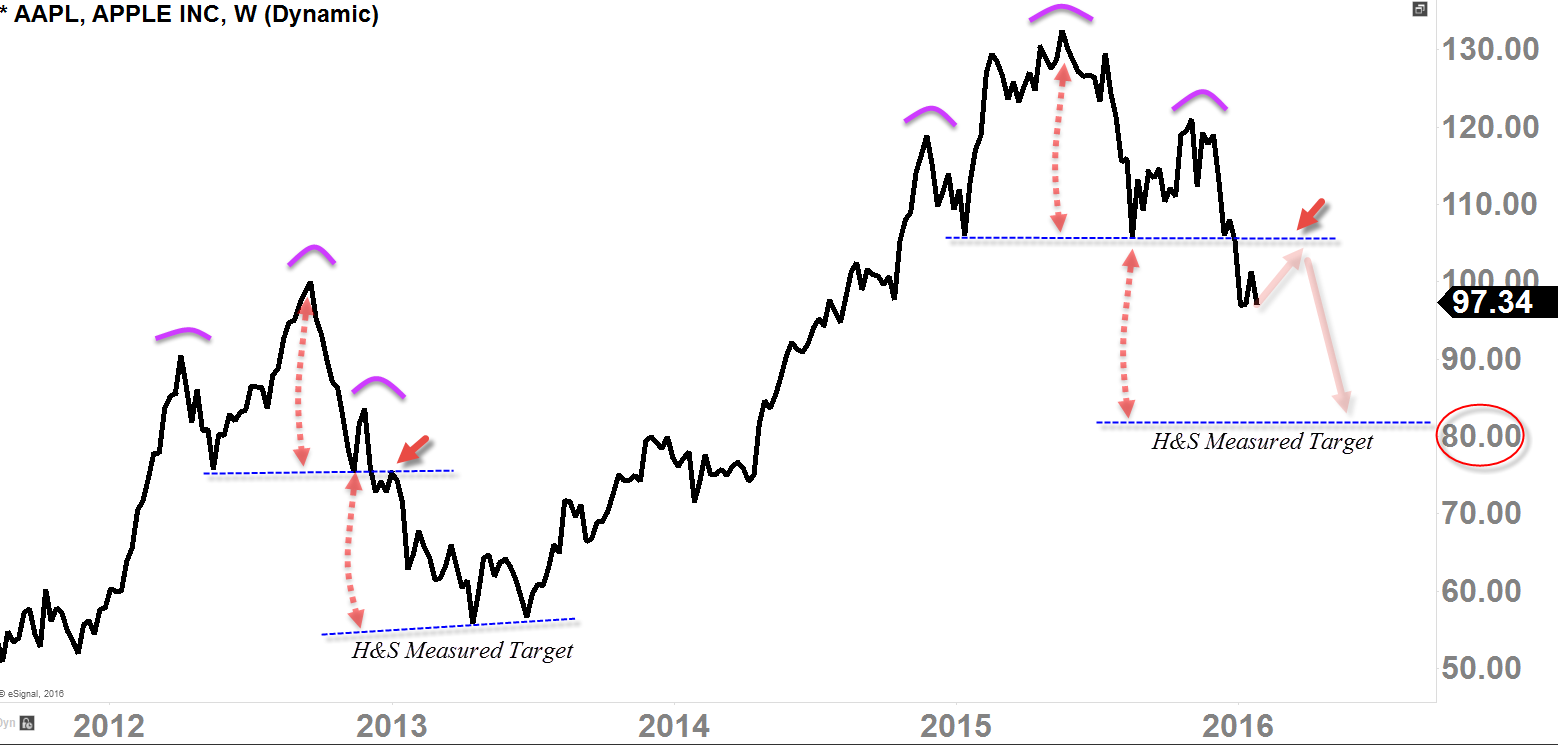

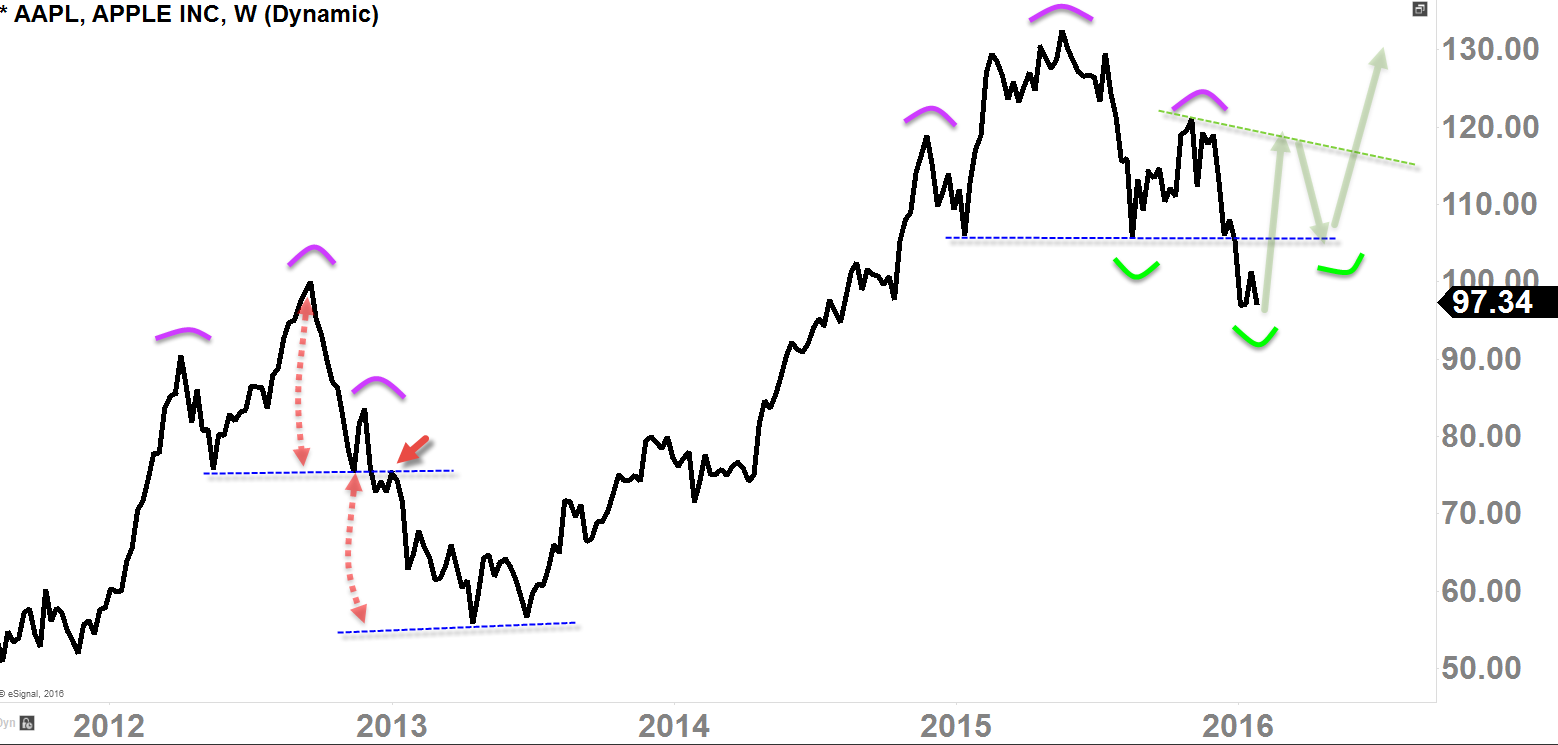

Sellers Downside Target

- Early-2013, H&S pattern was "confirmed" once it has retested the "neckline" (see arrow) resistance and got rejected

- Once the "neckline" was rejected, sellers rushed in, bring it down to the H&S Measured Target

- Today, we have broken below the "neckline", which means, next step (for the sellers) is to retest the neckline (see arrow)

- If we get rejected at the "neckline", like 2013, we may see sellers rush in to bring it down to the H&S Measure Target at $80ish.

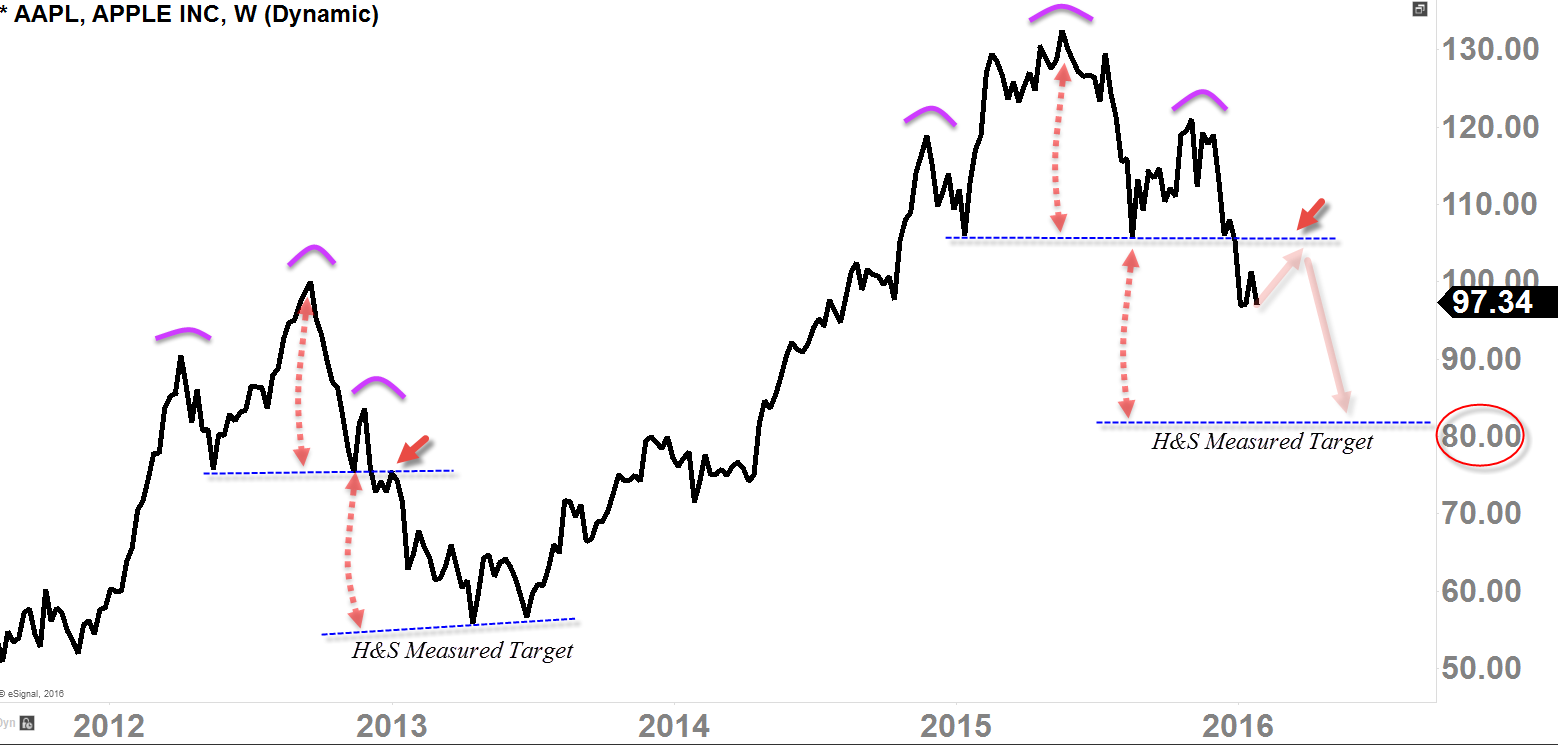

Buyer's Hope

- Weekly-200SMA (Simple Moving Average) has been served as the savior for Apple (O:AAPL) in 2009 and late-2013

- Today, we are sitting right on this moving average

- Fibonacci 50% Retracement (measuring from 2009-low to the 2012-high) level was the level where Apple bottomed back in late-2013

- Today, Fibonacci 50% Retracement (measuring from 2013-low to the 2015-high) is where we are sitting on

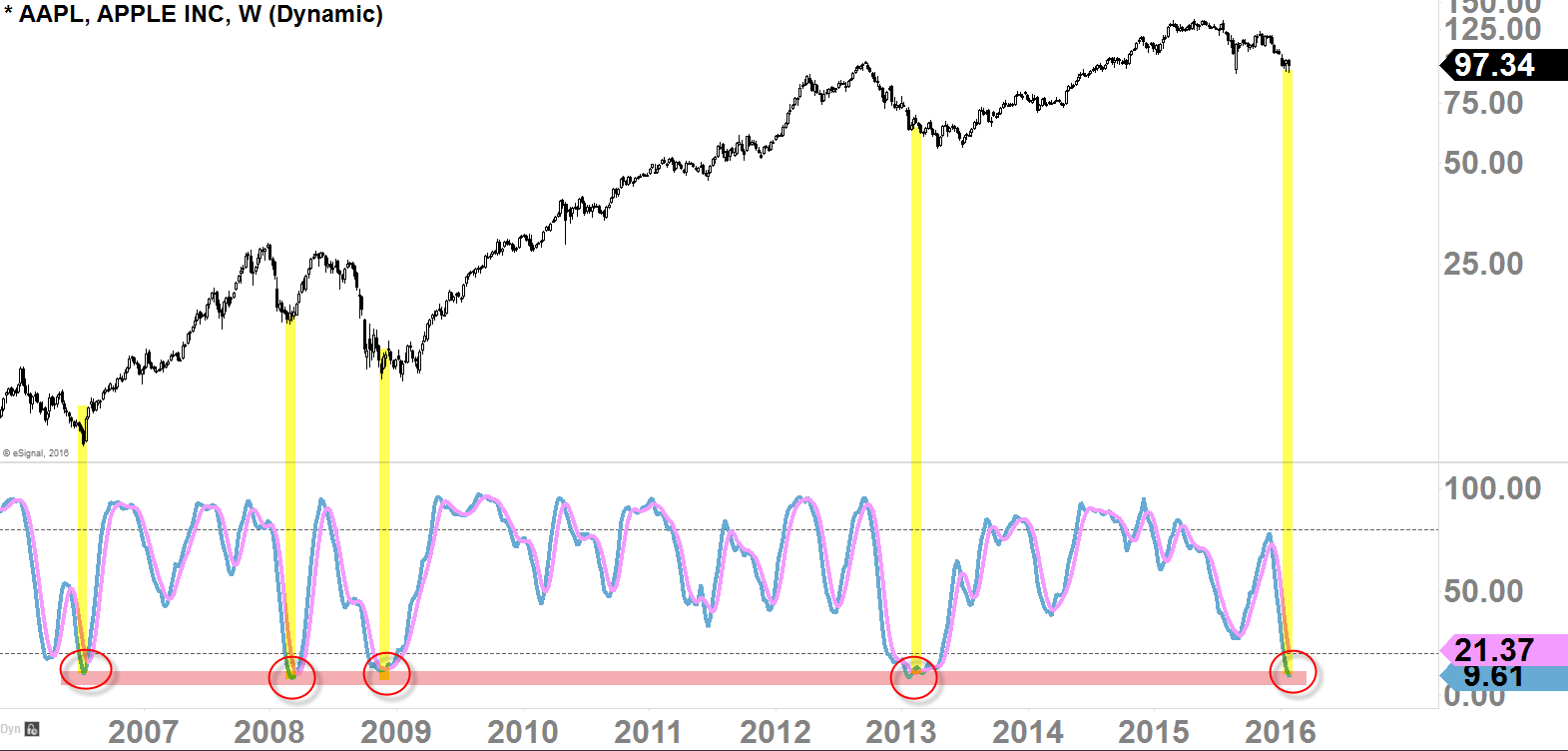

- Late-2016, 2008, 2009, and 2013; weekly-Stochastics insinuated the bounce was coming as the Stochastics was at the "overbought" level

- Today, we are back at the "overbought" level

- Minor-term bullish divergence has been formed

- Price-action needs to stay well above $103 to be "confirmed"

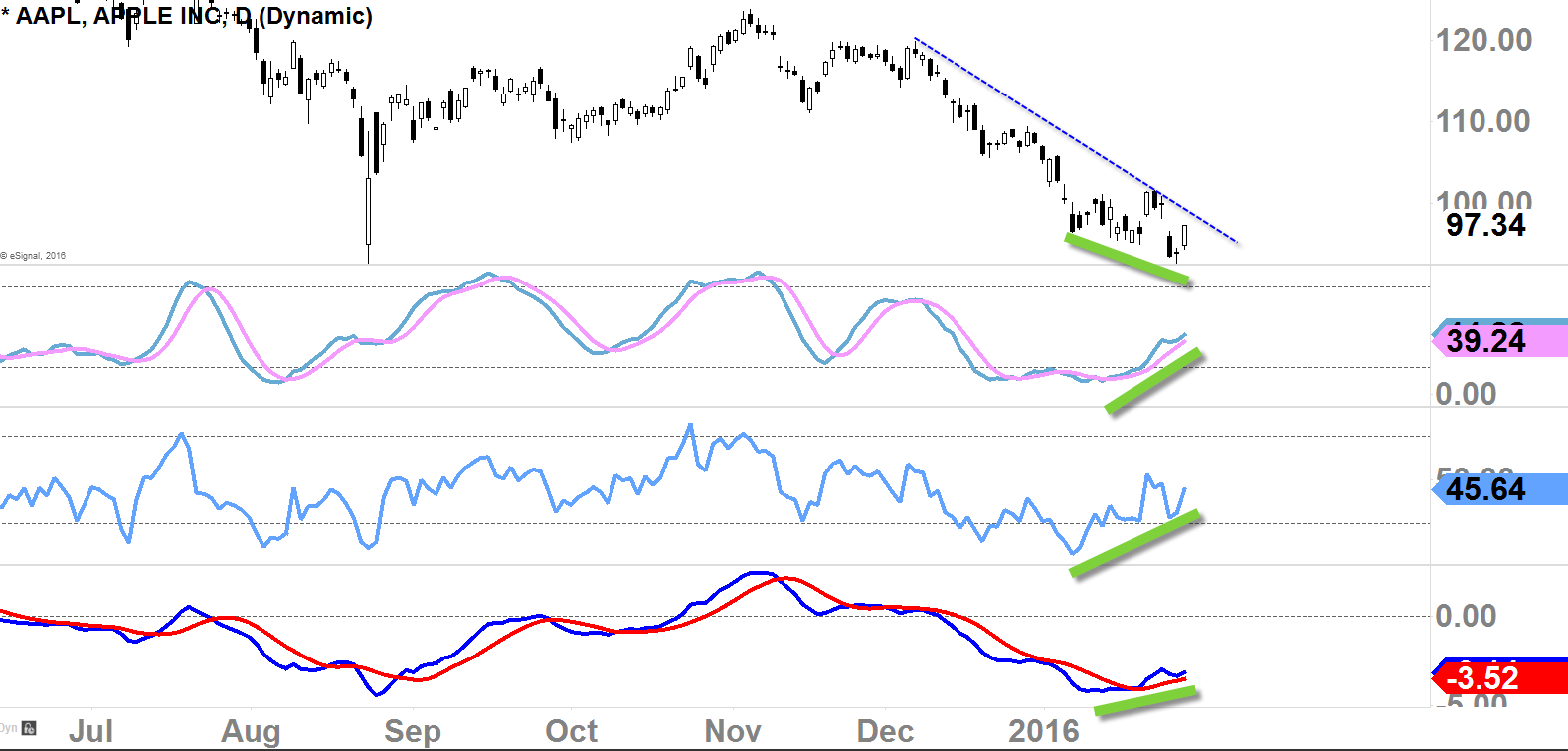

How to Nullify the H&S Pattern

It doesn't always happen, but sometimes (actually more often than we perceived as) H&S pattern can be nullified; if you go back and study the historical charts,

it actually happens quite often. So if the buyers want to see no further selling from this point on, the price must shoot-up to about $112-$115 level for this to work.

Once we get there, pullback will come, and this is where it's very important, when the pullback occurs, the price-action must print intermediate-term "higher-low" thus creating that "right shoulder" on this Inverted Head & Shoulder scenario I've drawn.

If the "right shoulder" has been created, now the Inverted H&S "neckline" must be reclaimed to the upside; and if we can do that by thrusting above the Inverted H&S neckline, I would have to say that's when the Apple has been completely reversed to the upside.

This process could take up to 2-4 months, if, indeed, it's happening this way.

Final Thoughts

Current H&S formation is deadly and dangerous for Apple.

If or when it gets fully confirmed, around $80 is probably where its headed (possibly even lower); especially, with the overall market inflicting extreme-fear upon the investors/traders,

it is not helping this stock. However, I did want to point out, that we are sitting on the last level of support if the buyers decide to make something happen. It's also interesting to note that many of the market-indices are sitting on the last level as well.

Buyers are just barely grasping for air before much more selling occurs for sure; but if the buyers are going to turn things around before we get to the $80, now is the time for the attempt.