Apple Inc. (NASDAQ:AAPL) was upgraded by research analysts at Vetr from a "hold" rating to a "buy" rating in a research report issued on Monday, MarketBeat.com reports. The firm currently has a $146.43 target price on the iPhone maker's stock. Vetr's price target would indicate a potential upside of 4.12% from the stock's previous close.

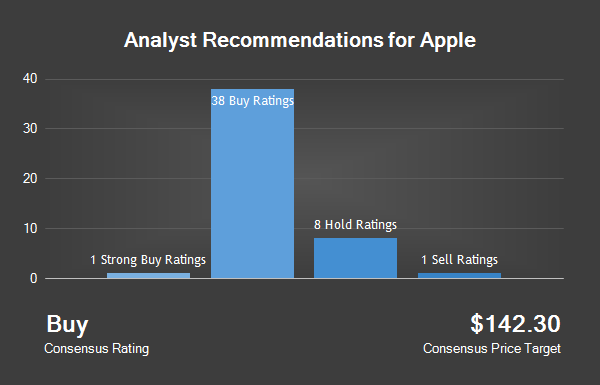

AAPL has been the subject of a number of other reports. Credit Suisse Group AG reaffirmed an "outperform" rating and set a $150.00 price target on shares of Apple in a report on Wednesday, December 7th. Canaccord Genuity lifted their price target on Apple from $140.00 to $142.00 and gave the stock a "buy" rating in a report on Wednesday, February 1st.

Royal Bank of Canada reaffirmed an "outperform" rating and set a $155.00 price target on shares of Apple in a report on Friday, MarketBeat.com reports. Needham & Company LLC reaffirmed a "top pick" rating and set a $150.00 price target on shares of Apple in a report on Tuesday, January 24th.

Finally, Rosenblatt Securities reaffirmed a "neutral" rating and set a $102.00 price target on shares of Apple in a report on Friday, December 16th. Two research analysts have rated the stock with a sell rating, eight have issued a hold rating, forty have given a buy rating and one has assigned a strong buy rating to the company's stock. The company currently has a consensus rating of "Buy" and a consensus target price of $141.89.

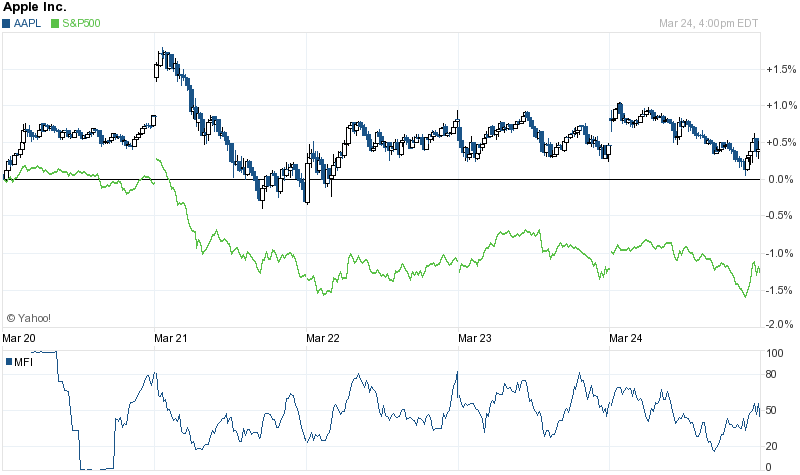

Apple opened at 140.64 on Monday, MarketBeat.com reports. The stock has a 50 day moving average price of $137.18 and a 200-day moving average price of $120.20. The firm has a market capitalization of $737.87 billion, a price-to-earnings ratio of 16.88 and a beta of 1.26. Apple has a one year low of $89.47 and a one year high of $142.80.

Apple last released its earnings results on Tuesday, January 31st. The iPhone maker reported $3.36 earnings per share (EPS) for the quarter, beating the Zacks' consensus estimate of $3.22 by $0.14. The firm earned $78.35 billion during the quarter, compared to analyst estimates of $77.37 billion. Apple had a return on equity of 34.94% and a net margin of 20.73%. Apple's revenue was up 3.3% compared to the same quarter last year. During the same period last year, the business posted $3.28 earnings per share. On average, analysts predict that Apple will post $8.94 earnings per share for the current fiscal year.

In other Apple news, CEO Timothy D. Cook sold 30,000 shares of Apple stock in a transaction on Thursday, January 19th. The shares were sold at an average price of $120.00, for a total transaction of $3,600,000.00. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Luca Maestri sold 2,300 shares of Apple stock in a transaction on Wednesday, December 28th. The shares were sold at an average price of $117.67, for a total transaction of $270,641.00. Following the sale, the insider now directly owns 4,632 shares of the company's stock, valued at approximately $545,047.44. The disclosure for this sale can be found here. Insiders have sold a total of 403,844 shares of company stock valued at $51,434,527 in the last three months. Company insiders own 0.08% of the company's stock.

Large investors have recently modified their holdings of the stock. Armbruster Capital Management Inc. raised its stake in shares of Apple by 35.1% in the third quarter. Armbruster Capital Management Inc. now owns 1,024 shares of the iPhone maker's stock worth $116,000 after buying an additional 266 shares during the period. Weaver C. Barksdale & Associates Inc. bought a new stake in shares of Apple during the third quarter worth about $122,000. Glacier Peak Capital LLC bought a new stake in shares of Apple during the fourth quarter worth about $127,000. D. Scott Neal Inc. raised its stake in shares of Apple by 701.3% in the third quarter. D. Scott Neal Inc. now owns 1,202 shares of the iPhone maker's stock worth $136,000 after buying an additional 1,052 shares during the period. Finally, Welch Investments LLC bought a new stake in shares of Apple during the fourth quarter worth about $146,000. 58.76% of the stock is owned by institutional investors.

Apple Company Profile

Apple Inc (Apple) designs, manufactures and markets mobile communication and media devices, personal computers, and portable digital music players, and a variety of related software, services, peripherals, networking solutions, and third-party digital content and applications. The Company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings.