By Carly Forster

Apple (NASDAQ:AAPL) finally released its highly anticipated Apple Watch for presale on April 10th and sold out of all models in 6 hours.

The Apple Watch will initially be available in the United States, Canada, China, France, Germany, Australia, Hong Kong, Japan, and the United Kingdom. The different models of the Apple Watch will retail between $349 for the sport watch and $10,000 for the top-of-the-line watch.

The company also offered a preview of the Apple Watch on April 10th before it officially goes on sale on April 24th, though most of the people who pre-ordered seemed to have purchased the watch without seeing it in person first.

Despite the quick sell out, Apple received some mixed reviews from Wall Street analysts.

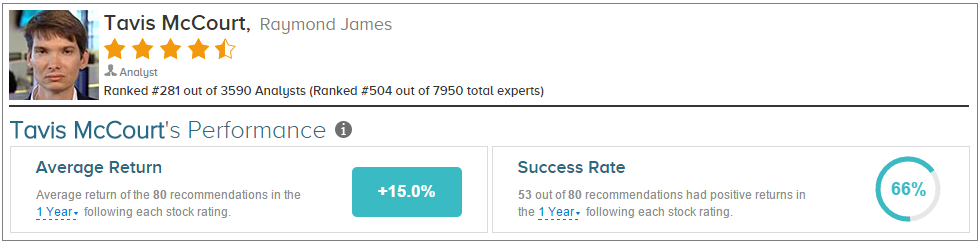

On April 10th, Raymond James analyst Tavis McCourt downgraded his rating on Apple from Outperform to Market Perform, noting “Early reviews on Apple Watch suggest it will fall far short of the ‘insanely great’ benchmark, at least in this first iteration [...] Although the financial impact of the Apple Watch is almost immaterial near term, we are concerned that relatively muted reviews so far could place added fear in investors’ minds about the company’s ability to launch successful new product categories.”

McCourt has rated Apple 42 times since January 2009, earning a 74% success rate recommending the stock and a +28.5% average return per recommendation. Overall, he has a 66% success rate recommending stocks and a +15.0% average return per recommendation.

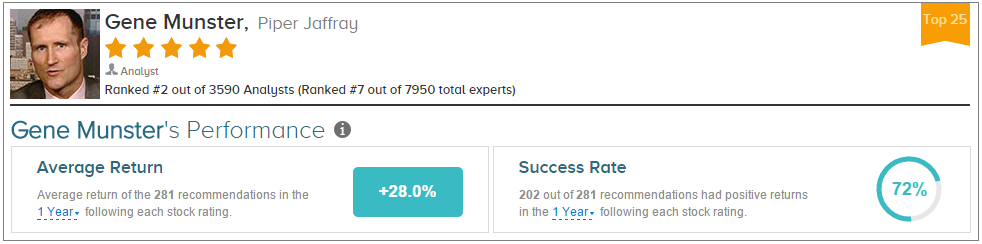

On the other hand, Piper Jaffray analyst Gene Munster reiterated an Overweight rating on Apple on April 10th with a price target of $160, according to SmarterAnalyst. Munster noted, “We have been monitoring lead times this morning and it appears that between 6AM and 9AM ET, lead times have been stable for 5 different SKUs at 4-6 weeks or June/July ship date. We believe that the current stable lead times suggests that supply was the main limiting factor in this morning’s sell out as if demand were extremely strong, it would seem that lead-times would continue to increase.”

Munster has rated Apple 136 times since January 2009, earning a 77% success rate recommending stocks and a +31.6% average return per recommendation. Overall, he has a 72% success rate recommending stocks and a +28.0% average return per recommendation.

On average, the top analyst consensus for Apple on TipRanks is Moderate Buy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Apple Watch Finally Released For Pre-Order: What Analysts Are Saying

Published 04/12/2015, 10:12 AM

Updated 05/14/2017, 06:45 AM

Apple Watch Finally Released For Pre-Order: What Analysts Are Saying

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.