We are looking at the last 5 weeks of the 4th quarter earnings for the S&P 500, and with the unofficial end of Q4 ’23 earnings this week with Walmart's (NYSE:WMT) report, despite the negativity about the quarter in November and December ’23, actual Q4 ’23 S&P 500 EPS growth was +10% as of today.

Walmart’s guidance spooked the analysts a little, which resulted in very little upward revisions to EPS for calendar ’25 and ’26, despite the healthy revisions in Walmart’s revenue estimates. (More on this in a coming blog post.)

Nvidia (NASDAQ:NVDA) has been talked about enough. There is very little that I can add to the story.

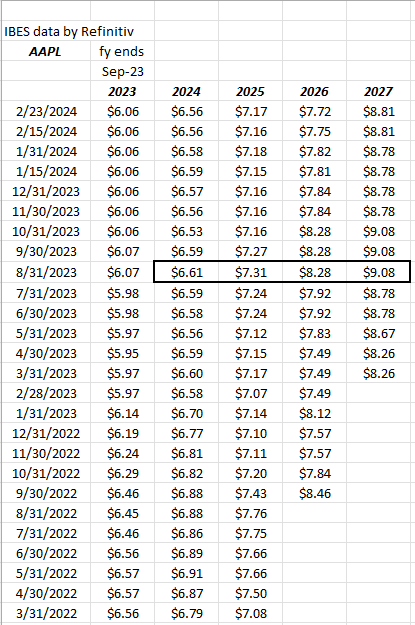

Apple EPS and Revenue Revisions:

Apple (NASDAQ:AAPL) EPS estimate revisions peaked in May ’22, bouncing around until 8/23. Since August ’23, looking at each fiscal year Apple’s EPS negative revisions:

- fy ’24: -1%

- fy ’25: -2%

- fy ’26: -7%

- fy ’27: -3%

FY ends 9/30

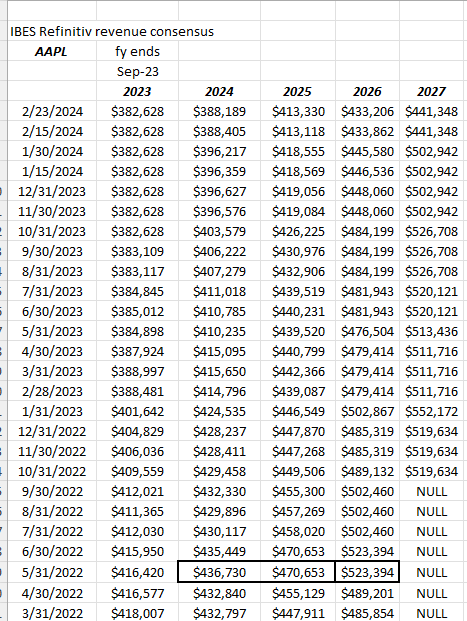

From May ’22, Apple's revenue estimates have seen downward revisions. Looking at the downward revisions, here is the percentage decline by fiscal year:

- fy ’24: -11%

- fy ’25: -12%

- fy ’26: -17%

Those numbers are more than a little surprising, and not in a good way.

So what’s going on with Apple? Hardware growth has been slower as the phone giant transitions into a services business. Are iPhones now a commodity? Is Apple finding it harder to innovate around the iPhone?

Looking at return data (courtesy of YCharts), here’s Apple’s and the S&P 500’s annual return from 12/31/21 through 2/22/24:

- Apple: +1.31%

- SPXTR: +4.80%

Apple (the stock) has been almost flat for 26 months.

Just sayin.

S&P 500 Data:

- The forward 4-quarter estimate (FFQE) this week increased to $242.76 from last week’s $242.57 and January 5th’s print of $243.98. (It’s a positive that the forward estimate is not being revised downward, as is the typical pattern.)

- The PE on the FFQE is 21x, versus 20.7x last week, so we continue to see a little PE expansion;

- The S&P 500 earnings yield has now declined for 8 straight weeks, starting ’25 over 5% and now at 4.77%. Better-than-expected S&P 500 EPS is probably keeping it from falling further.

- The Q4 ’23 bottom-up estimate is now $57.14, versus the early January ’24 estimate of $54.69;

- The S&P 500 EPS upside surprise is still at 6.8%; I thought maybe that would have been revised higher after NVDA and WMT.

- The S&P 500 revenue upside surprise is still at 1.1%

Conclusion:

Over the next several weeks we will start seeing February ’24 quarter-end earnings releases for a host of companies, including Nike (NYSE:NKE), FedEx (NYSE:FDX), Micron (NASDAQ:MU), and a host of others.

No companies followed by this blog are reporting next week.

The Apple revenue estimate revisions are interesting.

Disclaimer: None of this is advice or a recommendation. Past performance is no guarantee or suggestion of future results. Investing can involve the loss of principal even over short periods of time. Readers should gauge their own comfort with portfolio volatility, and adjust accordingly. All EPS and revenue data for the S&P 500 as well as individual companies are bought via a subscription through LSEG or the London Stock Exchange Group (LON:LSEG). Email tajinder.dhillon@LSEG.com for more information.