Cupertino-based tech giant, Apple Inc. (NASDAQ:AAPL) has garnered the support of Silicon Valley biggies in its nasty legal spat with chipmaker QUALCOMM Incorporated (NASDAQ:QCOM) .

Per media reports, the Computer and Communications Industry Association (CCIA) – boasting names like Alphabet (NASDAQ:GOOGL) , Amazon.com Inc (NASDAQ:AMZN), Facebook Inc (NASDAQ:FB) , Microsoft Corp (NASDAQ:MSFT), Samsung Electronics (KS:005930), Netflix Inc (NASDAQ:NFLX), Intel Corp (NASDAQ:INTC) and many more – has filed a petition with the United States International Trade Commission (ITC) to snub Qualcomm's demand of seeking an injunction on iPhone import.

CCIA was quoted saying that “Qualcomm is already using its dominant position to pressure competitors and tax competing products. If the ITC were to grant this exclusion order, it would help Qualcomm use its monopoly power for further leverage against Apple, and allow them to drive up prices on consumer devices.”

CCIA further added “The ITC has a choice whether to further reward anti-competitive behavior – or to reject this anti-free market, anti-consumer request." CCIA apparently says banning iPhone (which uses Intel’s chips) import will result in disruption of supply, thereby impacting consumers eventually.

At the beginning of this month, per a filing with the ITC, Qualcomm had asked to ban iPhone import from China, accusing Apple of violating six of its patents related to mobile technology. Moreover, the chipmaker had filed another lawsuit against Apple with the U.S. District Court for Southern California, seeking damages for patent violation.

The Apple-Qualcomm dispute started in January this year when Qualcomm was dragged to court by Apple in a $1 billion lawsuit related to licensing royalty payments. In the suit filed, Apple had accused Qualcomm of overcharging for chips and refusing to pay some $1 billion in rebates.

In Apr 2017, Qualcomm launched a counterattack on Apple. In a filing, the company elaborated on Apple’s illegal and improper handling of agreements and negotiations with device manufacturers, misleading regulators to attack Qualcomm around the world and not utilizing the full potential of its modem chips in iPhone 7. Apple has started using Intel chips for iPhone 7.

In Jun 2017, Apple fired a legal salvo at Qualcomm, accusing the chipmaker of having questionable business practices that helps it get more patent money and suppresses innovation at the same time.

A couple of days back, Apple’s suppliers – Compal, Hon Hai Precision, Pegatron and Wistron – had also pitched in, filing a lawsuit against Qualcomm in the U.S. District Court for the Southern District of California. They have accused Qualcomm of “violating” two sections of the Sherman Act, part of the U.S Antitrust Law in the suit filed. It is a retort to Qualcomm’s lawsuit filed in May this year, in which, the company had accused the four suppliers of holding its royalties/license fees on Apple’s insistence.

With so many twists and turns, we remain eager to see how this dispute actually pans out in the coming days.

Zacks Rank and Stock Price Movement

At present, Apple carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

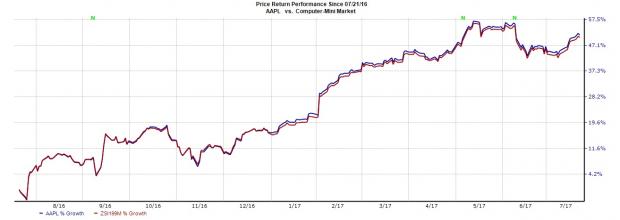

In the past one year, shares of Apple have registered growth of 51.2% compared with the industry’s gain of 50.1%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research