Apple Inc. ( (NASDAQ:AAPL) ) just released its fiscal fourth quarter financial results, posting earnings of $2.07 per share and revenues of $52.6 billion.

Currently, AAPL is a Zacks Rank #3 (Hold) and is up 3.21% to $173.50 per share in trading shortly after its earnings report was released.

Apple:

Beat earnings estimates. The company posted earnings of $2.07 per share, beating the Zacks Consensus Estimate of $1.87.

Beat revenue estimates. The company saw revenue figures of $52.6 billion, beating our consensus estimate $51.2 billion.

Apple reported iPhone unit sales of 46.677 million, beating our consensus estimate of 46.423 million. Today’s results included some of the initial sales of the iPhone 8 and 8 Plus, but the highly-anticipated iPhone X is not available for purchase until Friday.

The company also mentioned that its Services unit—which includes iTunes, Apple Music, Apple Pay, and Apple Care, among other things—witnessed record-high revenues of $8.5 billion, which represents a 34.4% climb from the year-ago quarter.

Management provided guidance for the first quarter of fiscal 2018. The company expects revenue between $84 billion and $87 billion, which is ahead of our current consensus estimate of $83.3 billion.

“We’re happy to report a very strong finish to a great fiscal 2017, with record fourth quarter revenue, year-over-year growth for all our product categories, and our best quarter ever for Services,” said CEO Tim Cook. “

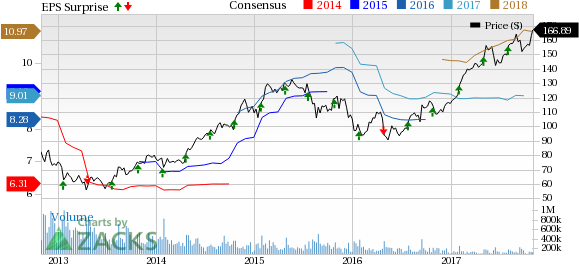

Here’s a graph that looks at Apple’s recent earnings surprise history:

Apple Inc. is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers, and portable digital music players. The Company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and Mac OS X operating systems, iCloud, and a range of accessory, service and support offerings. It sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers.

Check back later for our full analysis on Apple’s earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, and for the next month, you can follow all Zacks’ private buys and sells in real time. Our experts cover all kinds of trades: value, momentum, ETFs, stocks under $10, stocks that corporate insiders are buying up, and companies that are about to report positive earnings surprises. You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' private trades >>

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research