Apple Inc. (NASDAQ:AAPL) just released its first-quarter 2018 financial results, posting earnings of $3.89 per share and revenues of $88.29 billion. Currently, Apple is a Zacks Rank #3 (Hold), and is down over 1% to $165.92 per share in after-hours trading shortly after its earnings report was released.

AAPL:

Beat earnings estimates. The company posted earnings of $3.89 per share, beating the Zacks Consensus Estimate of $3.82 per share.

Beat revenue estimates. The company saw revenue figures of $88.29 billion, topping our consensus estimate of $86.29 billion.

Apple posted quarterly revenues that climbed nearly $10 billion from $78.35 billion in the year ago period. The company’s Q1 net income jumped from $17.89 billion in the year-ago period to $20.07 billion.

Revenues in the Americas jumped 10% year-over-year to $35.19 billion while European sales rose by 14% to $20.05 billion. Sales in Greater China hit $17.96 billion, which marked a 11% increase.

Apple iPhone unit sales fell short of our quarterly expectations at 77.32 million. But iPhone revenues, driven in large part by the higher price tag of the new iPhone X, climbed 13% year-over-year to $61.58 billion.

Looking ahead to the second-quarter the company expected to post revenues between $60 billion and $62 billion.

“We’re thrilled to report the biggest quarter in Apple’s history, with broad-based growth that included the highest revenue ever from a new iPhone lineup. iPhone X surpassed our expectations and has been our top-selling iPhone every week since it shipped in November,” CEO Tim Cook said in a statement.

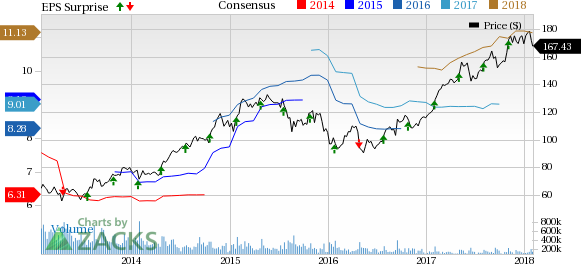

Here’s a graph that looks at AAPL’s Price, Consensus and EPS Surprise history:

Apple Inc. is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers, and portable digital music players. The Company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and Mac OS X operating systems, iCloud, and a range of accessory, service and support offerings. It sells its products worldwide through its online stores, its retail stores, its direct sales force, third-party wholesalers, and resellers. Apple Inc. is headquartered in Cupertino, California.

Check back later for our full analysis on AAPL’s earnings report!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Apple Inc. (AAPL): Free Stock Analysis Report

Original post