Per Verge, Apple (NASDAQ:) recently lowered prices of different tiers of Apple Music in India. A monthly plan for individuals now costs $1.43 compared with $1.73 earlier.

Apple also lowered prices of its family and student plans.

This apart, Apple recently lowered prices of its products globally to fight competition and boost market share. The company slashed prices of iPhone XR in India, lowered prices (roughly 6% on average) of many of its products, including iPhones, iPads, Macs, and AirPods in China and cut HomePod prices by almost 15% globally.

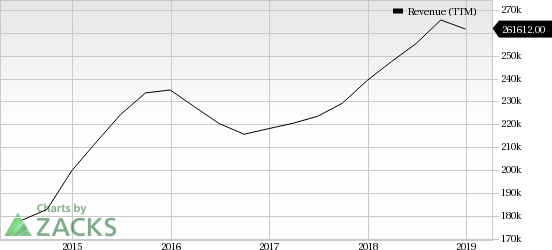

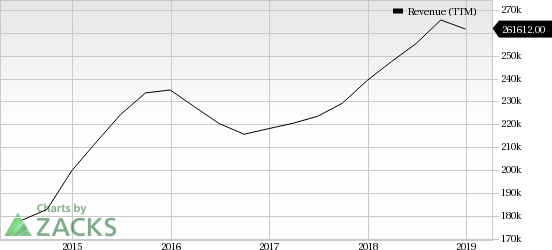

Apple Inc. Revenue (TTM)

Apple Inc. Revenue (TTM) | Apple Inc. Quote

Apple Ups the Game to Counter Competition

Apple Music price cut in India follows the announcement of the launch of Spotify’s (NYSE:) music services and Alphabet’s (NASDAQ:) YouTube Music in the country. Competition among the services now extends to India from their home market in the United States.

Apple’s move also follows annual price cuts from its India-based counterparts JioSaavn and Gaana this March. While JioSaavn, owned by Reliance Industries, cut its subscription price from $14.44 to $4.32, Gaana lowered its price from $15.87 to $4.32.

With music streaming revenues in India expected to reach $227 million by 2023 from $213 million in 2019, per statista, the players operating in India are waging price wars to win subscribers.

Notably, Apple’s monthly subscription ($1.43) is similar to YouTube Music, JioSaavn and Gaana. Spotify however charges a litter higher at $1.72/month, per Verge.

However, Apple is expected to face stiff competition from Amazon (NASDAQ:) , which offers a range of services through its Prime subscription including Amazon Music, costing only about $16/year in India.

Apple Banks on Services Growth

The iPhone maker is increasingly strengthening its services portfolio to boost the top line.

Services business, which includes revenues from Internet Services, App Store, Apple Music, Apple Care, Apple Pay, and licensing and other services increased 19.1% year over year to $10.88 billion and accounted for 12.9% of sales in first-quarter fiscal 2019.

Moreover, services gross margin expanded 450 basis points (bps) year over year in the same period.

Further, with the addition of new services like Apple TV+, Apple News+, Apple Credit Card and Apple Arcade to Apple’s portfolio, its services revenue growth may offset decline in sales from its flagship product — iPhone.

Notably, iPhone sales declined 15% from the year-ago quarter to $51.98 billion in first-quarter fiscal 2019.

Apple currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>