Per media reports, Apple Inc (NASDAQ:AAPL) and prominent Hollywood studios are at loggerheads over pricing of 4K content. This is highly concerning as Apple is expected to unveil its 4K and HDR streaming capable Apple TV at its Sep 12 event.

Reportedly, Apple wants to charge $20 for selling ultrahigh-definition movies on its new Apple TV. But studios want Apple to charge higher (say another $5 to $10) for selling the movies on iTunes. The studios argue that given the improvement in visual quality, it is not right to price ultra HD and full HD content at the same level.

At present, on an average, a consumer has to shell out $30 for watching any Ultra HD content across various platforms. Apple’s aggressive pricing could help it to gain market share but for the movie studios this is a tough deal as it will dent their profits, observe analysts. As a result, negotiations remain held up. There has been no official comment from Apple on the matter.

Apple TV was launched in Jan 2007. It is a digital media player and HDMI compliant set top device that needs to be connected to TV to work. Apple TV also gives access to Apple’s iTunes content as well as some third party content.

However, with increasing competition in the space, Apple TV has started to lose ground to Roku and Amazon. Per a Verge report, citing a survey by Parks Associates, while Roku’s market share, in the first quarter of 2017, jumped from 33% to 37%, Apple’s share has shrunk to 15% from 19% reported last year.

A heftily priced Apple TV ($150 to $200) compared to Roku’s $30 priced hardware is definitely a major factor for the declining market share, adds the report. Even Amazon’s (NASDAQ:AMZN) Fire TV Box costs around $80 while a Fire Stick comes in as cheap as $40.

Though there is a lot of buzz surrounding Apple’s 4K TV, it is to be noted that the market already has many devices that already offer 4K resolution and that too at a cheaper price. Plus, 4K Apple TV needs a 4K TV to work with. 4K TVs haven’t yet gone mainstream. Most people still stuck with the usual HD and LED TVs.

Will Apple find success with new Apple TV? It remains a wait and see story.

Zacks Rank and Share Price Movement

At present, Apple carries a Zacks Rank #3 (Hold).

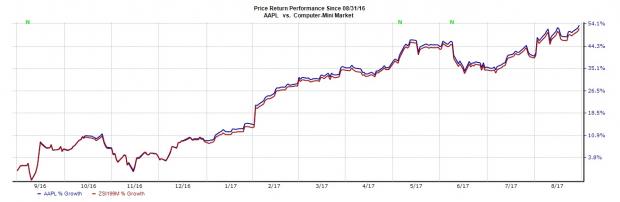

Notably, the company has outperformed the industry in a year. Shares of Apple have surged 53.5% compared with the industry’s 51.9% increase.

Stocks to Consider

Better-ranked stocks in the broader tech space include Garmin Ltd. (NASDAQ:GRMN) and The Trade Desk, Inc. (NASDAQ:TTD) , both sporting a Zacks Rank #1 (Strong Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

Garmin and Trade Desk have delivered average positive earnings surprise of 22.89% and 483.79%, respectively in the trailing four quarters.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

The Trade Desk Inc. (TTD): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

Original post