We expect Apple Inc (NASDAQ:AAPL) (NYSE:P) to beat expectations when it reports third-quarter fiscal 2017 results on Aug 1.

Earnings Whispers

Our proven model shows that Apple is likely to beat earnings because it has the right combination of the two key ingredients. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen.

Zacks ESP: Apple currently has an Earnings ESP of +1.27%. This is because the Most Accurate estimate is pegged at $1.59, higher than the Zacks Consensus Estimate of $1.57. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Apple carries a Zacks Rank #3. This combined with the company’s Earnings ESP of +1.27%, makes us confident in looking for an earnings beat this quarter.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Factors to Consider

This is a relatively calmer quarter for Apple. Apple’s revenues will continue to be driven by the fast growing “Services” segment as well the sales (albeit slowing down) of iPhone 7 and 7 Plus. Services include revenues from App store, Apple Music and Apple Pay.

Investors are more interested in the second half of fiscal 2017. This is because Apple will be launching its mega edition, iPhone 8, around September.

iPhone 8 is set to be launched to mark the tenth anniversary of the revolutionary iPhone. It is reported to have amazing features like a glass body, a dual-curved edge-to-edge OLED display with a built-in Touch ID sensor and wireless charging. iPhone 8 is already dubbed a “super cycle”. However, there are rumors that the launch might be delayed, which could mar its September-ending quarter results.

Meanwhile, the company remains focused on finding newer growth avenues. It is also working on developing technologies such as artificial intelligence (AI) and augmented reality/ virtual reality (AR/VR), which are fast emerging as lucrative business opportunities. The company’s interest in the autonomous car project is understandable as it is now being labeled as a big business opportunity. Apple also remains focused on increasing its market share in India.

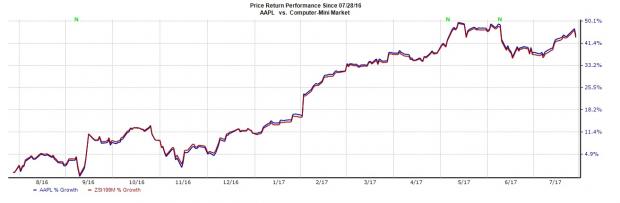

Over the past one year, the stock has registered growth of 44.3% compared with the industry’s gain of 43.7%.

Despite these, Apple continues to face a plethora of challenges. Competition from local players has been hindering iPhone growth in China. In the last reported quarter, owing to persistent macroeconomic weakness, Apple revenues declined around 14% year over year in the Greater China region to $10.7 billion.

For third-quarter fiscal 2017, Apple forecasts revenues in a range of $43.5–$45.5 billion. Gross margin is expected within 37.5–38.5%, while operating expenses are projected within $6.6–$6.7 billion. Operating expenses will be in the range of $6.6–$6.7 billion.

Other Stocks to Consider

Here are a couple of other stocks worth considering that, as per our model, have the right combination of elements to post an earnings beat this quarter.

CGI Group Inc. (NYSE:GIB) has an Earnings ESP of +5.71% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Pandora Media, Inc (NYSE:P) has an Earnings ESP of +15.39% and a Zacks Rank #3.

Fiserv Inc. (NASDAQ:FISV) has an Earnings ESP of +1.63% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Pandora Media, Inc. (P): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

CGI Group, Inc. (GIB): Free Stock Analysis Report

Fiserv, Inc. (FISV): Free Stock Analysis Report

Original post