Per media reports, Apple (NASDAQ:AAPL) has acquired a German company, SensoMotoric Instruments, which specializes in eye-tracking technology. There are no reports on the financial terms of the deal as yet.

SensoMotoric, headquartered in Berlin, has reportedly developed a suite of computer vision applications that find use in neuroscience, car systems, linguistics, physical training and biomechanics and augmented reality/ virtual reality (AR/VR). The company’s eye-tracking solutions have found usage in VR headsets like Facebook’s (NASDAQ:FB) Oculus Rift, add media reports.

Apple has been speculated to foray into the wearable glasses space. In November last year, Bloomberg stated that Apple was mulling over venturing into the wearable headsets space. However, the company was unlikely to initiate “mass production” as it had just ordered a small number of near-eye displays for testing purposes from a supplier.

Moreover, in January this year, tech blogger, Robert Scoble, citing a Carl Zeiss employee, stated that Apple is working on AR/mixed reality headsets and has partnered with renowned lens maker. He was more optimistic about the retail launch as he stated that the glasses could hit stores as early as this year. As a result, snapping up of an eye-tracking solutions company is completely understandable.

Apple CEO, Tim Cook has emphasized on developing the technology time and again over the last few months. Cook had mentioned the company’s AR efforts for the first time at the third-quarter fiscal 2016 earnings conference call. He has been quoted saying, "AR can be really great, and we have been and continue to invest a lot in this. We are high on AR for the long run. We think there are great things for customers and a great commercial opportunity." As a matter of fact, he has been quoted by media reports saying not VR but AR will be “the larger of the two, probably by far”.

The thing is Apple has been exploring newer growth avenues to boost its top line. With so much buzz created by the AR/VR and AI technologies, the company has started to focus on its development. These are fast emerging as lucrative business opportunities.

The market presents significant growth opportunity for Apple despite competition from Alphabet (NASDAQ:GOOGL) , Microsoft (NASDAQ:MSFT) and Facebook. According to a recent IDC report, global revenues of the AR/VR market will witness a CAGR of 198% over a period from 2015 to 2020 and will reach $143.3 billion by 2020.

To ramp up its efforts, Apple has acquired several smaller firms with expertise in AR hardware, 3D gaming and virtual reality software. These include Flyby Media, Emotient, TupleJump, Turi, Metaio and PrimeSense. This year, Apple scooped up Lattice DataInc, a startup specializing in AI technology for reportedly $200 million.

In addition, at its WWDC this year, Apple announced ARKit that will help third-party developers to work on creating AR experiences for its iOS platform.

Zacks Rank & Stock Price Movement

At present, Apple carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

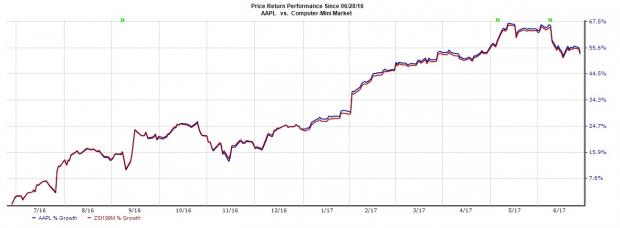

In the past one year, shares of Apple have registered growth of 53.6% compared with the Zacks categorized Computer Mini industry’s gain of 52.8%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research