Apple Inc. (NASDAQ:AAPL) has reportedly issued a new $1 billion green bond to ramp up its renewable energy and environmental efforts.

According to reports, the bond, expected to be Aa 1 rated, will mature in 2027 and yield 95 to 100 basis points more than treasuries. Bank of America (NYSE:BAC), Goldman Sachs (NYSE:GS) and JPMorgan Chase (NYSE:JPM) have made the sale arrangements.

Per Reuters, the latest offering comes a year after the company issued its first green bond of $1.5 billion following the 2015 Paris accord. It was the largest ever issued in U.S. corporate history, adds the media report further.

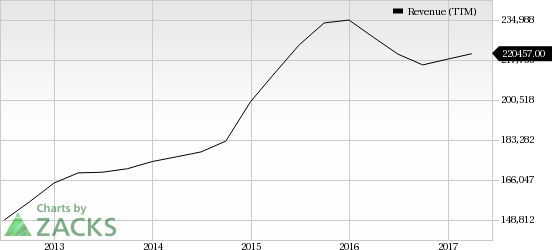

Apple Inc. Revenue (TTM)

A Step Closer to 100% Renewable Energy

We believe that Apple’s second green bond issuance is a part of its bid to attain 100% renewable energy efficiency. Two months ago, the company announced that it sources 96% of its worldwide energy from renewable sources and is committed to reach 100% by expanding the push into its supply chain through the RE100 initiative.

Now, RE100 is a global collaboration of influential businesses committed to 100% renewable electricity. The broader aim is a transition toward low carbon economy through increasing demand and supply of renewable energy. Some of the biggest technology companies are part of this initiative including Alphabet’s (NASDAQ:GOOGL) Google, Microsoft (NASDAQ:MSFT) , eBay (NASDAQ:EBAY) , and Salesforce.

Per reports, the proceeds from the bond sale will go to financing renewable energy projects, enhancing energy efficiency at the company’s supply chain and facilities and procuring safer raw materials. The move indicates that Apple won’t be using its offshore cash reserves in funding these projects.

The bond issuance is in line with Apple’s commitment to create a “closed-loop supply chain”, which will guarantee that only renewable resources and recycled materials are used in production.

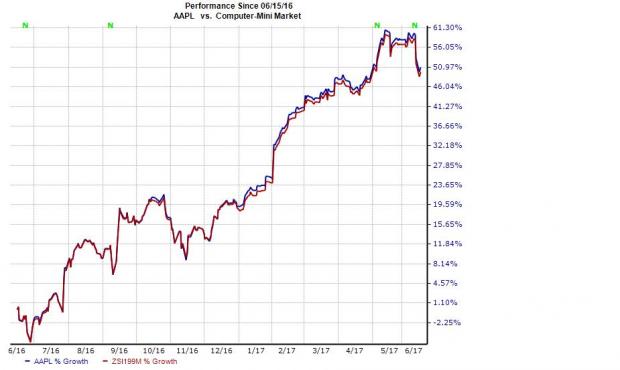

We note that Apple’s solid business model, impressive resources and technological prowess have allowed it to have an impressive run on the bourses. Over the last one year, the company has gained 50.9%, higher than the Zacks categorized Computer Mini industry’s addition of about 48.5%.

A Message to the President?

Notably, the news comes on the heels of President Donald Trump’s move to withdraw the U.S. from the Paris climate agreement. Apple was one of the several companies to have directly appealed to Trump to keep the U.S. in the pact but all its efforts went in vain.

With this green bond, the technology giant is sending a strong message to him that American businesses will abide by the Paris climate agreement.

Wrapping Up

It goes without saying that Apple is an influential name in the technology sector. So the company’s increasing effort toward fighting global warming could encourage more companies from the sector and even those from others to join these crucial global efforts. This in turn could attract more investors to help improve the environment.

Apple has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks' radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>

eBay Inc. (EBAY): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research