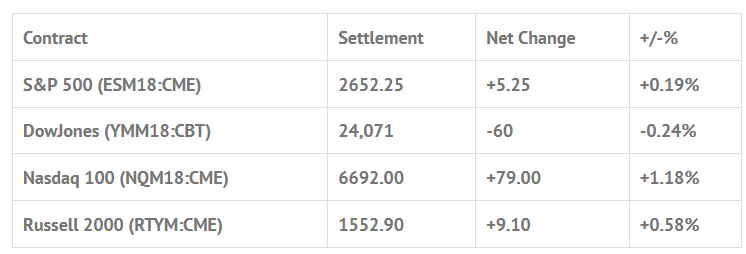

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp -0.01%, Hang Seng -0.27%, Nikkei -0.16%

- In Europe 11 out of 13 markets are trading higher: CAC +0.08%, DAX +1.11%, FTSE +0.39%

- Fair Value: S&P -2.04, NASDAQ +1.83, Dow -50.11

- Total Volume: 1.31 mil ESM & 1.12k SPM traded in the pit

Today’s Economic Calendar:

Wednesday: ADP private payrolls, April (+193,000 expected; +214,000 previously); Federal Reserve interest rate decision (1.5%-1.75% fed funds range previously, no change expected).

S&P 500 Futures: Higher Rates, Trade Wars, Trump Investigations, Iran and Israel Could Give ‘Sell In May And Walk Away A New Meaning’

On Globex, the S&P 500 futures traded up to 2653.75, and made a low at 2640.00 just before Tuesdays 8:30 futures open. The first print of the day came in at 2641.00. After the bell, the futures rallied a few ticks up to 2642.25, sold off down to 2635.75, and then traded above the vwap to 2642.75. From there, the ES then sold off down to a new low at 2643.00, made three lower highs at 2640.75, 2639.25 and 2638.75, and then got hit by several small sell programs that pulled prices down to a new low at 2626.50.

After the low, the ES popped up to 2634.50, traded in a 3 handle range for about an hour, sold off down to 2627.50, rallied up to 2643.00, and at 12:07 CT sold off down to a new low at 2623.25. At 1:05, the ES had popped back up to 2641.75, and then up to 2644.00, a +20.75 handle rally off the lows. After another small pullback, the ES traded up to a new high at 2648.50, and then pulled back down to 2644.00 before trading back up to 2647.75, and then back down to 2639.50 as the MiM went from from sell $306 million to sell $464 million.

The ES traded 2645.00 on the 2:45 cash imbalance reveal, as the MiM ‘flipped’ to buy $167 million. On the 3:00 cash close the ES traded 2652.25, and then went on to settle at the day up +6 handles, or +0.23%.

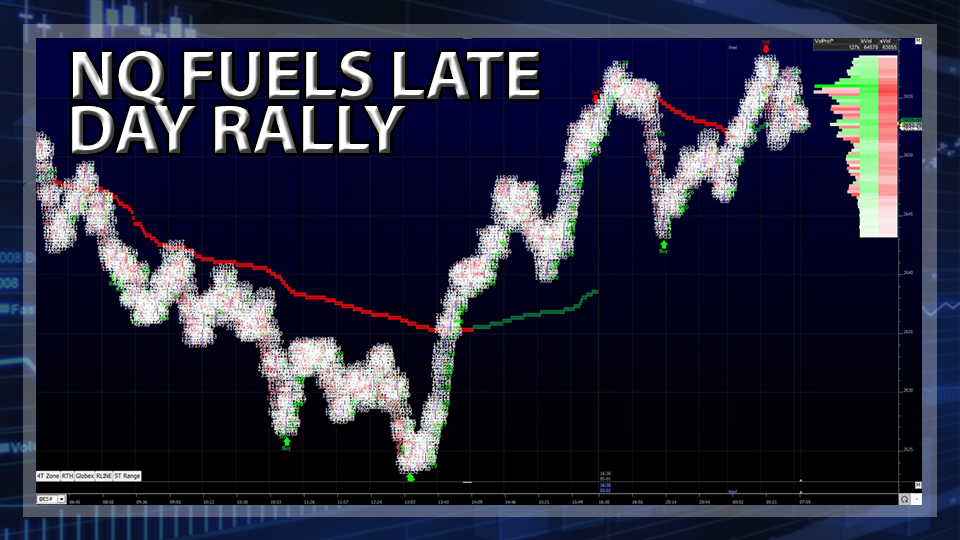

In the end, the key to the day was the NQ, it didn’t want to go down all day. The trade was all part of a big rotation; sell Dow / buy Nasdaq, and the S&P just went for the ride. ES volume was a little better than Monday’s, 1.29 million vs. 1.24 million.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.