The Q2 earnings season is gradually nearing its end with nearly 87% of the S&P 500 companies already having announced their results. Although the bulk of earnings releases have already come from different sectors, a significant number of retailers are yet to post their financial results.

Per the Earnings Trends as of Aug 4, out of the 420 S&P 500 members that have come up with their quarterly numbers, approximately 74.3% have posted positive earnings surprises while 68.3% have surpassed the revenue estimates. According to the report, the overall earnings of these S&P 500 companies are up 11.6% from the prior-year period, while revenues have increased 5.6% year over year.

Additionally, earnings for the total S&P 500 companies are expected to grow 10% from the year-ago period, while revenues will rise 5.1%. In the first quarter, earnings of S&P 500 companies increased 13.3%, while revenues rose 7%, which is the highest growth rate in nearly two years.

Per the latest report, nearly 69.4% of the Consumer Discretionary companies have already reported their results, out of which 68% beat earnings and only 56% surpassed revenue estimates. Total earnings for these companies were up 9% while revenues gained 10.5% year over year. Apparel stock forms part of the Consumer Discretionary sector.

Among Apparel stocks lined up to report on Aug 8, let’s take a sneak peek at two companies.

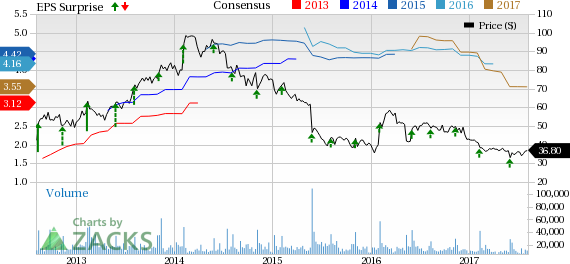

Michael Kors Holdings Limited (NYSE:KORS) is scheduled to report first-quarter fiscal 2018 results. In the last quarter, the company delivered a positive earnings surprise of 4.3%.

We remained concerned about Michael Kors’ wholesale segment performance, which has witnessed a sharp decline in the previous few quarters. In fourth-quarter fiscal 2017, wholesale segment sales declined 22.8% to $456.1 million primarily due to dismal performance of Americas and European regions, while on a constant currency basis, it fell 22.3%. In the third, second and first quarters of fiscal 2017, wholesale segment sales declined 17.8%, 18.4% and 7%, respectively. In fiscal 2018, the company anticipates wholesale segment to decrease in the low-teens range.

Stiff competition, waning comps, aggressive promotional environment and sluggish mall traffic are making things tough for Michael Kors. We noted that comparable sales had fallen 14.1% in the final quarter of fiscal 2017, following declines of 6.9%, 5.4% and 7.4% in the third, second and first quarters, respectively. The company is also struggling with its top-line performance. After registering a meager growth of 0.2% in the first quarter of fiscal 2017, it had declined 3.7%, 3.2% and 11.2% in the second, third and fourth quarters of fiscal 2017.

However, Michael Kors has been constantly deploying resources to expand product offerings, open new stores, and build shop-in-shops along with upgrading information system and distribution infrastructure. Management intends to upgrade eCommerce platform and expects the channel to be a significant contributor in the long run. (Read more: Is Michael Kors Likely to Disappoint in Q1 Earnings?)

Michael Kors carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%. The Zacks Consensus Estimate for the quarter is pegged at 62 cents.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

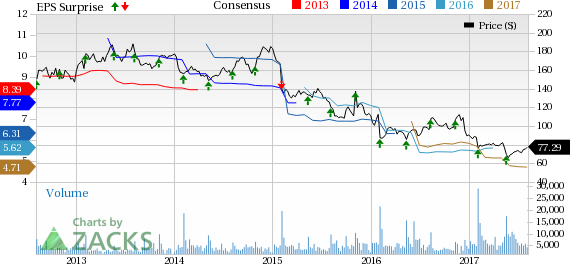

Ralph Lauren Corporation (NYSE:RL) is slated to release first-quarter fiscal 2018 results. The question lingering in investors’ minds is whether this designer, marketer and distributor of premium lifestyle products will be able to deliver a positive earnings surprise in the quarter to be reported. The company has delivered positive earnings surprises consistently in the trailing four quarters, with an average beat of 14.2%.

Ralph Lauren continues to battle foreign currency headwinds, which is expected to hurt margins and sales in the first quarter and fiscal 2018. Moreover, the company is reeling under soft traffic trends, which weighed upon its top line in the last reported quarter and remains a deterrent for the upcoming quarter as well. All these factors have caused management to issue a drab sales view for the first quarter and fiscal 2018, when it reported its last quarterly outcome.

Evidently, the company expects fiscal first-quarter reported revenues to be down low-double digits, excluding currency impact. Operating margin for the fiscal first quarter is expected to be 9.5–10%. The company expects currency headwinds to reduce revenues growth by nearly 225 basis points (bps) and operating margin rate by about 75 bps. For fiscal 2018, the company expects revenue to decline 8–9%, excluding currency. Operating margin is estimated to be 9–10.5% on a currency-neutral basis. Foreign currency is anticipated to pull down revenues by 150 bps and operating margins by 50–75 bps in fiscal 2018. (Read more: Currency & Soft Traffic May Hit Ralph Lauren Q1 Earnings)

Ralph Lauren carries a Zacks Rank #4 and has an Earnings ESP of -1.04%. The Zacks Consensus Estimate for the quarter is pegged at 96 cents.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Original post