An Earnings Beat: U.S. energy firm Apache Corporation (NYSE:APA) reported earnings per share – excluding one-time items – of 33 cents, ahead of the Zacks Consensus Estimate of 21 cents.

Shares of Apache, meanwhile, rose 2.7% in premarket trading.

Estimate Revision Trend & Surprise History: Investors should note that the Zacks Consensus Estimate for the quarter has been unchanged in the last 7 days.

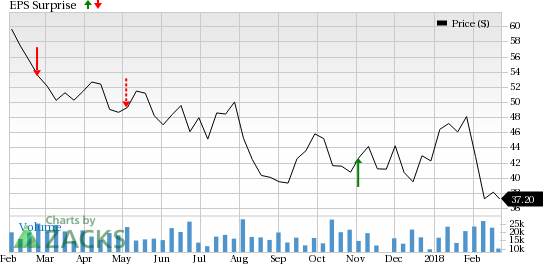

Coming to earnings surprise history, Apache is on a bit of a slippery surface. Before posting the earnings beat in Q4, the company went past the Zacks Consensus Estimate just once in last four reports, as shown in the chart below:

Overall, the company has a negative earnings surprise of 23.33% in the trailing four quarters.

Revenue Came in Higher than Expected: Revenues of $1,586 million were above the Zacks Consensus Estimate of $1,540 million.

Key Stats: The production of oil and natural gas (excluding divested assets and non-controlling interests) averaged 362,251 oil-equivalent barrels per day (BOE/d) (68% liquids), essentially flat from last year. Apache’s production for oil and natural gas liquids (NGLs) was 246,672 barrels per day (Bbl/d), while natural gas output came in at 693,477 thousand cubic feet per day (Mcf/d).

The average realized crude oil price during the fourth quarter was $58.36 per barrel, representing an increase of 23.1% from the year-ago realization of $47.39. Moreover, the average realized natural gas price during the December quarter of 2017 was $2.90 per thousand cubic feet (Mcf), up 1.8% from the year-ago period.

Apache’s fourth quarter lease operating expenses totaled $334 million, down 10.9% from the year-ago quarter.

Guidance: Apache announced a 2018 capital budget of $3 billion. The company also aims to grow production by 7-13% in the next one year.

Zacks Rank: Currently, Apache carries a Zacks Rank #3 (Hold) which is subject to change following the earnings announcement. While things apparently look favorable, it all depends on what sense the just-released report makes to the analysts.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Check back later for our full write up on this Apache earnings report later!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Apache Corporation (APA): Free Stock Analysis Report

Original post

Zacks Investment Research