Fridays core inflation numbers from the U.S., Europe and Japan were anything but, giving the U.S. Dollar a helping hand to start the week.

Trading is off to a quiet start in Asia this week with the markets barely moving after President Trump’s interview in the Financial Times this weekend. The major takeaways, most of which should be dollar positive to some degree, are he is prepared to take unilateral action against North Korea if China continues to vacillate. That currency manipulation and China is not of the table, and that governing is harder than he thought it would be. The last being of no surprise.

However is was Friday’s core inflation numbers from the “big three” that are probably most troubling. Japan with a mind-numbing 0.1%, the U.S with an expected 1.75% and most troubling, Europe undershooting at 0.7%. Europe will have the reflationista’s more than a little nervous given we are approaching the tapering phase of the ECB’s quantitative easing (QE) programme. After the mother of all QE programmes in Japan, Friday’s number may be causing a few sleepless nights in Tokyo as well.

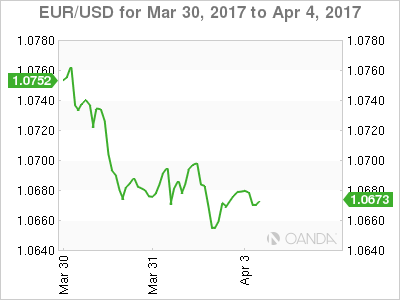

At least the United State’s is delivering it’s inflation Nirvana, albeit at a pace the street is slightly underwhelmed with. Taken in totality Friday’s numbers were USD positive with the Euro, in particular, starting the week as it finished, on a soggy note.

This week features both the ECB and FOMC minutes, President’s Trump and Xi of China meeting in Florida. Perhaps over a game of golf. We then culminate in the U.S. Non-Farm Payroll on Friday. Into the mixture we see Fed. Governor Dudley speaking twice and an RBA rate decision. Mr Dudley’s speeches and the non-farms being the most likely to move the needle on volatility this week.

The Eur has rallied in Asia as EUR/JPY, EUR/AUD and EUR/GBP buying today, support the single currency. The Commitment of Traders (COT) report also showed a large unwind of Euro shorts against the dollar. Although supportive in the short-term, the COT is backwards looking by a week. Euro will find resistance at Friday’s highs around 1.0700 with support at 1.0650, a 61.8% Fibonacci, and 1.0630 the 100-day moving average.

EUR/USD

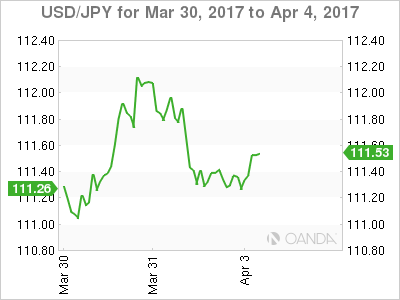

Having failed at 112.00 again on Friday, USD/JPY sits mid-range at 111.37 today. Key support and resistance are 110.00 and 112.00 with the street unlikely to get excited until one or the other is broken. This morning’s Tanken report was a fizzer, and unsurprisingly, the COT report showed a large reduction of JPY shorts from the previous week.

In the short term, USD/JPY has support at 111.10 with seller sat 111.40/50. It should remain supported in Asia by cross flows and a positive Nikkei.

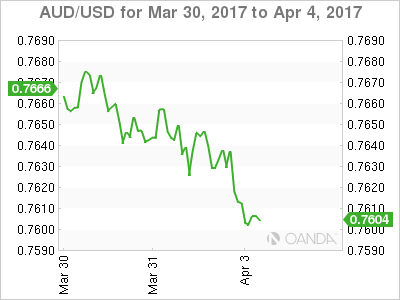

Post a poor building approvals data set this morning, AUD/USD is trading heavy despite AUD/JPY buying. AUD has support at 7590 with the possibility of some stop losses lurking below there. Resistance lies at 7670. The RBA rate decision tomorrow is unlikely to provide fireworks and remain unchanged. What will be interesting is if the RBA strike a quite dovish tone which could see AUD optimists heading for the door.

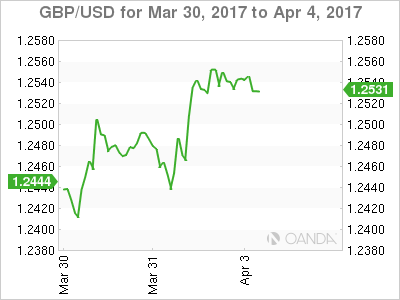

GBP has drifted lower in Asia on EUR/GBP buying this morning, but still remains in a most un-Brexit way, near the top of its recent range at 1.2550. 1.2600 is the key resistance area to watch while support sits at 1.2520 initially. It is a light data week for the U.K. and sterling will mostly likely move to the beat of both the USD and EUR/GBP flows.

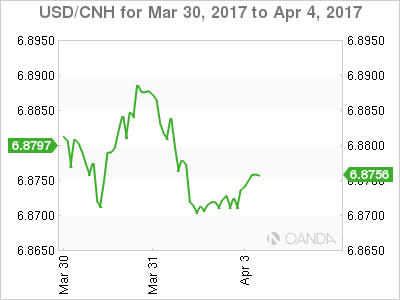

Moving higher in Asia with a strong USD in general at 6.8800 today. The 6.8400 level remains the key support for the pair with resistance in the 6.9300 regions. Neither level appears to be in imminent danger unless we see a very large USD elsewhere. This may well have to wait for Friday’s Non-Farms. Asia looks content to trade the 6.8700/6.8900 range today. Bring a good book to read.

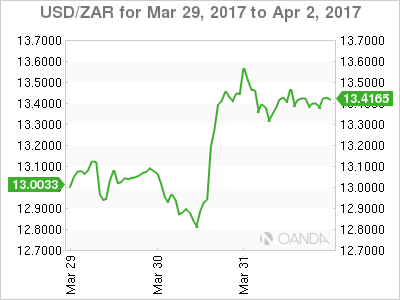

President Zuma’s night of the long knives with his cabinet last week is overshadowing improved South Africa trade data. As it should, with the respected finance minister removed amongst others. Traders looking for some volatility to start the week should almost certainly find it here. Political rumblings within his own ANC and the opposition mean this story may have more to run and should see USD/ZAR bid on any meaningful dips.

Support sits at 13.3000 with resistance at 13.6000. Expect this pair to remain extremely volatile and vulnerable to news headlines out of South Africa.

Overall the USD appears to be shrugging on its recent lethargy and making a quiet comeback. At the very least, the U.S. has some inflation to show for its troubles, as opposed to Europe and Japan, and in a light data week until Friday, this should be supportive.