APAC Currency Corner – The Pound Pounded

Investor sentiment soured over the July 4 long weekend.” Just when you thought it was safe to go back in the water”, the pound got pounded as speculation around Brexit forms into something more concrete.

Aside from the market noise and price swing fluctuations, for the greater part, the market continues to take huge upticks in volatility in its stride; chaos is becoming the new calm on trading desks.

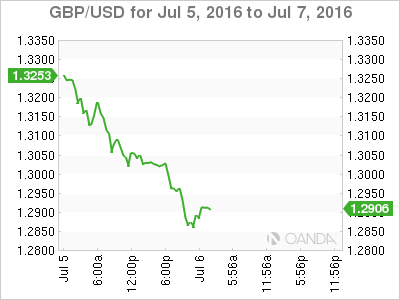

GBP – Tumbling Tuesday

Several of the UK’s biggest property funds have halted trading to prevent liquidation as fears mount over the potential for widespread commercial property selling; a similar scenario to 2008. This move was the catalyst to send a wave of risk-off sentiment through global markets, leaving investors scurrying for safe-haven assets. The US benchmark, the 10 Year Bond, tumbled below 1.36 %.

The knockout punch for the sterling occurred when the Bank of England (BoE) cut its Countercyclical Capital Buffer (CCyB) for banks to 0.

Reducing a Bank’s capital requirement is as good as an easing policy, as it boosts a bank’s lending capability by as much as GBP150 billion. The policy move fueled further speculation that the BOE will ease monetary policy at its next MPC meeting on 14 July

Traders went into full bear mode. It is unlikely that we have seen the lows of the sterling yet and I would expect any headline-driven GBP rally to quickly fade.

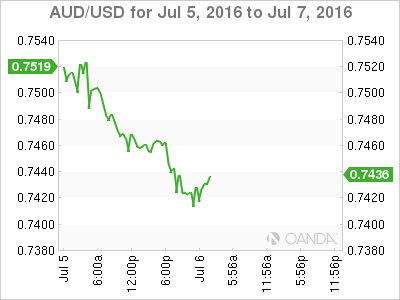

AUD – Tarnished Tuesday

The RBA meeting passed with little fanfare, leaving the Aussie bulls a bit disappointed. Profit-taking mentality is setting in.

The weaker trade balance figures came out yesterday, but together with an overnight shift in risk sentiment it has left the Australian dollar vulnerable over the short term. Coupled with the ongoing uncertainty on the domestic political front, AUD appeal is tarnished for the near term.

Yield appeal should continue to see flows into the AUD, but with risk-off moves dominating price action, we may see the GBP short versus the long AUD trade switch to a more guarding strategy of short GBP through USD or JPY. This could also weigh on sentiment of the AUD having quasi-safe haven appeal.

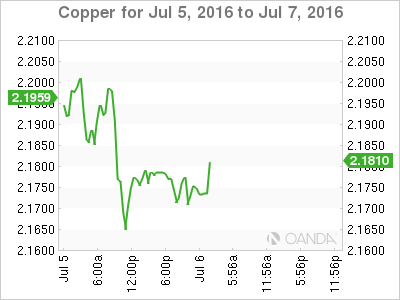

Commodities

Copper prices have come off a two-month highs on concerns over Chinese demand, due to the mainland’s uncertain economic outlook, which is weighing heavy on commodity currency sentiment. Oil prices have fallen on excess supply concerns, with Libya and Nigeria expected to ramp up production, but related is an increase in the number of US oil rigs. Baker Hughes Data showed that US oil rigs rose by 11 the past week. USD 50.00 per barrel continues to attract shale drillers back online.

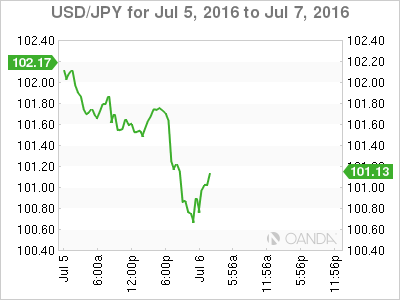

JPY – Risk Driven

There’s a high level of complacency in USD/JPY trade as the markets have no defined direction other than chasing risk sentiment. I expect further probes lower as the latest Brexit sell-off is simply the tip of the iceberg. However, I also believe that it will take something other than souring risk sentiment to move the market convincingly towards 100 JPY.

Traders remain focused on Friday’s Non-Farm Payroll, which could play out to be the primary catalyst for near-term JPY direction. In the meantime, traders will be monitoring Kuroda comments for hints that the

BoJ is nearing a policy move, given the recent JPY appreciation. The ever-present threat of intervention and stimulus rhetoric will likely limit downside USD/JPY potential, despite souring risk sentiment.

Yuan-Policy Driven Yuan Fix

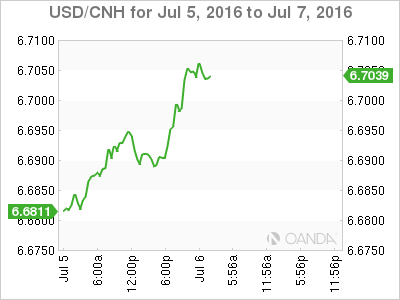

A slide in the yuan continues because China’s policy makers are guiding a path of depreciation to support waning export markets.

The path is based on self-perpetuating trades, where weaker PBOC Yuan pegs drive fears of further policy driven currency depreciation, and in turn, traders predictably bid the USD/CNH market higher.

That said, I anticipate some position squaring and profit taking as we near Friday’s US Non-farm Payroll figures release.

MYR – Holiday Mode

Traders squared position ahead of the Malaysian Hari Raya holidays, with markets closed today and tomorrow.

With USD non-farm payroll looming, oil prices are falling and risk sentiment created an about-face overnight, so we are likely to see some residual pressure on regional currencies like the MYR over the short term.