Federal Reserve chief Janet Yellen struck all the right chords as the U.S central bank used another Get Out of Jail Free card, which followed the dismal NFP. This data gave an opportunity for another rate hike delay while sounding upbeat about the US economy.

Whether by intention or not, her comments fuelled speculation that the Fed will keep rates lower for longer. As a result, investors are smiling once again as they pile back into the emerging market space, looking for yield. Let’s hope Yellen’s optimism on the US economy plays out in the data.

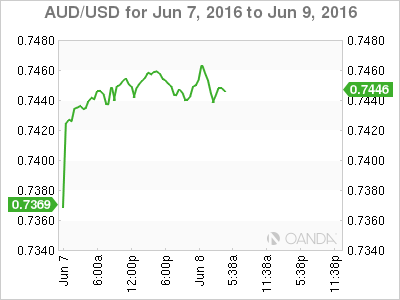

The Aussie – marching to one-month high

The Australian dollar has benefited from the fact that the RBA has remained neutral and chosen not to introduce an easing bias. There were some concerns that the appreciating Aussie dollar, in the wake of last week’s NFP and a less assertive Federal Reserve Board, would influence the RBA stance.

Instead, RBA Governor Stevens provided little forward guidance and will correctly wait until next month's CPI print as an inflation barometer before considering any additional rate cuts.

However, the risk is that the market is only pricing in a 50% likelihood of a rate cut in August, when it’s doubtful domestic inflation will rebound. So we are likely to see substantial offers emerge on further upticks.

In the meantime, the AUD remains well supported by a combination of neutral RBA policy, general dollar weakness, and rally, albeit fragile in risk assets. Commodity and oil prices are also proving supportive, which should keep the Aussie marching higher over the near term as 0.7500 comes into view.

In early trade, after breaching 0.7450, the AUD is sliding on the back of weaker risk sentiment as S&P futures are under some pressure at this morning’s open.

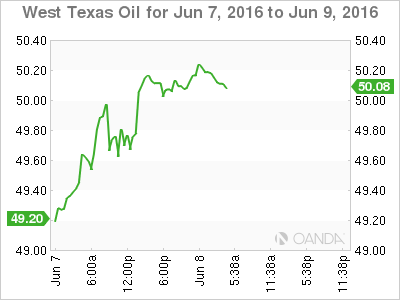

Oil – rises above $50 on supply concerns

On the oil front, both WTI and Brent are now trading above $50 a barrel, with sentiment primarily driven by supply disruption chatter. On the back of upgraded US Energy Information Administration forecasts, traders will be closely monitoring the crude oil inventories reports from both the American Petroleum Institute and the Department of Energy.

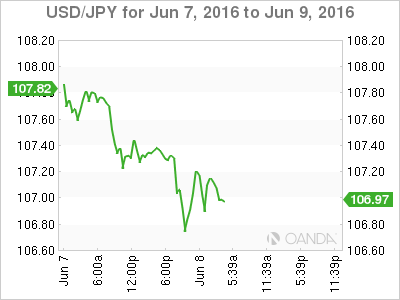

Yen – in a lull before major policy meeting

A range-bound session in the overnight market saw USD/JPY supported by improving risk sentiment. Yet it was weighed down by the prospects of lower-for-longer US interest rates and uncertainty over the BoJ’s next move, which arguably faces the most urgent of problems. It feels like we’re in a bit of a lull period and very much guided by the impulse of risk sentiment gyrations.

Traders will keep close tabs on US equities, as we have been pressing and bouncing off some incredibly lofty resistance points during the last 24 hours. Risk sentiment should be the primary focus today.

The other major factor is what’s in store leading up to the BoJ policy meeting (Jun 15-16) and just how dovish Governor Kuroda leans in the wake of a less confident Fed interest rate outlook. Bare in mind that the BoJ has already disappointed the market in April. Lots of questions remain with few concrete answers.

In early trade, markets are turning a bit unsettled, expressing disappointment by trading through USD/JPY 107 on the lack of urgency from Japanese policymakers. This, after a senior aide in Japan Prime Minister Shinzo Abe’s government says Abe plans to propose an economic stimulus package worth about JPY10tn (USD93bn) when the parliament convenes in the fall after elections in July.

Details could be announced shortly after the election.

On the data front, Japan Q1 final GDP Q/Q came in at 0.5% as expected, and annualized GDP at 1.9 % as expected. While the Current Account Balance printed ¥1.88T V ¥2.30TE and the Trade Balance: ¥697B V ¥919BE.

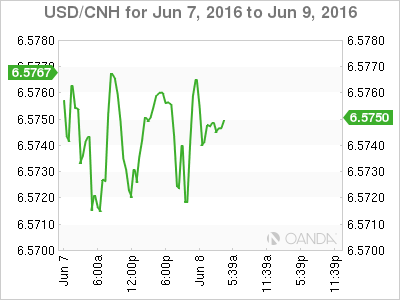

Yuan – buying on dips

Prospects of a June or July US rate hike have significantly diminished, and an earlier-than-expected Fed rate hike remains the key risk for the CNH. Positively, expectations of additional fiscal spending should remain supportive.

Anticipation of increasing cross-border flows after the Shenzhen Connect announcement in coming weeks, along with the MSCI decision on A-share inclusion due by June 15, should provide additional support for the yuan. Yet there has been keen interest to buy USD/CNH on dips, despite broader based USD weakness.

This morning China’s foreign exchange regulator, as expected, attributed the sharp fall in the mainland’s foreign exchange reserves to valuation changes of other major currencies amid a strengthening USD. The PBPC set the yuan midpoint at 6.5598 versus 6.5618 and muted market reaction followed today’s fix.

EM supportive flows, along with a bounce higher in oil prices, has supported the MYR in overnight markets. Given the predominant weakness in the broader USD market, I would expect traders to sell upticks.