Share price of ANSYS Inc. (NASDAQ:ANSS) rallied to a new 52-week high of $132.07, eventually closing a bit lower at $132.01 on Sep 12. The outperformance can be attributed to the company’s expanding product portfolio and consistent execution, which are driving top-line growth and profitability.

We note that ANSYS has beaten the Zacks Consensus Estimate for earnings in all of the trailing four quarters with an average positive surprise of 5.02%.

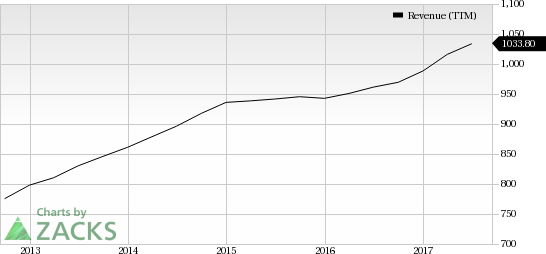

Last quarter, earnings increased 6.5% year over year to 99 cents on revenues of $264.4 million, up 13% at constant currency. ANSYS also raised its fiscal 2017 guidance.

Moreover, the stock has returned 42.7% year to date, substantially outperforming the industry it belongs to. ANSYS has a market cap of $10.89 billion.

Currently, ANSYS holds a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Factors

ANSYS is a dominant player in the high-end design simulation software market and its expanding portfolio has been a key catalyst. The company recently unveiled ANSYS Discovery Live that supports fluids, structural and thermal simulation applications.

The software enables engineers to experiment with design ideas and see instant feedback. Notably, the combination of NVIDIA’s (NASDAQ:NVDA) graphic processing units (GPUs) and ANSYS Discovery Live simulation software makes result calculations a thousand times faster compared with traditional methods.

Moreover, acquisitions like Computational Engineering International (CEI), SpaceClaim, Reaction Design and Evolutionary Engineering have expanded the company’s expertise in processing and analysis of simulation data, 3D modelling, chemistry simulation and cloud-based composite analysis and optimization technology.

These have eventually expanded ANSYS’s total addressable market (TAM). The company can now address the needs of diverse industries like IoT, next-gen 5G product designs, autonomous vehicle, mobile products as well as high-performance chips for advanced driver assistance systems (ADAS). Moreover, growing demand for energy efficient products is also a key catalyst.

Additionally, collaborations with leading vendors like Autodesk (NASDAQ:ADSK) , Synopsys (NASDAQ:SNPS) and NVIDIA are expected to drive demand for the company’s products.

However, declining perpetual license revenues will hurt top-line growth at least in the near term. Moreover, weakness in Europe and adverse foreign currency exchange rates are other major concerns.

Estimate Revisions

The Zacks Consensus Estimate for fiscal 2018 and fiscal 2019 has been steady at $3.86 and $4.14 over the last 30 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Autodesk, Inc. (ADSK): Free Stock Analysis Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

ANSYS, Inc. (ANSS): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post