With the first overhaul of the US tax code in over 30 years passing yesterday, US corporations in particular stand to do very well in 2018, and potentially even top their stellar performance from this year. The S&P 500 saw earnings grow nearly 10% in 2017, a yearly rate not seen since 2011. These companies have more cash on hand than they know what to do with, and while share buybacks dropped in 2017, dividends saw record levels, with CAPEX and R&D increasing as well.

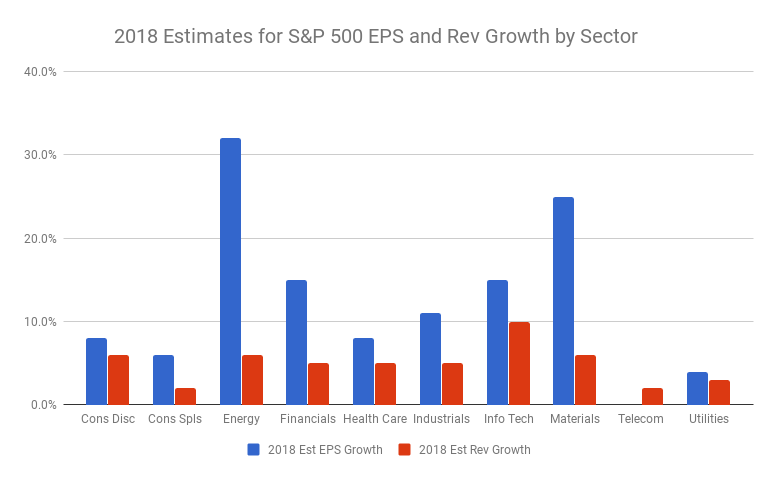

In the new year, S&P 500 earnings growth is expected to put up another 10%, the first time there have been two consecutive years of double-digit growth since 2010 and 2011. Furthermore, five of the ten sectors are estimated to put up double-digit year-over-year (YoY) growth.

After getting crushed in 2015 and 2016, commodities are back! The Energy and Materials sectors were the top two profit growers of 2017, and are expected to hold those titles again in the new year. Year-over-year comparisons are getting more difficult as prices in oil and metals normalizes, meaning the triple-digit profit growth seen for many of these names last year will remain a thing of the past. With that said, Energy is anticipated to put up hefty earnings per share (EPS) growth of 32% with Materials following closely behind at 25%.

Next up we have Financials and Information Technology, both expected see YoY EPS increase by 15%. Insurer’s helped boost the bottom line for the Financials sector in 2017, with analyst’s anticipating names like AIG (NYSE:AIG), Progressive (NYSE:PGR) and Travelers (NYSE:TRV) will have a repeat performance this coming year.

The big banks will also be one of the largest beneficiaries of a lower corporate tax rate, with Morgan Stanley (NYSE:MS) calculating earlier in the year that a move to 20% rates from 35% would help deliver a double-digit increase in profits for their own bank, in addition to Bank of America (NYSE:BAC), JPMorgan (NYSE:JPM), Goldman Sachs (NYSE:GS) and Wells Fargo (NYSE:WFC). Only Citigroup (NYSE:C) would would see a single-digit increase due to a balance sheet that includes billions in deferred tax assets.

Within tech the focus will continue to be on Internet Software and Services names such as Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOGL) as well as Semiconductors such as Micron (NASDAQ:MU), Advanced Micro Devices (NASDAQ:AMD) and NVIDIA (NASDAQ:NVDA). Chip names have been leading tech for the last year as they demand increases outside of PC and into things like gaming consoles and automobiles.

No companies expected to post negative EPS growth in 2018, but the laggards are Utilities and Telecommunication Services at 4% and 0%, respectively. These are the two smallest sectors in the S&P 500, both by number of companies as well as market cap.

Revenue growth tends to run slightly lower than that of earnings growth, and that is no exception for 2018. However, in many cases revenue growth is the more important number to watch as it cannot be manipulated in any way with accounting methods, sales are are more straightforward. Overall the S&P 500 is expected to put up revenue growth of 5%. The leading sectors are Technology with 10%, and Energy and Consumer Discretionary at 6%. Only Telecom is expecting a decline of 1.5%.

After three years of stagnating corporate earnings results, 2017 marked a turn for the better, and one that has sustainability. The environment remains ripe for these large cap names, supported by an improving GDP, strong employment numbers and an empowered consumer. The only hope is that we’ll see US corporations more efficiently put their money to use in the year ahead.