Another U-Turn

Risk markets have experienced a dramatic U-turn in the past day, as the Trump election risk premium evaporated in the wake of FBI Director Comey’s comments that there was no evidence of criminal actions in the latest batch of Clinton emails.

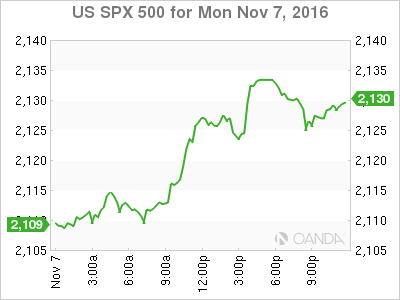

Across the board, there has been an uptick in risk appetite, bolstered by anticipation of a Clinton victory. Investors scurried to fill the sell-off gap from Oct 28 when the FBI rocked markets with news of the investigation, effectively snapping one of the longest consecutive S&P daily losing streaks recorded since 1980.

Currently, the polls are siding with and consolidating to a Clinton lead. Any hopes of big swings to Trump on Election Day from the Independents likely went up in smoke with Comey’s comments. Now that there is clarity into both the polls and the FBI investigation, traders are not relying on morning markets tea leaves readings for election clues and is diving in head first into the markets today.

For those that still believe the race is too close to call, take note that Wall Street is sending a huge endorsement to the Clinton camp. There is a risk that markets may be too complacent in expecting a Clinton victory, with a significant portion of the street still maintaining there is enough inconclusiveness in the polls and prefer to wait and see. Undoubtedly, Brexit poll memories are still fresh.

Strap In, Capital Markets Are In For A Wild Ride

USD Surges Ahead of US Presidential Election

Japanese Yen

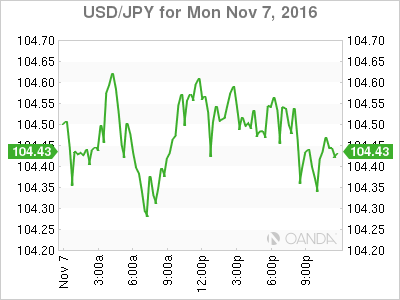

Not unexpectedly, USD/JPY price action is still primarily driven by risk sentiment on the back of the US election. However, the pair stalled out overnight, consolidating in the 104.40-60 zone. The yen was clearly the best performer yesterday, but there remains formidable resistance at the 105-106 region, as traders guardedly look past the election outcome and set their sights on a December lift off.

The USD/JPY could certainly get a lift from Clinton victory, but I maintain the pair will struggle to gain traction above 106 given the likelihood of a near-term Fed rate hike expectations remains at an elevated level. As the election risk fades to the background, the Fed trade marches into the foreground. Traders will be quick to refocus crosshairs on December Fed lift off.

Volumes remain low suggesting traders continue trading in small clips while warehousing less outright US dollar risk on the JPY as the election event risk approaches. I expect liquidity to deteriorate as should spreads over the next 24 hours.

Australian Dollar

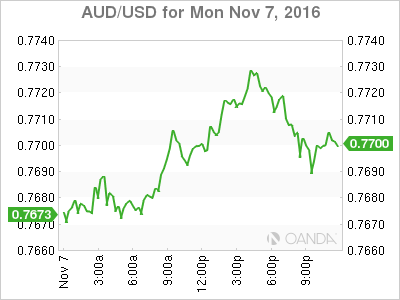

The AUD took to risk sentiment like a moth to a flame overnight, as risk-sensitive currencies joined the Wall Street pre-election party. The Australian dollar surged through the .77 resistance level on its way to making a .7730 heading into the NY close.

Once again, we find ourselves at the formidable 7725-50 resistance level, but with a massive shift in risk sentiment, there may be less conviction to fade resistance, so we could see the AUD primed to break out topside.

Dealers have been hesitant to add risk over the past fortnight, but with Wall Street’s latest moves, the Aussie should continue to show some spunk as traders favour a Clinton Presidency.

The AUD also remains well supported by surging commodity prices, so a breakout to the .78 + level appears likely, especially with the RBA on hold and a Federal Reserve Board certain to look for excuses not to hike in December.

On the data front , the NAB consumer confidence index came in at 4 vs 6, which has temporarily taken the wind out of the Aussie sails.

Chinese Yuan

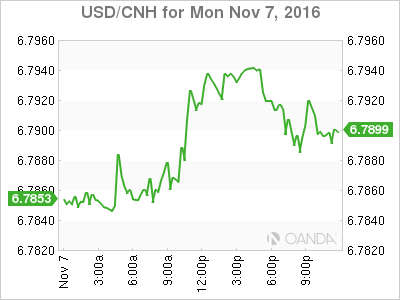

The USD/CNH continues surging towards the Key 6.80 level on the backdrop of broader USD strength. Given the proximity of the US election, it would make sense to see some position squaring ahead of the event, making an outright test of 6.80 unlikely, at least for today.

EM Asia

Investors have lighted position considerably, but there was some interest expressed on the IDR and MYR bond markets overnight but having little impact on currency markets

The MYR remains vulnerable to the Oil Patch and election risk so trading remains subdued.

DISCLAIMER: This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.