The probability of another rate hike for the Fed’s policy meeting in June continues to tick higher, according to futures data, but no change in rates is expected at next week’s FOMC meeting.

Fed funds futures are currently pricing in a 75% probability that the central bank will lift the Fed funds futures on June 14, according to CME data as of yesterday (Apr 26). By contrast, the probability for a hike at the May 4 meeting is just 4%.

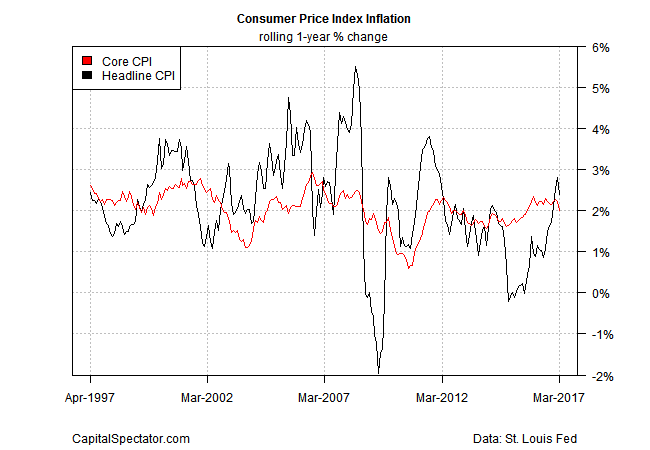

From the perspective of inflation pressures, recent data suggests that the Fed isn’t behind the proverbial eight ball. Inflation has picked up a bit over the past year or so, but the latest numbers point to pricing pressure that’s still moderate. Notably, core CPI nudged lower to a 2.0% year-over-year rate in March (red line in chart below), the softest pace in over a year and in line with the Fed’s inflation target.

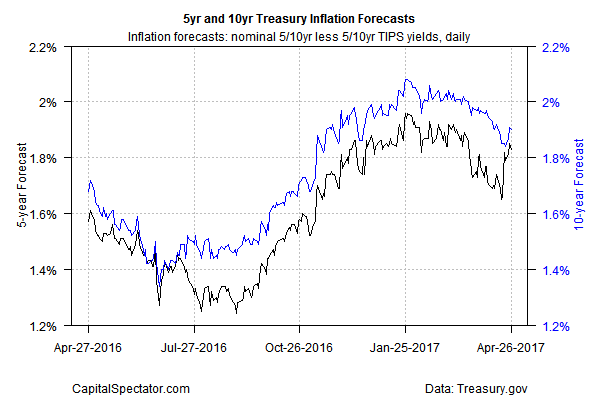

Meanwhile, there’s minimal sign of an upside bias in the implied inflation forecast via the Treasury market, based on the yield spread between nominal and inflation-indexed securities. The 5-Year and 10-Yearr maturities remain comfortably below the Fed’s 2% target at the moment.

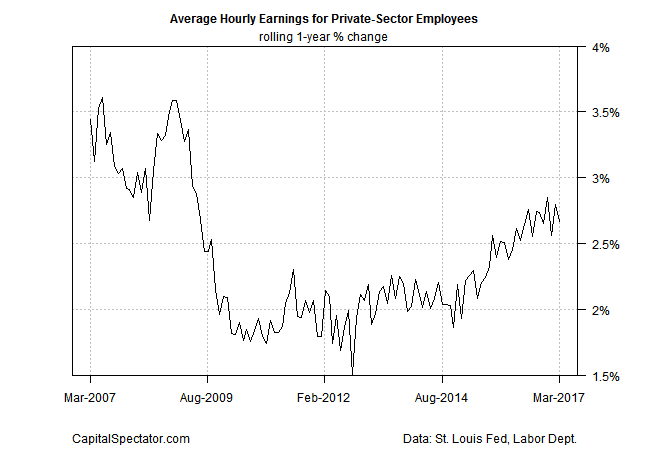

Average hourly earnings are running modestly hotter these days, which some monetary hawks say is a reason to continue squeezing policy. Wages are up 2.7% through March in year-over-year terms, close to the highest level in eight years. But the rebound follows several years of unusually low wage gains and so it’s reasonable to argue that the firmer trend reflects a normalizing process rather than a new inflation threat.

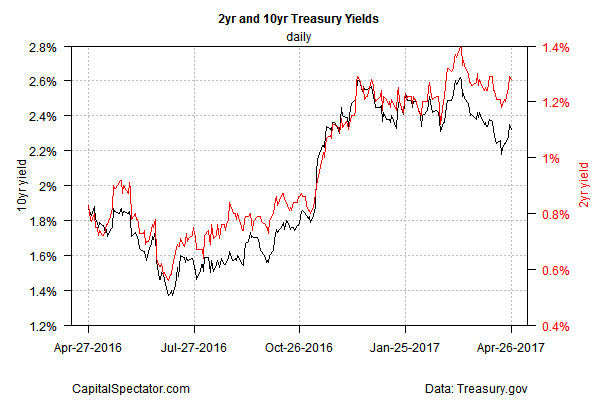

The policy sensitive 2-YearTreasury yield appears to agree. As of yesterday, the 2-year rate inched down to 1.28%, which is modestly below the recent high of 1.40%, based on daily data via Treasury.gov.

Deflation risk has certainly faded for the American economy, but there’s not a lot of evidence at this point for arguing that inflation is headed materially higher from current levels. “We have turned the corner on low inflation,” says Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics. “But future increases will be gradual and not without occasional setbacks. There are significant risks in both directions.”

The current inflation profile suggests that the Federal Reserve has the luxury to raise rates at a slow pace, but there may be other reasons why the central bank is eager to lift yields. Michael Boskin, an economics professor at Stanford and the former chairman of President George H. W. Bush’s Council of Economic Advisers, recently outlined the rationale:

Unprecedented long-term monetary stimulus and massive spikes in public-debt burdens have left governments poorly equipped to manage the next economic downturn when – not if – it arrives. The next recession probably will not be as bad as the last one, but advanced economies will be far better prepared for it if they undergo gradual monetary-policy normalization and fiscal consolidation in the meantime.

The good news is that recession risk for the US is low at the moment, and near-term projections point to more of the same (see my analysis here). But with the Fed funds target rate (currently at a 0.75%-to-1.0% range) still close to a record low, the bank is probably itching to elevate the price of money in order to offer more flexibility for policy actions when the next crisis strikes.

Kansas City Federal Reserve President Esther George no doubt speaks for several (most?) Fed officials when she advised last week that “overall, I am encouraged by the start of the normalization process and want to see it continue.”