Another Inflexion Point

US equities rebounded yesterday, and UST 10-year yields are up eight bps from yesterday’s swoon. Sterling was the focus overnight as the UK Supreme Court ruled against the government, meaning a parliamentary vote is needed to trigger Article 50. However, with little chance that Parliament would stand in front on Article 50, sterling’s reaction was somewhat muted as the decision was widely expected. However, a win for the government was that the Courts ruled Parliaments in Scotland, Wales and Northern Ireland will have no voice in the Brexit deliberations.

In a major North American development, Trump inked an executive order to advance the Keystone and Dakota pipelines, which provided a nice boost to the Canadian dollar overnight.

Infrastructure and tax chatter is heating up after reports surfaced that Senate Democrats will throw down the gauntlet and hold Trump to campaign promises by unveiling a USD 1-trillion infrastructure plan; offering President Trump their support if he backs it. Of course, the President will reject it, but none the less the market is on infrastructure headline watch.

Cooler heads prevailed overnight after yesterday’s USD verbal intervention downdraft abated, but political uncertainty remains very much in the limelight. As such, currency movements will reflect a substantial degree of trader uneasiness that permeates all markets. While some calm has come over the foreign exchange market in the past 18 hours, dealers are on a razor’s edge, awaiting the next precipitous and spotty currency action.

For the Fed watchers, Fed speak entered hibernation as the unofficial pre-FOMC blackout period is in effect.

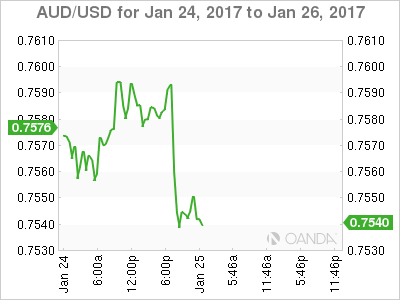

Australian Dollar

The AUD has remained sidelined overnight ahead of today’s Key Domestic Q4 CPI print, but there are growing signs that the Aussie may be a key currency to hang your hat on for the foreseeable future.

If we consider the moves on commodity and equity markets, the reflationary trade is alive and well. Global equity bourses remain on solid footing and are expected to climb. iron ore rebounded convincingly yesterday, and copper continues marching higher now, approaching critical resistance levels around $273-275. These commodity price surges convince me the markets are expressing the reflationary bias more actively through commodity markets and less so through the USD. Add in positive global risk sentiment for good measure and the AUD should be the clear-cut beneficiary in the near term; and with a decent CPI print today, it’s all gravy.

Unless there’s a complete outlier miss to the downside on the CPI, the AUD should continue to attract flows.

Unfortunately, the CPI missed to the downside, and the Aussie moved sharply lower. I think the move is more about short term position capitulation along with a subtle reprice lower along the STIRT curve. However, given the recent uptick in regional inflation and surging commodity market, I expect today's sell off to be limited.

Overall the .5 Q/Q vs .7 expected print is not a big enough miss to topple the Aussie apple cart. The market was certainly gunning for the topside so we may see this morning’s momentum abate until a clearer upside signal develops and short term traders square up.

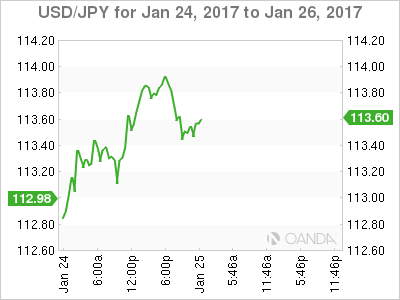

Japanese Yen

We know the drill, US 10-Year yields higher, USDJPY higher. In all seriousness, we’ve been seeing top side interest on the USDJPY this morning. The move is on the back of heightened infrastructure chatter, but until absolute fiscal clarity is forthcoming, given the increased level of uncertainty on the dollar trade, dealers and funds may relish this opportunity to lighten up on their base long USDJPY position.

Let’s face it – the Treasury yield seesaw, together with theNikkei’s propensity to flounder, should provide significant headwinds for the greenback. However, the test of the key 114.30 near-term level may hold the key to this daily momentum. I think that “Daily” is about as far out as the dealer’s risk profile runs these days. Given the enormous uncertainties with any current bias, dealers will continue to run day positions and will have little appetite to build or maintain a longer-term view.

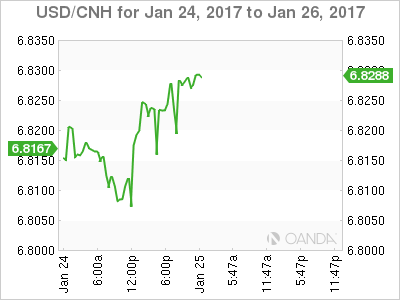

Chinese Yuan

Chinese New Year has reduced trading activity to a trickle, but there have still been some interesting headlines overnight. Reuters had an exclusive with the MSCI head, who expressed concerns over China’s capital controls. Voicing a consensus market view that “China’s progress toward full inclusion of its stocks in global benchmarks could be halted if the world’s second-largest economy cracks down further on people moving money out of the country.” If you cannot take your money out the door, how appealing is that to investors??

If nothing else, it highlights the increasing challenge ahead for the PBOC, which appears to be putting yuan global acceptance and a move towards a freely traded currency on the back burner.

EM Asia

Regional trading conditions continue to deteriorate as we near the Chinese Lunar New Year. The market is flip-flopping on broader USD moves, but dealers lack the conviction to add to the existing risk, unless on extremely outsized moves.