Many will be disappointed by the progress that the S&P 500 has made this week after breaking the broad range from the fall Friday. Since then, it has done nothing. Just moved sideways. Well, that is one way to look at it.

Another perspective might be that it is holding up well. Like the parent watching their child crawl up steps for the first time, the sentiment is nervous that the pause may result in a fall. But after climbing a few steps, the baby will often rest and then start higher again.

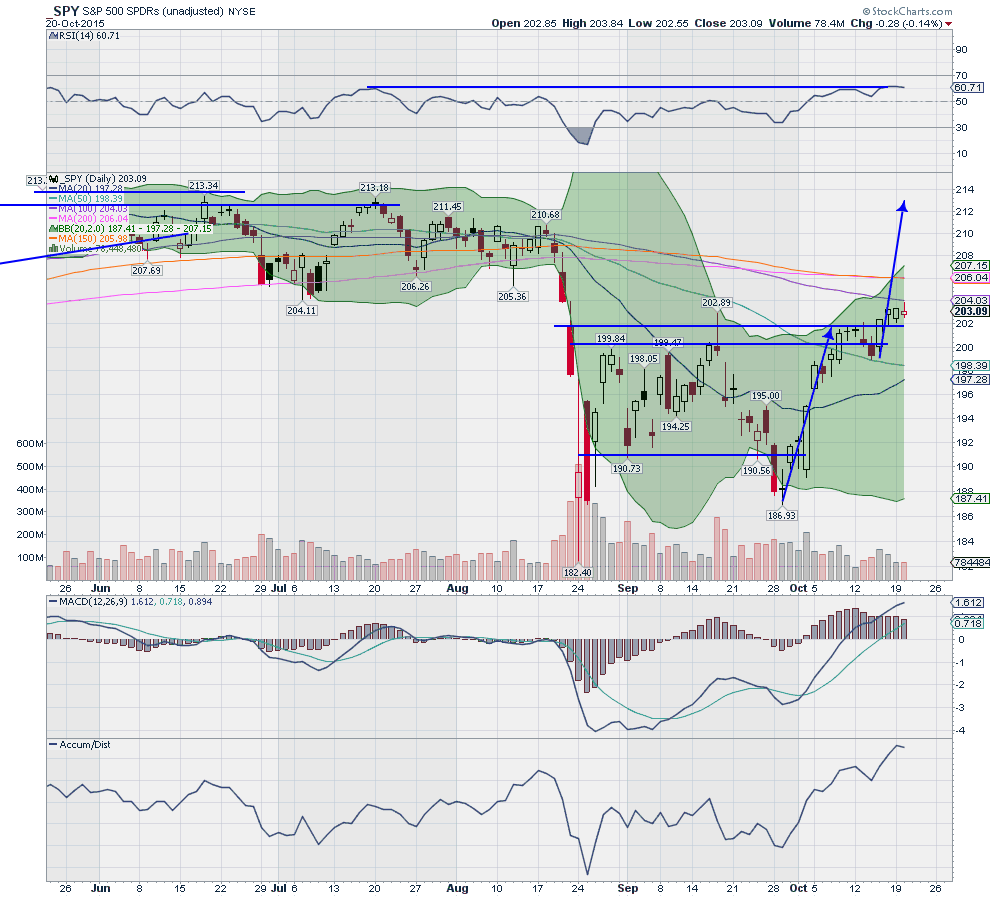

N:SPY Daily Chart

The positives for the market remain. The S&P 500 has held over the break out and looks to open over it again today. The momentum indicators are still strong, but nowhere near overbought. The Bollinger Bands® are giving it room to the upside. Finally, the accumulation/distribution line is rising.

The positive movement is there. The set up is there. Now like the child on the steps, it just needs the collective will to move forward. The next step is at 204.40, which just happens to be near the 100 day SMA. Then 206.4, near both the 150 day and 200 day SMA’s. Expect the parents to remain nervous until those steps are cleared.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.