The Nasdaq 100 broke out of a Diamond shaped consolidation range in June of 2016. Since then it seems to have done nothing but race higher. So far it has racked up a 1700 point gain since then, almost 40%. Surely it must be running out of fuel right? Well those that follow the fundamentals of stocks will tell you that the recent reports of Nasdaq 100 companies have been smoking hot.

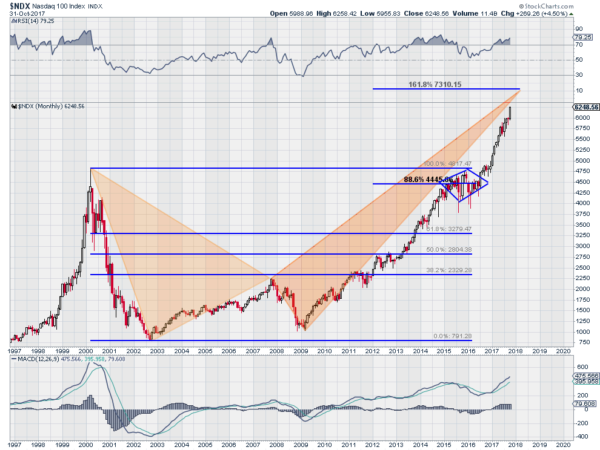

So what is going on with the Nasdaq 100? Does it have more fuel in the tank? One view suggests it is about to fire the next booster rockets. The chart below shows the long term monthly picture of the Nasdaq 100 over the last 20 years. There are two patterns to look at in the chart.

The first is the harmonic pattern in the 2 orange triangle. This Crab harmonic triggered on the move out of the Diamond and gives a Possible Reversal Zone (PRZ) above at 7310, a 161.8% extension of the move from the top of the Tech bubble to the low at the start of the century. That is another 1050 points higher.

The second is the Diamond itself. The move into the Diamond, from about 2300, extended to the move out gives a preliminary target to 6600. This might give it pause in the shorter run. Momentum is running strong, but if you look left the RSI and MACD are still no where near the highs reached in 2000. Of course these patterns may fail, but until they do there is room for the Nasdaq 100 to continue to rocket higher.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.