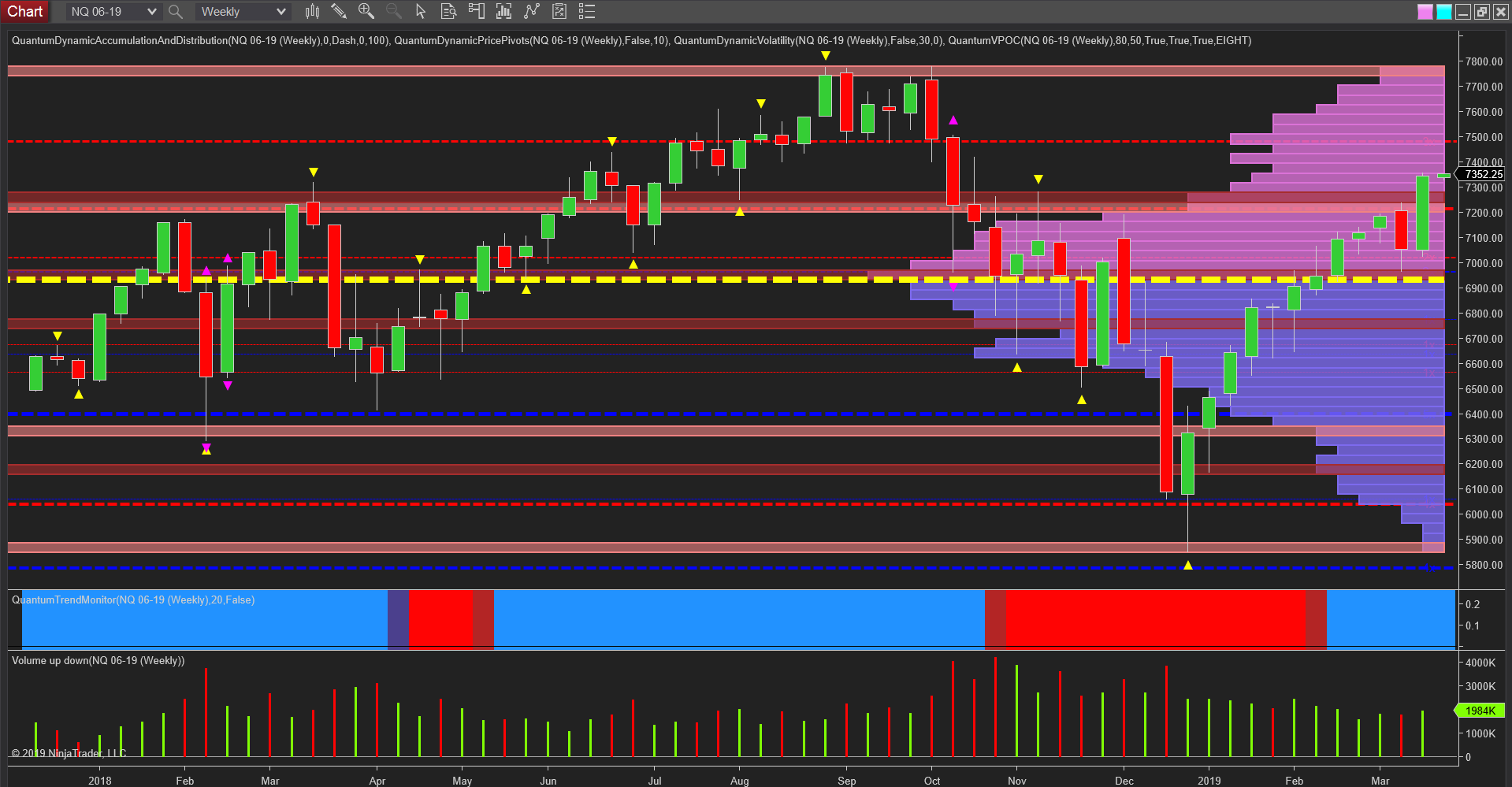

At the start of another trading week I thought it would be apposite to check out the US indices and in particular, the NQ emini which was leading the way last week as the Dow Jones labored following the Boeing (NYSE:BA) disaster. However, rather than consider the daily chart, the weekly timeframe is more revealing from a price and volume perspective for the longer term. And the price action which is relevant here is that of last week which saw the NQ emini close with a wide spread up candle, and with tiny wicks to the top and bottom. However, note the volume associated with this price action which looks to be an anomaly. After all, given some of the preceding price action and associated volumes, we should have expected to see more significant volume on such a move, particularly when compared with price action at the start of the year. Note the volumes in January, where we see wide spread up candles on volumes which are much the same as last week’s – yet last week’s price spread is significantly greater, and so signalling the anomaly.

In addition, although the index has still some way to go before it approaches its all-time high, for a longer term continuation of the bullish trend we should expect to see stronger participation and rising volumes, which does not seem to the case at present. Given this analysis on the weekly chart, expect to see some congestion build in the short-term, with the potential for a secondary reversal as occurred on the first week in March.

From a fundamental perspective, markets are still waiting for some clarity on the ongoing Sino-US trade talks and this week we also have the FOMC where the consensus is the FED will hold on interest rates. However, it is the statement and subsequent press conference that will be closely scrutinized and in particular the FED’s interpretation of the recent run of poor data.